With the current economic instability, senior leadership teams are scrambling to protect margins. The best prepared companies are the ones that never waver on brand building. They reap the benefits of consistency. They have built sustainable pricing power over the years. And as a litmus test for a company’s marketing excellence, this economic landscape is the moment they have diligently prepared for.

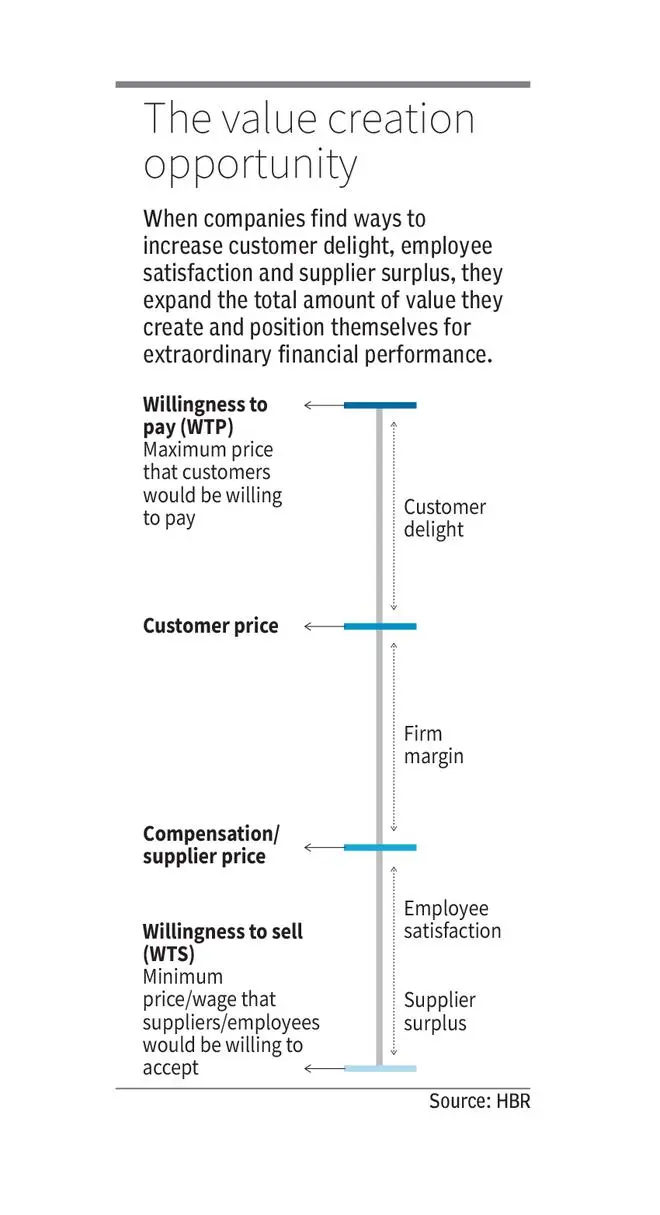

For any company, even the unprepared or less inoculated ones, the first reaction to protect margins should be to check how far a brand can increase its prices without losing volume or share to the competition. In times of spiralling inflation, no proverbial money should be left on the table. We’d argue there is another often overlooked hidden turbo to pricing power that CMOs, CFOs, and CEOs should be aware of, visualised in the simple yet powerful concept of the value creation opportunity or value stick by Harvard Business School Professor Felix Oberholzer-Gee in his book Better Simpler Strategy.

Tune up your market price

Effective brand management is an eternal high-wire act: building long-term brand assets and intelligently monetising that asset value short-term. As the Americans say: “walk and chew gum at the same time”.

Untapped equity reserves in the consumer or customer mind should get translated ASAP into real P&L added value by bringing real market prices as close as possible to their willingness to pay (WTP). But now look at the bottom of the value stick. Companies can also grow margins by lowering costs. Not just by rudimentary cutting costs, but by smartly leveraging pricing power to lower the willingness to sell (WTS).

Intuitively, one can see how, for a company with aspirational strong brands (i.e.,brands with sustainable pricing power), there are a number of hidden benefits that can put a turbo on the full margin, including (but not limited to) the below:

Employees: may join and stay longer at lower cost

Debt: banks may offer lower interest cost for lower risk

Equity: investors may pay more for your shares

Suppliers: may accept better payment terms to get you as a client

Customers: may accept you as a reference supplier at lower cost

Regulators: may accept lower risk mitigation cost (lower insurances, etc.)

The ethics of pricing power

The potential WTP is higher for a stakeholder-focused corporation, while its potential WTS can be significantly lower. Close your eyes and picture a cigarette company versus a purpose-driven company like Patagonia. It all goes back to the sustainability of your brand. Pricing power needs to be sustainable. Research has amply demonstrated that the best companies add value to all stakeholders in society, not just to shareholders. A first decent proxy for this today is the ESG ratings. What Professor Oberholzer-Gee’s research confirms is that it pays to be stakeholder-focused.

Mind you, the value stick is a concept. Nobody gets their margins handed to them just like that. It requires a focused organisation to translate potential into actual margin. Creating WTP or WTS is one thing, monetising it requires daily operational excellence.

A last point here is the ethics of pricing power. Just because you can increase prices or lower WTS doesn’t mean that you should. In 2022, Amazon Prime increased its yearly subscription by 17 per cent from $119 to $139, when the average inflation rate was 8 per cent in the US. The hike did cause Amazon Prime to lose some customers, but so far, its pricing power has held. Pundits are weighing in on whether Amazon Prime will raise prices again, and the question is, should they take the risk? Again, it is the stakeholder versus shareholder. But what about consumer empathy in tough times. How much does Amazon, a self-proclaimed (and proven) champion of customer experience, really feel the pain of its shoppers?

Purpose-led pricing power

Brands that stand out look for ways to creatively and ethically use pricing power that not only can positively impact customers and/or employees, but can also benefit shareholders.

Patagonia is a shining example of ethical pricing power. The top-tier outdoor and athletic clothing company has an annual revenue of around $1.5 billion, reflecting consumers’ willingness to pay for clothing that’s priced on the high end (its bestseller rain jacket sells for $179). That is in large part because consumers connect with Patagonia’s purpose. It has given away tens of millions of dollars to non-profit environmental firms via a global programme it launched in 2002 where 1 per cent of its yearly sales is donated. And Patagonia is known for prioritising employee well-being, resulting in a reported annual turnover rate of about 4 per cent, more than three times less than industry average in the US.

As you continue to explore the dynamic between WTP and WTS for your brand, remember to leverage the value stick. Think both long term and short term. And always focus on creating a sustainable brand that considers shareholders and stakeholders, and that’s all about operational excellence every day.

(Chris Burggraeve is the founder of Vicomte, former global CMO of AB InBev, and former president of the World Federation of Advertisers. Ranganathan Sundaram is the global head of marketing and ecosystems, TCS Interactive.)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.