Wheat prices have gained 6 per cent in agricultural produce marketing committee (APMC) yards across the country over the past four weeks with trade and flour millers complaining that arrivals of the cereals are meagre.

This has now led to demand from the user industries to ban exports of maida, which are not being used to serve non-resident Indians. “The Centre has curbed exports of wheat flour (atta). But it should have actually banned maida shipments,” said a trader, who did not wish to be identified given how sensitive the issue is.

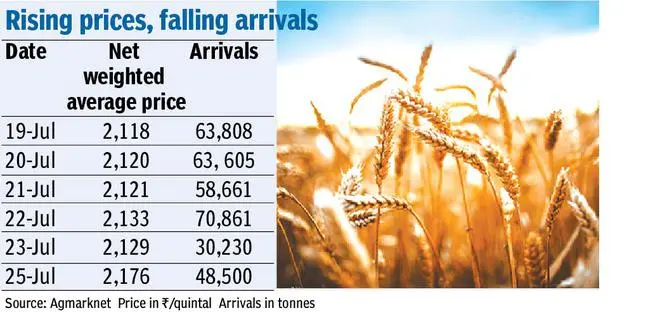

According to Agmarket data, the net weighted average modal price (the rate at which most trades take place) of wheat increased to ₹2,176 a quintal on Monday (July 25) from ₹2,050 on June 27. Arrivals over the past week have dropped to below 60,000 tonnes nationally from over 60,000 tonnes until July 20.

Data from the Consumer Affairs Ministry show that retail prices of wheat have increased by 4.37 per cent month-on-month to ₹30.34 a kg now, while atta (wheat flour) rates have gone up by 3.28 per cent to ₹34.31 during the same period.

For the user industry in the South, wheat is delivered at ₹28,000 a tonne but industry sources say ample stocks are not available.

“It is not as if we have run out of wheat stocks. Many traders had stocked wheat following export demand. They had bought it at a price which is higher than current market prices. They will not release the stocks now as they will burn their hands,” said a trade analyst, not wishing to identify in view of the sensitiveness of the issue.

“Even rice traders had bought wheat when there was a huge demand for exports,” said the trader.

Many traders had bought wheat and built inventories to gain on export demand as supplies from Russia and Ukraine, which make up 30 per cent of global trade in wheat, got affected due to the war between them. This resulted wheat in galloping to an 11-year high of $12.75 a bushel ($468.47 a tonne) on the Chicago Board of Trade (CBOT).

The traders also bought huge volumes of wheat anticipating a record 111.43 million tonnes (mt) of production in India this year. However, a heat wave that swept across the country in March and April affected the crop, resulting in the Agriculture Ministry pruning its crop estimated to 106.41 mt. The US Department of Agriculture has pegged it even lower at 99 mt.

Traders bought wheat at a price much higher than the minimum support price (MSP) of ₹2,015 a quintal set for this year. This resulted in the Food Corporation of India (FCI) being able to procure only 19 mt of wheat for the buffer stocks against 43.44 mt last year. Besides, surging inflation left the Centre worried.

As a result, it banned wheat exports from May 13 catching the traders on the wrong foot. However, they are still holding on to the stocks expecting to make gains during the latter part of the year when prices rise further.

“The problem for the Centre is that it cannot impose stock limits as wheat is harvested within a short time and stored until the next harvest due in March-April 2023. Imports even at zero customs duty are also ruled out as prices are above $400, which is almost ₹32,000 a tonne,” said the trade source. India imposes a 40 per cent Customs duty on wheat imports.

Currently, benchmark wheat futures on CBOT are ruling at $7.99 a bushel ($293), but spot prices, according to the International Grains Council, are $323 a tonne for US Soft Red Winter wheat and $351 for EU French grade wheat. US Hard Red Winter wheat is quoted at $371 a tonne and Argentine wheat at $410. All these prices are free-on-board, which means there are additional costs for insurance and freight.

Last week, Bangladesh finalised a tender to import 50,000 tonnes of wheat at $448.38 a tonne (₹35,800).

“The Centre has to inspect its buffer stocks and probably, offload 3 mt of wheat in the open market during the festival season between October and December. Prices will not only cool but also bring out the hoarded stocks,” the trader said.

The trade analyst said traders are expecting the area under wheat to decline next year in view of high fertiliser prices. “So, they are holding expecting prices to surge later this year or early next year,” he said.

According to trade, the Centre is watching the situation closely but its options are limited. Meanwhile, the Roller Flour Millers Federation of India is set to meet Food Ministry officials on August 3 to discuss the issue of wheat availability.

Wheat prices had gained mainly on export demand. Currently, the spike is in view of lower production and buffer stocks. As of July 1, the FCI had 28.5 mt of wheat stocks—the lowest since 2008—against 60.35 mt a year ago.

A section of the trade says with wheat having dropped 44 per cent from the peak, it is looking technically week. The UN-sponsored deal between Ukraine and Russia to allow wheat exports from the Black Sea region could further put pressure on wheat.

Published on July 26, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.