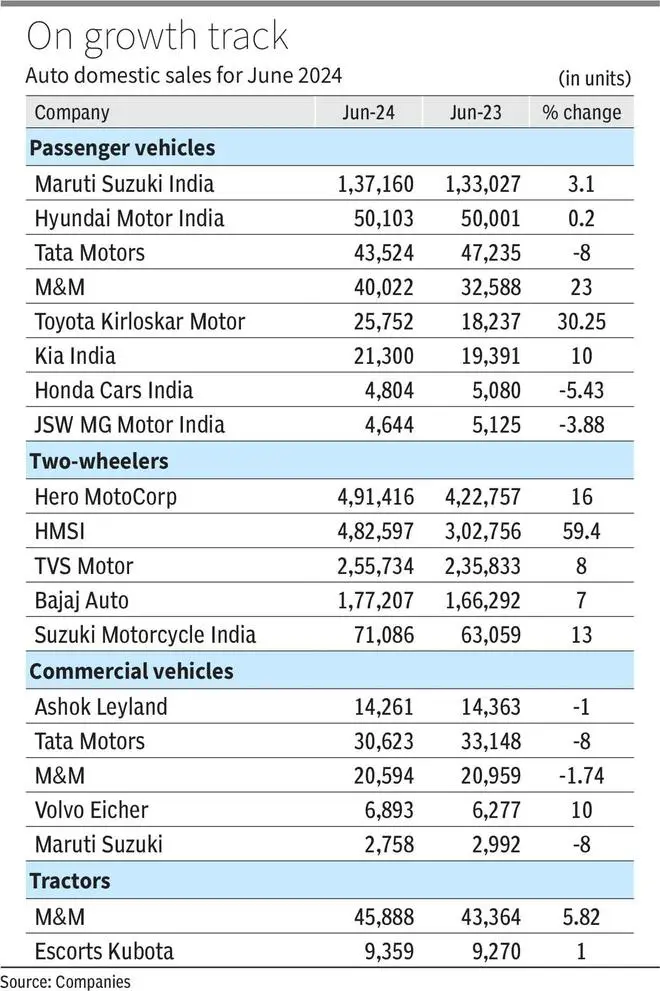

New Delhi The Indian car makers continued to struggle for better sales in June over higher base last year, where the overall passenger vehicle dispatches last month stood at 3,40,784 units, a growth of 3.67 per cent year-on-year (YoY) compared with 3,28,710 units in same month last year.

Country’s largest passenger vehicles maker Maruti Suzuki India (MSIL) on Monday reported domestic wholesales (dispatches to dealers) of 1,37,160 units in June which is a year-on-year (YoY) growth of 3.10 per cent as compared with 1,33,027 units in the corresponding month last year.

The company however, reported its highest-ever exports in a month at 31,033 units during the month, which is a growth of 57 per cent YoY against 19,770 units in June 2023.

Talking about the exports, Rahul Bharti, Executive Officer, Corporate Affairs, MSIL, said, “The fire test of global competitiveness in technology, quality, cost and performance is in exports. Customers in India are also likely to choose models which they know are favorites of customers across many countries of the world. Maruti Suzuki contributes about 42 per cent of all car exports from India.”

Similarly, second largest passenger vehicle manufacturer, Hyundai Motor India reported a marginal growth in its domestic wholesales to 50,103 units during the month as compared with 50,001 units in the same month last year.

Utility vehicles maker Mahindra & Mahindra (M&M) reported a YoY growth of 23 per cent in its domestic wholesales to 40,022 units in June as compared with 32,588 units in the corresponding month last year.

“June has been a momentous month, as we rolled out the 200,000th XUV700 from our facility. We also celebrated 25 years of Bolero Pik-Ups, a category creator and a market leader in the light commercial vehicle segment,” Veejay Nakra, President, Automotive Division, M&M said.

Toyota Kirloskar Motor (TKM) also has maintained its strong sales momentum and recorded a growth of 40 per cent in June 2024 by selling 27,474 units. This includes domestic wholesales of 25,752 units along with 1,722 units of exports, it said.

‘Sonet’ maker Kia India, also recorded a growth of around 10 per cent in its wholesales to 21,300 units in June, compared with 19,391 units sold in June 2023. The newly launched Sonet emerged as Kia’s best-selling model for the month, with 9,816 units sold, it said.

“We are committed to sustaining this positive trend for the remainder of the year through network expansion and by adding value to our customers’ aspirations,” Hardeep Singh Brar – Senior Vice President and National Head Sales & Marketing, Kia India said.

However, ‘Punch’ maker Tata Motors reported a YoY decline of eight per cent in its domestic sales to 43,524 units during the month as compared with 47,235 units in June 2023.

“In Q1 FY25, after a boost in demand in the first half of April, due to festivities in some parts of country, the passenger vehicle industry saw a decline in retails (registrations) in the months of May and June, influenced by the general elections and heat waves across the country. Tata Motors wholesales of 1,38,682 cars and SUVs in Q1 FY25 remained flat compared to Q1 FY24, as we readjusted our wholesales in line with retails to keep channel inventory under control,” Shailesh Chandra, Managing Director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility said.

JSW MG Motor India also recorded decline of 9.38 per cent in its sales to 4,644 units in June, as compared with 5,125 units in same month last year.

In the two-wheeler segment, Bajaj Auto reported domestic wholesales of

1,77,207 units during the months, a growth of seven per cent YoY as compared with 1,66,292 units in June 2023.

In the two-wheeler segment, scooter market leader Honda Motorcycle & Scooter India has recorded a robust growth of more than 59 per cent YoY to 4,82,597 units in June as compared with 3,02,756 units in the same month last year.

Other manufacturers including Bajaj Auto, TVS Motor Company and Suzuki Motorcycle India have also reported growth in their sales on yearly basis.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.