When Bill Ramsey sang ‘It’s the little things that count’, he was probably eyeing the future, looking at how micro ATMs are growing. According to the RBI data, the number of these tiny devices used for cashless transactions and card-less cash withdrawals deployed have almost tripled since the pandemic began.

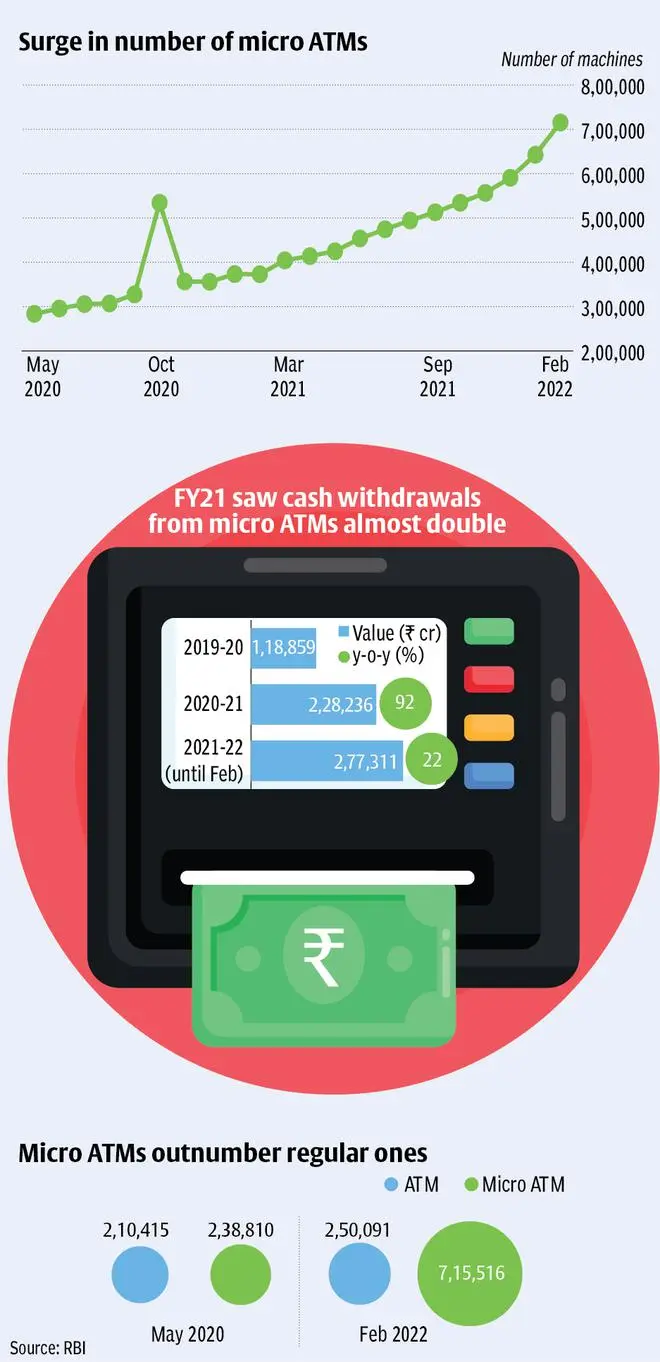

While 2,38,810 micro ATMs were deployed in May 2020, the number is at staggering 7,15,516 in February 2022. This is almost thrice the number of regular ATMs. The growth in regular ATMs has been rather sluggish with 2,50,091 right now against 2,10,415 in May 2020, registering a growth of 19 per cent.

Cash withdrawals through micro ATMs, too, had almost doubled during the pandemic year, according to the RBI data. While the initial spurt was huge, the growth was only 22 per cent in the last financial year (data available only until February). The cash withdrawals worth ₹1,17,086 crore was done through micro ATMs in FY20. This grew by 92 per cent to ₹2,25,041 crore in the next financial year, when India was under the lockdown on most months. Between April 2021 and February 2022, the value of withdrawals was ₹2,71,297 crore.

Experts from the industry say that the pandemic, lockdown and the functional ATMs shortage would have fueled the demand for these devices. “The initial growth has been high due to low base and subsequent welfare payments during the Covid period pushed the transactions, which has now stabilised,” says Ashish Ahuja, Chief Operating Officer, Fino Payments Bank.

According to the February 2022 RBI bulletin, 41 per cent of the total micro ATMs in the country are deployed by Fino. “Micro ATMs are deployed in the neighbourhood shops which adds to customer convenience, especially in rural areas where the nearest bank branch or ATM is far away. Customers have gradually accepted the anytime availability and hassle-free banking services at Micro ATM enabled outlets, resulting in increase in transactions,” he noted.

While Anand Bajaj, the founder of PayNearby agrees, pointing out how the Aadhaar-enabled Payment System (AePS) is quite beneficial in the rural areas. “A lot of people, especially in the rural areas did not have debit cards or their mobile numbers linked to their bank accounts. At that time, they could withdraw cash using micro ATMs with their aadhar numbers,” he said. The Centre had previously mandated all bank account owners to link their aadhar cards to their accounts.

While the numbers of micro ATMs increased from May to October 2020, the numbers came down in November and December. Commenting on the growth pattern, fintech RapiPay’s CEO Nipun Jain says that the sector has been facing a steady supply issue. “The pandemic had forced people to withdraw more cash in 2020, when they faced financial emergencies. However, by the next year, their savings have gone down. This may be why we don’t see much of a growth in cash withdrawals in recent months,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.