The way Silicon Valley Bank recorded a large loss on its government securities portfolio, has brought bank holding of government bonds into the limelight. The Federal Deposit Insurance Corporation (FDIC) has revealed that unrealised losses in the sovereign bond holding of US banks amounted to $620 billion towards the end of 2022. What could be the estimated loss in the government securities bought by Indian banks since the pandemic?

A businessline analysis shows that banks added ₹15.9 lakh crore of G-Secs since FY21 and the approximate loss on these assets could be around ₹97,000 crore. But with most of these securities being held in the HTM category (held to maturity), there is no immediate risk from these assets. The change in valuation of bonds held in the HTM category does not have to be recognised periodically.

Also, with the loan book of Indian banks being more diversified, with over 63 per cent of bank deposits with households and G-Secs forming only 18-22 per cent of bank assets according to Jefferies , Indian banks are not at a great risk, for now.

Loss in G-sec holding

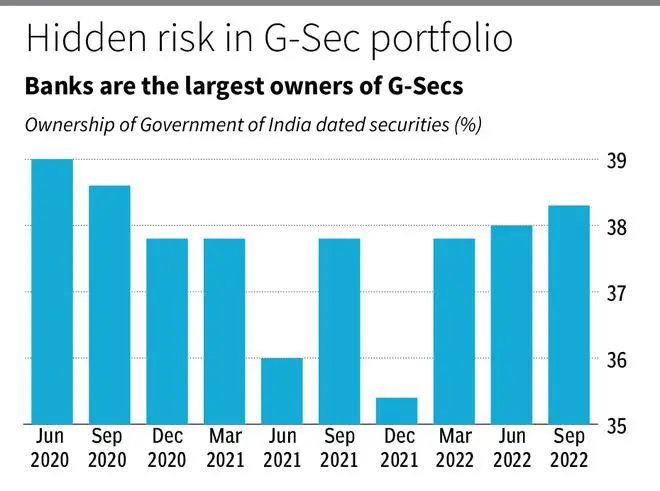

Banks had been holding close to 19.5 per cent of their Net Demand and Time Liabilities in government securities, even before the pandemic to meet the SLR (statutory liquidity ratio) mandate. Banks’ holding of government securities amounted to ₹37,47,349 crore towards the end of March 2020.

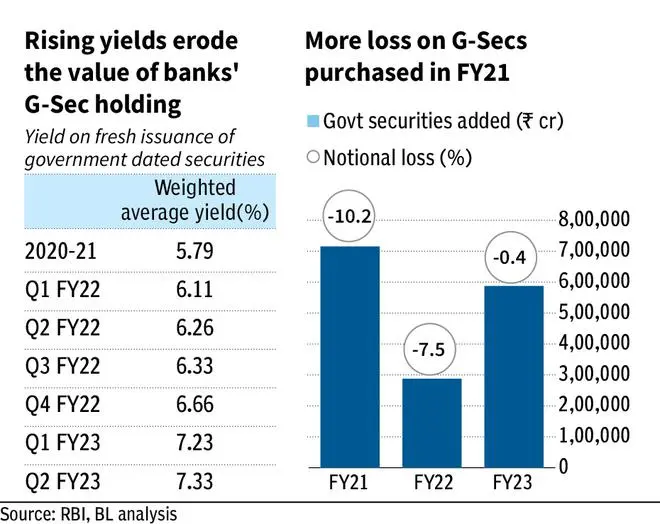

As the G-Sec issuances surged during the pandemic to bridge the widening fiscal deficit, banks were encouraged to buy more G-Secs by allowing them to hold more government bonds in the HTM category. Banks’ G-Sec holding increased by ₹7.15 lakh crore in FY21, ₹2.27 lakh crore in FY22 and has further increased ₹5.87 lakh crore so far in FY23.

G-Sec yields bottomed in FY21 when the economy was contracting and inflation was also low. According to RBI, weighted average yield of fresh G-Sec issuances in FY21 was 5.79 per cent. This rose to 6.28 per cent in FY22 and further to 7.33 per cent by the second quarter of FY23.

We used the average return in the Nifty 10-year benchmark clean price index to calculate the approximate unrealised loss in the bonds purchased during the pandemic. This shows us that the G-Sec purchased in FY21, FY22 and FY23 have notional loss of 10.2 per cent, 7.5 per cent and 0.5 per cent respectively.

This amounts to a loss of around ₹73,000 crore on G-secs added by banks in FY21, loss of ₹21, 500 crore on G-Secs added in FY22 and ₹2,500 crore on G-Secs bought this fiscal year. So the total loss on government bonds purchased during the pandemic could be around ₹97,000 crore.

This notional loss is only on the bonds purchased since the pandemic. There will be unrealised loss/gain on the government bond portfolio held before the pandemic as well, depending on the tenor and coupon rate of these bonds. But with Indian G-Ssec yields being largely kept under check by the RBI over the last two years, the notional loss will not be too much.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.