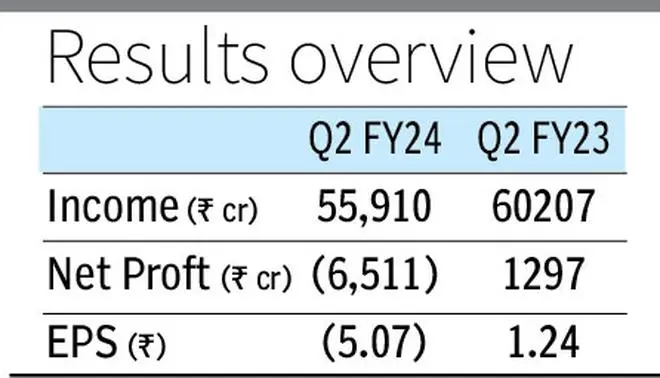

Tata Steel has reported a net loss of ₹6,511 crore in the September quarter against a profit of Rs 1,297 crore logged in the same period last year, due to lower realisations and provisions made for its troubled European operations.

Income was down at ₹55,910 crore (₹60,207 crore). Overall expenses were down at ₹55,853 crore (₹57,684 crore).

The company has made a provision of ₹3,255 crore for impairment of non-current asset in Europe and another ₹3,612 crore for restructuring of European operations.

The loss would have been much higher if not for the write-back of deferred tax of ₹1,342 crore. EBITDA was down at ₹4,147 crore (₹5,817 crore), while EBITDA per tonne plunged to ₹5,869 (₹8,045).

UK restructuring

“We have assessed the potential impact of the EAF (electric arc furnace)-based decarbonisation project and restructuring in the UK. We have taken an impairment charge of ₹12,560 crore in standalone financial statements and ₹2,746 crore in consolidated financial statements. In addition, we have taken a charge towards restructuring and other provisions of ₹3,612 crore in consolidated financial statements,” it said.

Tata Steel will shortly submit the detailed decarbonisation proposal to the Government of Netherlands seeking regulatory and financial support which is critical for Tata Steel Netherlands. Based on the support indicated by the Netherlands Government, Tata Steel will duly consider the project for approval, it said.

In Europe, the company’s margin moderated especially in the UK business, while Netherlands business was broadly stable. However, revenue per tonne was lower in Europe.

Focus on Kalinganagar

TV Narendran, Managing Director, Tata Steel, said the company has started producing FHCR (full hard cold rolled) coils at Kalinganagar CRM complex and has started receiving approvals from automotive OEMs.

The company had incurred a capital expenditure of ₹4,553 crore in the quarter in line with annual capex guidance of ₹16,000 crore for this fiscal. It will prioritise completion of the 5-MTPA Kalinganagar expansion. Tata Steel net debt stands was higher at ₹77,032 crore and the group liquidity position was at ₹27,637 crore.

On a standalone basis, the company incurred a loss of ₹8,531 crore against a profit of ₹2,215 crore and income was down at ₹34,073 crore (₹35,457 crore).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.