The battle for control of NDTV has turned bitter with the media company taking cover under a 2020 order that barred promoters Prannoy and Radhika Roy from selling stakes in the company.

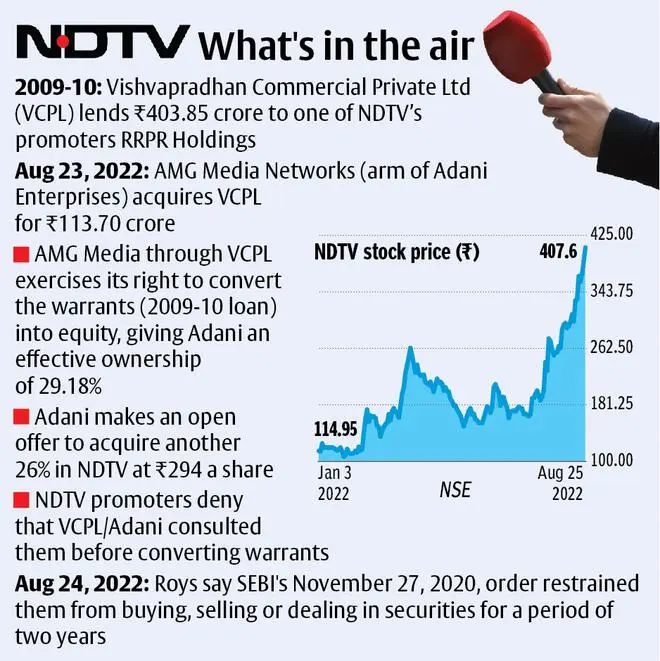

However, the 2009 loan agreement that the Roys signed to borrow ₹403 crore from a private lender Vishvapradhan Commercial Pvt. Ltd (VCPL), leaves little room for any legal recourse against the hostile takeover bid of the news channel by the Adani Group.

The agreement

In 2009, RRPR Holdings, a company owned by the Roys, issued warrants constituting 99.99 per cent equity stake to VCPL against the loan. The key clause of the agreement was that VCPL has the ‘sole’ option to convert warrants into an equal number of equity shares (99.99 per cent) at par “any time during or after the loan tenure without any further act or deed on the part of the lender.”

Another clause in the loan agreement, seen by BusinessLine, says Roy should allot to the lender or any person nominated by the lender, equity shares as specified, on notice of just two business days. Also, the warrants can be exercised and converted into equity shares in one or more tranches until they have been fully converted into shares aggregating to 99.99 per cent of RRPR.

“The above three clauses are part of ‘Schedule I — Terms of Warrants’ and they simply mean that Roys have to adhere to the demand from VCPL to convert the warrants of RRPR Holdings into equity whenever it is made, just at the notice of two days without much-ado and to whomsoever nominated by VCPL,” said a legal source.

In this case, VCPL is acquiring the warrants in concert with Adani Group. VCPL now is a subsidiary of Adani Group and once 99.99 percent of warrants of RRPR Holdings are fully converted, Adani Group will have full control over RRPR Holdings. Importantly, RRPR, an unlisted company, holds 29.18 per cent stake in NDTV and by virtue of this, Adani will own the same amount of stake in NDTV.

Due to this structure of the loan agreement, legal experts say, that Roys may not have much legal recourse left. Clause no 6.1 in the agreement has tied Roys’ hands. It says terms and conditions set out in Schedule 1 should be followed on the conversion of the warrants.

The Roys can now take support only in clause 6.3 — which says the lender cannot have over 26 per cent stake in NDTV without the consent of the parties. Hence, it is likely that Adani may restrict itself to holding a 25.99 per cent stake via VCPL. Still, there is no bar on the open offer from Adani, which was already announced, a former regulatory official said.

SEBI’s role

NDTV, on its part, has told the Adani Group that it would need the approval of market regulator SEBI to acquire the 29.18 per cent stake due to an earlier bar (in November 2020 — for two years) on current promoters from selling stake.

NDTV has told stock exchanges that since SEBI in November 2020 had barred the Roys from dealing in stock markets or buying and selling their stake in NDTV till November 2022, the Adani Group now requires SEBI permission to acquire their NDTV stake. A law firm on behalf of the Roys said, “Given RRPRH’s shareholding in NDTV and accompanying voting rights, it needs to ensure acquisition by VPCL does not constitute an indirect transfer by the Roys of 29 per cent of NDTV, since that would violate the SEBI restrictions, which cover both direct and indirect transfers of any sort. RRPRH will meet all its contractual obligations based on explicit and not implicit provisions and without assuming authority on matters that are dealt with by SEBI or other authorities. It is upto the SEBI to confirm that this transfer doesn’t violate its own order, and if it does, to grant an exemption.”

But experts said since the Roys had transferred 29.18 per cent of their NDTV stake to RRPR Holdings for availing the loan in 2009, the regulator’s order is not retrospective. “The claim by Roys that SEBI order prohibits them to convert warrants of RRPR into shares is only a delaying tactic. SEBI cannot overturn a pre-existing contract. The onus of getting SEBI approval for RRPR also lies with the Roys. In any event, now or eventually in November, VCPL will have to issue RRPR shares. SEBI order does not apply to unlisted shares and warrant conversion of RRPR is a fait accompli,” said Shriram Subramaniam, Founder Director of InGovern, a proxy advisory.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.