An Adani group promoter entity sold 6.8 crore shares or 2.76 per cent of the equity of Ambuja Cement for ₹4,254 crore on the block deal window of the NSE.

According to exchange data, the shares were sold at ₹625.5 apiece by Holderind Investments, which had held 50 per cent stake as of June 30.

businessline had reported that the Adani group promoters were looking to offload stakes in some key companies in the group, including Ambuja Cement, in order to raise funds that would be used to retire costly overseas debt.

Sources has indicated that some of the portion of the funds being raised through strategic stake sales would be used to pay down the debt outstanding to international banks from whom the group had raised loans to fund the acquisition of ACC and Ambuja.

A part of the funds may also find their way into real estate, especially the ambitious Dharavi Slum Rehabilitation project in Mumbai.

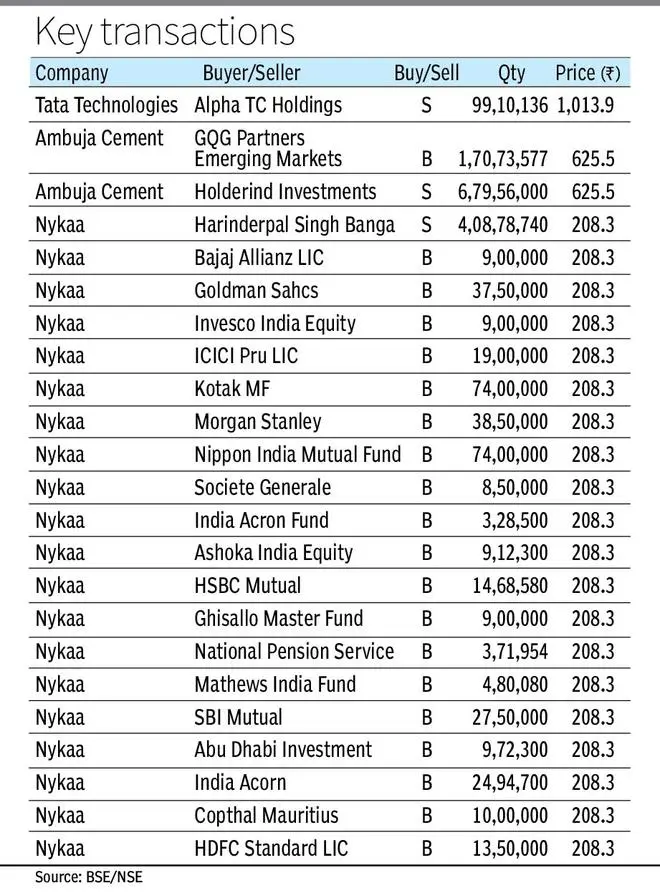

The stake offloaded by the promoter was picked up a number of overseas and domestic funds. The biggest buyer was GQG Partners which bought xx per cent stake for ₹1,676 crore. Other major buyers were Vanguard, Axis MF, ICICI PruM MF, Invesco MF, SBI Life, and Norges Bank.

Other block deals

The Street was buzzing with other block deals as well.

Harindarpal “Harry” Banga, an early investor in beauty retailer Nykaa, sold around 4.1 crore shares or 1.4 per cent stake in it for ₹854 crore on the BSE. He had held 6.4 per cent stake at the end of June.

The shares found wide acceptance from a host of buyers including Indian and global mutual funds, sovereign wealth funds, pension funds and insurance companies.

The stock has been a consistent outperformer and in the last one year the price has appreciated close to 92 per cent.

Tata Technologies, which listed about nine months back, saw Alpha TC Holdings sell 2.4 per cent stake for a little over ₹1,000 crore. It held 4.34 per cent stake at the end of June. There were no details on who had acquired the stake.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.