What has changed in rules related to the use of international credit cards

Earlier, overseas use of international credit cards was not included in the overall limit under the liberalised remittance scheme LCS). But with a slight tweak, all international credit card transactions overseas have been brought under LRS. This, in turn, means that TCS (tax collection at source) of 20 per cent will be applied to all international credit card transactions.

On Friday, the government said any payments by an individual using their international Debit or Credit cards up to Rs 7 lakh per financial year will be excluded from the LRS limits and will not attract any TCS.

What is Liberalised Remittance Scheme (LRS)?

Under the LRS, all resident individuals, including minors, can remit up to $2,50,000 per financial year for any permissible current or capital account transaction or a combination of both. In 2021-22, $19.61 billion was remitted under the LRS, rising from $12.68 billion in 2020-21. In 2022-23, it grew to more than $24 billion, of which overseas travel accounted for more than half.

Why is there a change related to the use of International Credit Cards?

Payments by debit cards have been treated as LRS even earlier. Due to the exemption, expenditure through credit cards was not accounted for under the specified LRS limit, which has led to some individuals exceeding the LRS limit. The differential treatment between debit cards and credit cards needed to be removed in the interest of uniformity and equity in the treatment of modes of drawal of foreign exchange and for capturing total expenditure under.

What is the TCS rate applicable to overseas use of international credit?

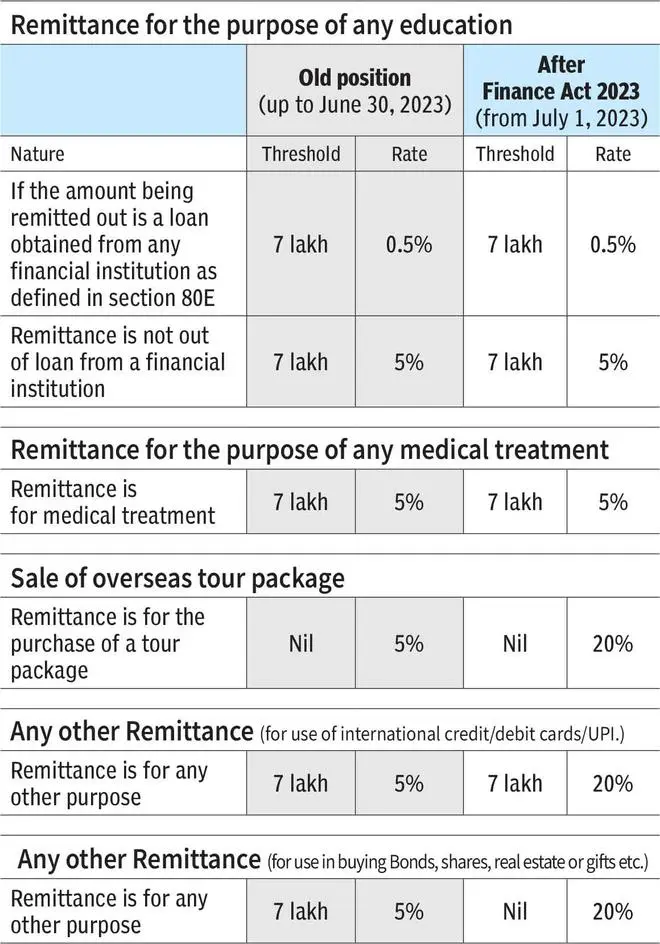

The FY24 Budget had proposed maintaining 5 per cent TCS for foreign remittances exceeding Rs 7 lakh towards education and medical treatment. Similarly, it proposed no change in the 0.5 per cent TCS on foreign remittances exceeding Rs 7 lakh towards education through loans from financial institutions. However, “for foreign remittances for other purposes under LRS and purchase of an overseas tour programme,” it proposed hiking the TCS from 5 per cent to 20 per cent and that, too, removing the threshold of Rs 7 lakh. Between May 16 and June 30, the TCS rate will be 5 per cent if the spend exceeds Rs 7 lakh on an international credit card abroad, and from July 1, every penny spent will attract TCS at the rate of 20 per cent.

Does LRS cover business visits of employees?

No. When an entity deputes an employee, and the expenses are borne by the latter, such expenses shall be treated as residual current account transactions outside LRS

What must Indians keep in mind when using an international credit card overseas?

First is the limit under LRS, which is $250,000, and second is the tax implication. Russell Gaitonde, Partner with Deloitte India, advises Indians to remember that (i) they must pay TCS when using an international credit card for international transactions, and (ii) they must claim credit for the tax payment when filing annual income tax returns in India. Those who have not been filing tax returns previously will have to do so now to be able to claim credit for the TCS paid on overseas transactions using international credit cards, he says.

How will the rule change affect the online buying of goods from a foreign company while sitting in India?

Gaitonde says it will apply to forex transactions such as online purchases undertaken by an Indian present in India through an international credit. In other words, if foreign companies offer Indian customers the price in INR and the customer uses an international credit card to pay INR, then it will not be treated as part of LRS, and no TCS will be levied. However, if the price of goods and services is in foreign currency by a foreign company and the customer pays in INR, but the card-sponsored bank converts this into foreign currency and remits the same to a company located abroad. It will be part of LRS and attract TCS at the rate of 20 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.