Chennai, May 1

With government officials at the Centre saying wheat production this year could be 8-10 million tonnes lower than initial estimates, the Food Corporation of India (FCI) and other State agencies may find it tough to even procure 20 million tonnes (mt) of the grain during the current rabi marketing season. This is less than 50 per cent of the 44 mt target set for wheat procurement.

With the crop shrivelling in excess heat witnessed since the second week of market, production is likely to be lower than the record 111.32 mt estimated by the Ministry of Agriculture last month. Stakeholders in the wheat industry are divided on their view over wheat output.

Pessimistic views peg the production at around 95 mt, while the optimistic outlook is that it could be around 105 mt.A section of farmers BusinessLine spoke to in Punjab and Haryana say their production this year is 10-15 per cent lower than normal. Both the States produce nearly 28.5 mt of wheat annually.

This is not the only reason why FCI procurement has been affected this year. Reports from States such as Rajasthan say private traders have been pro-active in procuring wheat at the farm gate of growers, offering the minimum support price of ₹2,015 a quintal or a tad higher.

Private traders are procuring wheat to export the grain as Indian wheat is in demand in South, South-East, and West Asia besides North Africa in view of the Ukraine war. Russia and Ukraine meet nearly 30 per cent of the annual global demand and the conflict has affected supplies from both the nations.

The other reason is that farmers are looking for higher prices. A farmer in Madhya Pradesh’s Dewas district told BusinessLine he would wait for wheat prices to increase by at least ₹500 a quintal before selling the 100 tonnes he has produced. Another in Haryana, who has sold part of his produce at price higher than the MSP, said he would sell the rest only after five months. All these have affected FCI procurement this year.

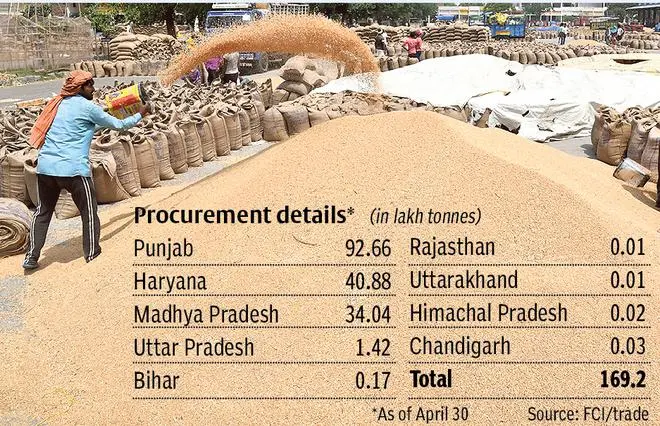

According to official data, FCI has procured 16.9 mt of wheat till April 30, down 39 per cent, against 28.03 mt during the same period a year ago. This drop is now troubling the stakeholders.

When wheat was in demand for exports, government officials had scaled down their outlook on procurement to 34 mt. Then, looking at the response to FCI procurement, they expressed the fear that the purchases may be around 25 mt only. But, stakeholders see it even lower now.

“Looks like we may procure only 18-19 mt now going by the arrivals,” said a miller, who did not wish to be identified.

“The maximum FCI can procure this year could be 20 mt,” said Delhi-based exporter Rajesh Paharia Jain.

A New Delhi-based trade analyst said procurement could touch 22 mt if the FCI and buying agencies put in a bit more effort.

FCI currently has 35.8 mt of wheat stocks, including 18.9 mt carried over from last season. The carryover stock is the lowest since 2018.

According to officials, the annual wheat offtake under various welfare schemes in 2021-22 was 29.47 mt, including 21 mt under the National Food Security Act and 6.34 mt under the open market sale scheme. An additional 18.72 mt was distributed free of cost under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY).

It is likely that the Centre might discontinue the OMSS, traders said. Even if PMGKAY is discontinued after September, the government would still need a total of 32.5 mt of wheat for the entire fiscal. It would also need to mandatorily carry 4.46 mt of operational stock and 3 mt of strategic reserve. This takes the total wheat required for government use to 40 mt. If the FCI ends up procuring 20 mt of wheat totally this fiscal, it would have to do a tight rope walking.

“It may be tight, but looking at what the Centre did during Covid-19 when it ensure no one died of hunger, it is possible that a fixed volume of wheat could be procured at a higher price,” said the analyst.

“Though this government is Right politically, it is Left economically,” he said.

Jain said the Centre may discontinue PMGKAY if total stocks with FCI are limited to around 35 mt and could opt to meet future demand with rice, which is available in plenty.

In view of this, India will now have to at least partly give up its ambition of “feeding the world”.

“Once wheat exports top 10 mt, the Centre may impose tax on wheat exports,” said Jain.

The analyst said Prime Minister Narendra Modi had, perhaps, been misled over wheat availability when he made the statement of India turning an “anna data” for the world.

“India may not pursue exporting more than 10 mt seriously,” he said.

At least 2 mt of wheat is estimated to have been exported in April, Jain said.

Pramod Kumar, Vice-President, Roller Flour Mills Federation of India, said May 10 will the crucial day when the wheat scenario will unfold fully. “It is usually the last date of arrival. The government is probably waiting till then to see how procurement goes. Based on the situation then, it could take measures to ensure domestic availability,” he said.

(With inputs from Prabhudatta Mishra)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.