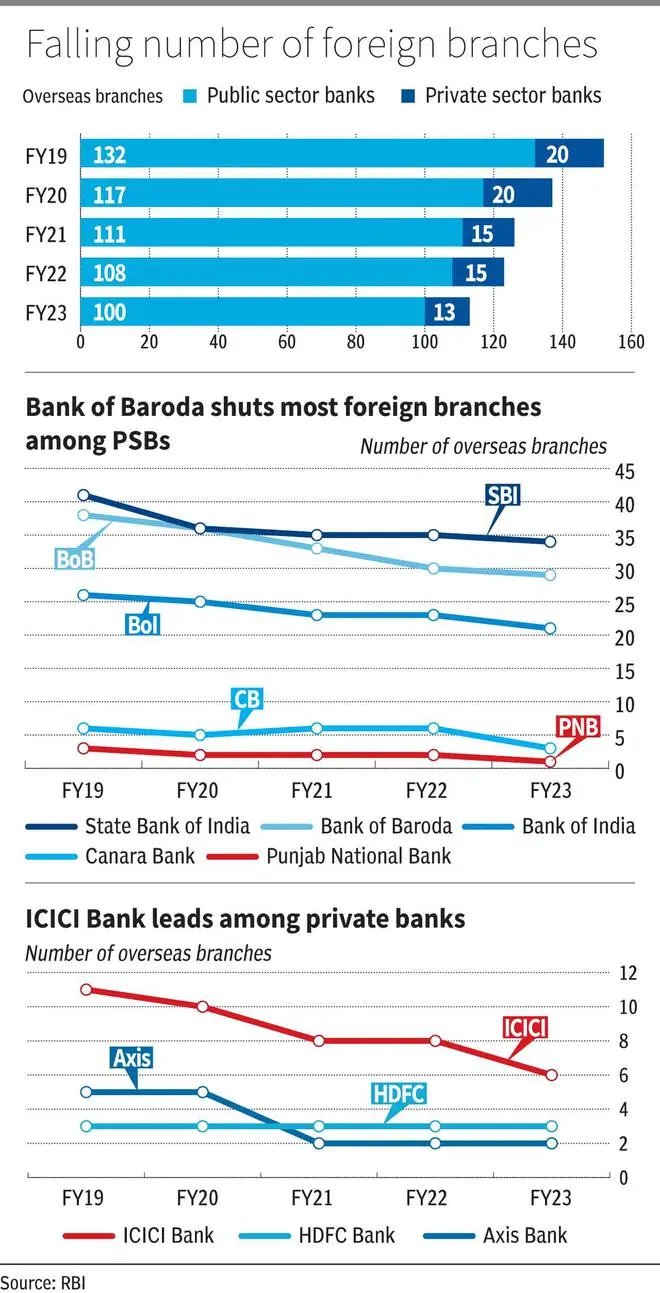

Indian banks are on a song as brisk growth in credit, urban consumption and cleaner balance sheet put them in a sweet spot. But did you know that banks are shutting down their overseas branches as they focus on domestic growth? As of March 31, 2019, Indian banks (private and public sector combined) had 152 overseas branches. But in 2023, the number has come down to 113; 25 per cent lower.

Towards the end of FY19, 10 Indian PSBs cumulatively had 132 overseas branches and four private banks together had 20 branches abroad. The numbers started dropping since then and towards the end of FY23, there were 100 PSB branches and 13 private sector bank branches in other countries according to the RBI.

BoB leads

Bank of Baroda has closed the highest number of overseas branches – nine, between FY19 and FY23. It now has 29 overseas branches,

SBI is the second on the list, having shut seven branches. Its number of overseas branches has come down to 34 from 41. It also has the highest number of overseas branches, as of FY23. According to the bank’s official website, it began overseas operations in 1864. At that time, the Bank of Madras, one of the three Presidency Banks of British India opened a branch in Colombo. The Bank of Madras in 1921, merged with the Imperial Bank of India, which later became the SBI.

ICICI Bank shut the third highest number of overseas branches - five, bringing its number of branches outside India by almost half in five years. Among the private players, it has the highest number of overseas branches (six branches as of FY23).

Albeit the largest private sector bank in India, HDFC Bank has just three overseas branches. The bank maintained the number consistently since FY19, without any closure.

Not a bad thing

Closure of foreign branches gained momentum following the massive Punjab National Scam of 2018. The Centre had ordered the closure of a large number of PSB branches overseas then.

But there are other reasons too. According to Sujan Hajra, Chief Economist & ED, Anand Rathi Shares and Stock Brokers, the decline in the number of overseas branches is attributed to three major reasons. “There has been significant consolidation of public sector banks in recent years. Branch consolidation following the merger appears to have played an important part in this process,” he says.

Hajra adds, “With the rapid growth of digital banking, there appears to be less need for physical presence, which could have resulted in a decline in the number of branches abroad. Third, the stringent customer privacy and data protection standards implemented by many OECD countries have significantly increased the costs and contingent liabilities of banks with physical presence in those jurisdictions. In addition, greater emphasis by Indian banks, on operational efficiency and profitability may have resulted in the closure of certain overseas operations with inadequate profitability.”

Vivek Iyer, Partner, Grant Thornton Bharat, also stresses the profitability part. He also says, “With the advent of GIFT city, the access to international markets becomes easily available with branches of Indian banks through the GIFT CITY route, making the need to have international branches sort of redundant.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.