Just a couple of months ago, the Union government was confident that the country would not face a power crisis, and boasted of a decline in import of coal and an increase in domestic supply early this month. However, the power crisis is now at the doorsteps and experts blame the government’s failure to read the domestic coal demand.

The Ministry of Coal is focussing on accelerating domestic production of coal by allocating more coal blocks, pursuing with States for assistance in land acquisition, and coordinated efforts with Railways for its movement.

However, experts in the energy sector say that decline in imports is uncalled for despite Coal India (CIL) doing a good job. “We are seeing the highest energy demand, and a drop in imports will lead to a gap in the system. The system will remain under stress as the coal market has gone haywire for various reasons and coal prices are fluctuating,” said one of the senior energy experts requesting anonymity.

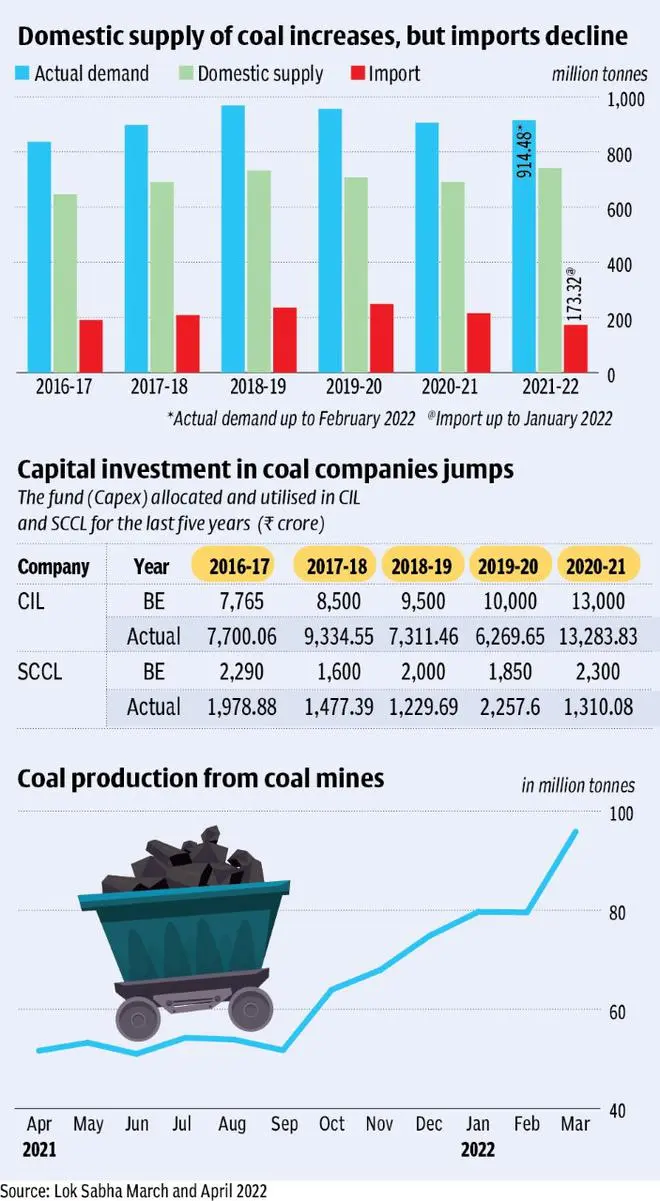

Coal Ministry data show that during April 2021-January 2022, coal import has decreased to 173.32 million tonnes (mt) compared to 180.56 mt during the corresponding period of the previous year. Coal import by the power sector declined from 69.22 mt in 2019-20 to 45.47 mt in 2020-21. Further, during April 2021-January 2022, it decreased to 22.73 mt as compared to 39.01 mt during the year-ago period.

Meanwhile, coal imports for the non-power sector from April to January was at 141.55 mt and 150.59 mt in 2020-21 and 2021-22, respectively. Today, the coal stocks at imported coal-based power plants have slipped below 10 days and many States such as Maharashtra are on the verge of load shedding.

CIL performance

The share of coal supply by CIL, which was around 60.8 per cent of the total consumption in 2019-20, increased to 63.3 per cent in 2020-21 and further to 64.3 per cent in 2021-22 (April-January). In 2021-22 (up to Feb 28, 2022), CIL has dispatched 487.88 mt to the power sector, with a 22.6 per cent growth over the last year.

The Singareni Collieries Company Limited (SCCL) and captive coal blocks dispatched 48.91 mt and 74.65 mt coal to the power sector (up to Feb 28), which is 36 per cent and 40.8 per cent, respectively, more than the same period of last year.

During FY23, CIL has proposed a production target of 700 mt. The data show that monthly domestic coal production from coal mines has seen a constant rise from October 2021 (63.93 mt) to March 2022 (95.809 mt)

Crisis situation

Last year, the rising power demand after the pandemic and rains in the coal-bearing areas in August and September led to a lower dispatch from coal mines, resulting in a major power crisis across States.

“With the Russia-Ukraine conflict, inconsistency will prevail in the energy market. Once rains start, the gap in the system created by the decline in imports will create problems. The coal market is tight and dropping imports cannot be glorified. We should have imported and created an inventory when coal prices were low. Now, if we decide to import, the cost would be heavy,” said one of the experts closely working with the government.

Pratim Ranjan Bose, Advisor, Iravati Research and Communication Centre (IRCC), said, “The increased tightness of the global market following the Ukraine crisis, may inspire captive miners to do better in FY23. There is a substantial inventory in the system. To be on the safer side, the government has ordered the power sector to import fuel for blending, this fiscal.”

He added, “India has a high (35 percent) import dependence for primary energy when compared to the global average (21 per cent). Buoyancy in the import market is, therefore, crucial to avoid stress in the immediate run. In the longer run, the ongoing energy transition should help India reduce the gap.”

Meanwhile with the recent Australia-India Economic Cooperation and Trade Agreement (AI-ECTA), tariffs on coal that Australia exports - will be immediately reduced to zero. Duty-free import of coal could resolve the crisis and imports could go up.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.