The Centre will sell up to 2.5 per cent stake in Hindustan Zinc at a floor price of ₹505 per share – a 10 per cent-odd discount over the current price - through an Offer for Sale (OFS) starting November 6, the Ministry of Mines has said in a notification to the bourses. The sell has been long awaited.

Under the OFS, the Centre will sell over 5.28 crore shares or 1.25 per cent as the base offer; while there is a green-shoe option of another 5.28 crore-odd shares. In market parlance, a green-shoe option, also known as an over-allotment option, is a provision in an initial public offering (IPO) underwriting agreement that allows to sell more shares than originally planned.

“Offer for Sale in Hindustan Zinc Ltd (HZL) opens tomorrow for Non-Retail investors. Retail investors can bid on Thursday, November 7. Government will divest 1.25 per cent equity with an additional 1.25 per cent as green-shoe option,” Tuhin Kanta Pandey, Secretary, Department of Investment and Public Asset Management (DIPAM), wrote on the micro-blogging site X (formerly Twitter).

OFS details

The offer will open for non-retail investors on November 6, which is the T day. The non-retail investors can indicate their willingness to carry forward their un-allocated bids for T+1 day, which is on November 7.

Retail investors can place their bids on November 7. Around 10 per cent of the offer size shall be reserved for allocation to retail investors.

The OFS regulations state retail investors and employees will be allowed to place their bids on Thursday. But those non-retail investors, who have placed their bids on Wednesday and have chosen to carry forward their un-allotted bids to the next day, will also be allowed to revise their bids.

No single bidder other than mutual funds and insurance companies shall be allocated more than 25 per cent of the OFS

Seller’s brokers include Axis Capital, HDFC Securities, ICICI Securities and IIFL Securities. IIFL Securities will be acting as the settlement broker on behalf of the seller’s brokers.

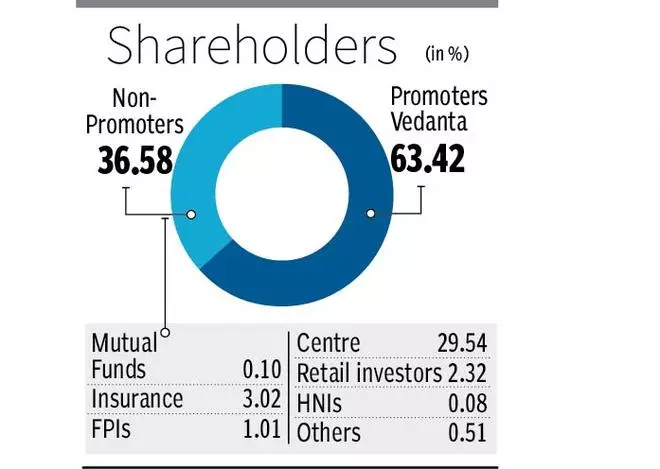

The Mines Ministry holds about 29.54 per cent stake in the Vedanta-controlled Hindustan Zinc, the country’s largest zinc and silver producer. Vedanta holds the majority stake of 63.42 per cent.

For the quarter ending September 30, the company reported a near 35 per cent increase in consolidated net profit to ₹2,327 crore – beating Street estimates. Net profit was ₹1,729 crore; revenue from operations stood at ₹8,252 crore, up 22 per cent from ₹6,791 crore a year ago.

Shares of Hindustan Zinc closed at ₹559.45, up 2.99 per cent on the BSE.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.