External Commercial Borrowings (ECBs) have picked up pace in recent quarters as Non-Banking Financial Companies (NBFCs) face challenges in raising domestic finance and private capex sees an uptick.

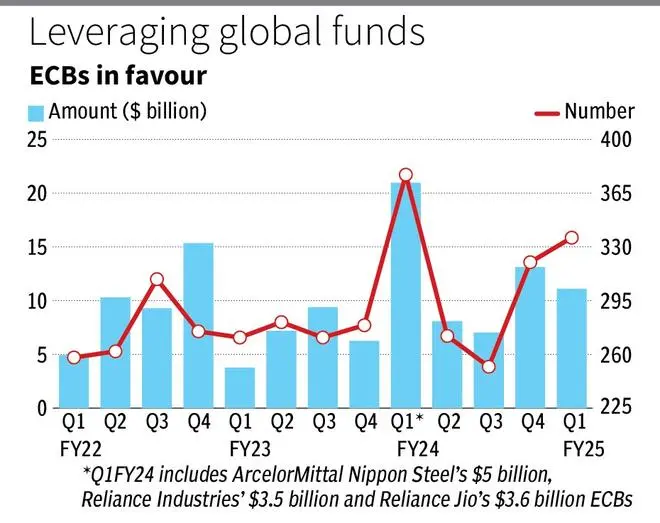

Reserve Bank of India (RBI) data show ECB registrations continued to stay elevated in the first quarter of FY25 with total borrowings of $11.1 billion across 336 deals. Jan-March 2024 witnessed 320 ECB loans raising $13.1 billion and this tally stood at $21 billion across 377 deals in Q1 of FY24. The Q1 FY24 spike was due to large external borrowings by Reliance Industries ($3.5 billion), Reliance Jio ($3.6 billion) and Arcelor Mittal Nippon Steel ($5 billion).

The count of ECBs taken by companies for ‘new projects’ is up to 45 in Q1FY25, from 36 in the immediately preceding quarter, and 39 in the same quarter last year. The number of ECBs taken by NBFCs for on-lending is up 37 per cent YoY in Q1FY25.

Madan Sabnavis, chief economist, Bank of Baroda, said the uptick in private investment, which is seen in rising domestic credit to industries, is also likely spilling over to ECBs. With rupee stable and global interest rates also not seeing sharp increases, Indian companies may look to diversify with global borrowings, he noted.

Analysis of borrowers shows NBFCs hold the largest share. RBI’s move to increase risk weights for bank loans to NBFCs in 2023 is a likely reason, analysts say. The average quarterly share of NBFCs in total ECBs was 18.1 per cent in FY22, which rose to 26.7 per cent in FY23, and 28.9 per cent in FY24. In Q1 FY25, NBFCs accounted for 41.5 per cent of ECBs at $4.6 billion. Infrastructure entities make up 36 per cent of ECBs at almost $4 billion.

“The landed and fully hedged cost of ECB is more or less at par with domestic borrowing. Even if the impact of higher withholding tax is factored in, the ultimate cost may go up a few BPS (basis points), but still it opens up a new avenue of raising money,” Pankaj Naik, Director, India Ratings & Research, said. On the other hand, pricing on domestic banks loans has inched up for NBFCs, analysts note.

Published on September 6, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.