Despite the Indian government’s recent initiative to promote the cultivation of coarse cereals, particularly nutri-cereals, it has been a mixed bag this year as far as kharif sowing is concerned.

The major reason is that growers, even those who got record prices for maize in the last season that ended in June, are looking for better returns this season.

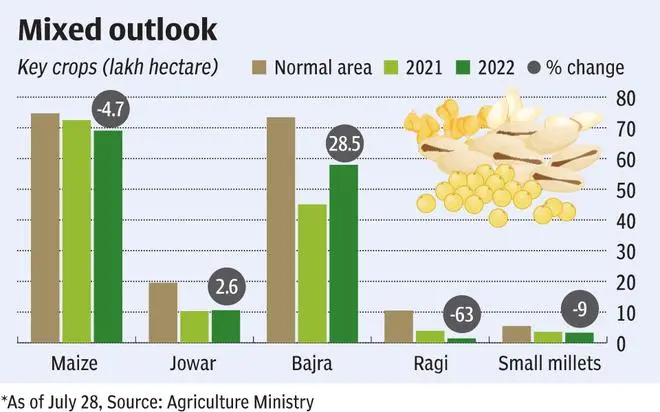

As of July 28, the area under all coarse cereals was 142.21 lakh hectares (lh) against 135.30 lh a year ago. While the acreage in jowar (sorghum) and bajra (pearl millet) has increased, coverage of maize and ragi (finger millet) is showing a decline.

During the last kharif season, the total area under coarse cereals across the country was 180.6 lh and production was 35.64 million tonnes (mt) (22.65 mt of maize and 12.99 mt of nutri-cereals). This season, the target is to produce 40.60 mt(23.10 mt of maize and 17.50 mt of nutri-cereals).

Surprising development

Trade experts and analysts say it could be an uphill task to achieve the production target for coarse cereals.

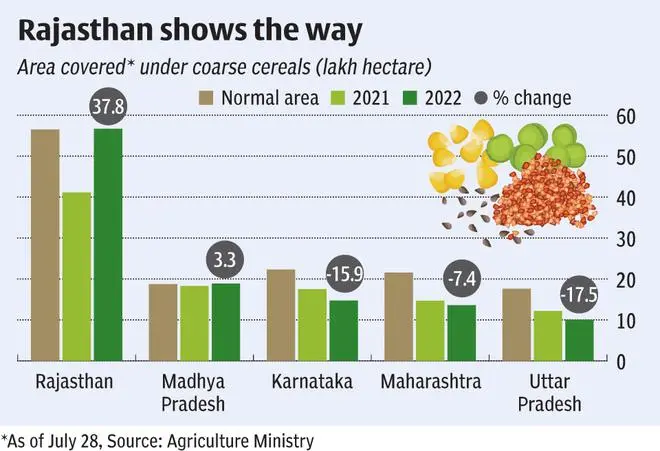

One of the major reasons for the situation is that this year the three major producers—Karnataka, Maharashtra and Uttar Pradesh—have reported a lower acreage, even though the overall sowing area has increased by 5 per cent on the back of nearly 30 per cent surge in bajra coverage.

The development is surprising since maize prices are currently ruling at a record high of ₹2,600 a quintal at the user end. “Generally, maize prices have seldom ruled above ₹1,400 but throughout last year they were above ₹1,700 a quintal. There is good demand for exports from countries such as Bangladesh, which are offering $320-330 a tonne,” said Mukesh Singh, Director, MuBala Agro Commodities Pvt Ltd.

The minimum support price for maize for the last crop year was ₹1,870 a quintal and this year it has been fixed at ₹1,962.

The national weighted average modal price (the rate at which most of the trades take place) is currently ₹2,001 a quintal against ₹1,665 a year ago.

No uniform pattern

“Farmers are looking for better returns. Though maize prices are at a record high, they think they can get better prices by growing other crops such as cotton, sugarcane and oilseeds. We are witnessing that this year,” said M Madan Prakash, President, Agri Commodities Exporters Association.

“Ultimately, farmers will decide the crop based on what is most remunerative for them. You cannot force or persuade them to diversify to a particular crop. If demand is created and better prices are offered, farmers will definitely opt for coarse cereals,” said food policy analyst Vijay Sardana.

“There is no uniform pattern seen in sowing this year as farmers in Karnataka and Maharashtra have shifted towards soyabean and cotton while maize area in Madhya Pradesh is at par. In Rajasthan, jowar, bajra and maize acreage has topped last year’s total areas already,” said Sain Dass, a maize breeder and former president of the Indian Maize Development Association (IMDA).

“Rains have been the major contributing factor affecting the impact. We have also witnessed an insect attack last year which has resulted in a fall in sowing of those crops this year,” said Sateesh Nukala, CEO & Co-founder, BigHaat.

High labour wages

Vetavalam Manikandan, President, Tamil Nadu Farmers Association, said maize and ragi acreage is lower this year mainly since communication from the government to agricultural workers at the bottom of the pyramid has been poor. “In addition, there are problems of higher labour wages in cultivating maize and ragi,” he said.

Vangili Subramaniam, President, Tamil Nadu Egg Poultry Farmers Marketing Society (PFMS), said higher production costs have resulted in farmers not sowing these crops this year. “Benefits from these crops do not commensurate the efforts put in by growers,” he said.

According to Rajasthan government data, the area under maize in the State has reached 9.38 lh. Bajra has been sown on 44.4 lh and jowar on 6.7 lh. This is against the total areas for the entire season being 9.36 lh, 43.01 lh and 6.2 lh, respectively. Rajasthan is the top producer of coarse cereals in the country with about a 30 per cent share in the area.

Maize slips

“All crops are higher from the year-ago period in Rajasthan as monsoon reached earlier this year prompting farmers to go for early sowing early. While 75 per cent of sowing got completed in the targeted area of 163.88 lh until August 3 last year, 97 per cent area has been covered out of 164.17 lh targeted this season. So, comparison with the year-ago sowing area does not give the actual scenario,” said Rampal Jat, president of Kisan Mahapanchayat. “We have also seen a drop in the cultivation of ragi and maize this year,” said Nukala.

In Karnataka, the top producer of maize and ragi, the acreage under the kharif coarse/nutri-cereals is down by 16 per cent at 14.72 lh. The sowing of maize is still on and current acreages are around 12.33 lh against 12.54 lh a year ago. “There’s a good amount of maize sowing as prices are good for the farmers and there should be a good crop this year,” said K S Ashok Kumar of MAA Integrators in Bengaluru. The crop size would depend on the yield as many areas are still witnessing rains.

The new crop is likely to hit the market around September-end. Besides, the strong domestic offtake due to the rebound in poultry placements post-Covid, the export demand is also keeping the prices of maize firm, Kumar said.

Jowar area up a tad

Fortunately, there have been no reports of the fall army worm (FAW) insect this year in Karnataka whereas the pest had lowered the maize yield successively in the past couple of years.

In Telangana, there has been a sizeable coverage of maize in the current kharif season. Against the normal (5 years average) acreage of 4.74 lh under maize, sowing in this season is down at 1.7 lh from 2.5 lh a year ago, but it is expected to pick up. Moreover, recent rains and floods have damaged the crop and many farmers said it would not be possible for them to resow the crop.

In Andhra Pradesh, the State has targeted to increase the maize area by 10,000 hectares to 1.18 lh as against the average area of 1.10 lh. Sowing is progressing well with 48,000 hectares covered as of July 28.

BigHaat’s Nukala said the cultivation of jowar has increased marginally, but bajra has witnessed a sharp rise. However, the area under ragi is down sharply with the acreage being affected badly in Tamil Nadu.

Poor returns for ragi

“Farmers have not been getting a good price for ragi so far. Also, it is a job that needs more workers, especially during and after harvest,” said Manikandan.

The weighted average modal price of ragi is currently ₹2,237 a quintal against ₹3,680 a year ago. The MSP for ragi has been fixed at ₹3,578 this season against ₹3,377 last season.

Nukala said the North-Western parts produce bajra in a big way, while Maharashtra, Karnataka, Tamil Nadu, and Rajasthan are major producers of jowar. In comparison, ragi is cultivated in Karnataka, Tamil Nadu, Andhra Pradesh and Maharashtra, and maize in southern Andhra Pradesh, Karnataka, Maharashtra and Telangana.

In Karnataka, the sowing of jowar and bajra has been sluggish as farmers have shown a preference for more lucrative crops such as cotton and soyabean.

The area under ragi is down considerably at 0.52 lh as of July 28 against 2.81 lh in the corresponding period a year ago. The ragi growing belt in south Karnataka has been witnessing continuous rains and the expectation is that the acreage may pick up in the days ahead once the weather clears.

In Telangana, the area under jowar is down at 10,000 hectares against 24,280 lh a year ago.

Lauding the Centre’s efforts in declaring 2023 as the international year of millet, Sardana suggested a more professional campaign to promote nutri-cereals. This is particularly true given the Centre’s efforts to popularise coarse cereals cultivation.

This is fourth in the series of reports on kharif crop outlook. Tomorrow: Oilseeds outlook

(With inputs from K V Kurmanath in Hyderabad, Vishwanath Kulkarni in Bengaluru and Subramani Ra Mancombu in Chennai)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.