The edible oils sector is the one that is currently smiling as growers have opted for oilseed crops in a big way this year. This is because, over the last couple of years, prices of edible oils surged in view of the Covid pandemic affecting oil palm production in South-East Asia and soyabean output was hit by dry weather in South America. The Russia-Ukraine war was another blow for consumers as sunflower oil supplies were affected from both the nations.

While Indian farmers have switched over to oilseeds — particularly soyabean, sunflower and groundnut — from other crops such as coarse cereals, a big question hanging over the growers is how will prices rule when the crops are harvested, especially since palm oil prices have crashed in the global market.

Traders and experts see a bearish trend ahead since it is peak palm oil production season and Indonesia, the largest palm oil producer, is under pressure to cut its inventories.

In addition, the Centre has allowed duty-free import of soyabean and sunflower oil under the tariff rate quota (TRQ) from Junefor two years. A total of 4 million tonnes (mt) — 2 mt each year — can be shipped into the country, which could further impact the returns to the growers.

However, growers have gone by price trends that were prevailing before June, especially in the case of soyabean and sunflower. A favourable monsoon is helping growers increase oilseeds coverage in kharif season if the estimations of the industry and the government are any indication. In fact, stakeholders in the oilseeds sector are now expecting the total area to cross last year’s figure of 194 lakh hectares (lh).

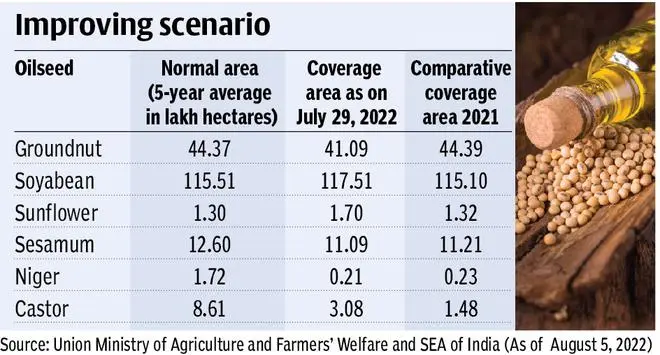

Weekly official data on area coverage under kharif crops as of August 5, had estimated the area under oilseeds crops at 174.79 lakh hectares (lh) against 173.82 lh, up nearly one per cent.

Atul Chaturvedi, President of Solvent Extractors’ Association (SEA) of India, recently said the sowing area under oilseeds crops is likely to increase in the coming days. “We should not be surprised to see it cross the last year level of 194 lh,” he said.

BV Mehta, Executive Director of SEA, told BusinessLine that the good price for oilseeds in the market, especially soyabean, and a good monsoon will lead to the increase in the oilseeds acreage during the current kharif season.

Stating that the figures provided are of 10 days prior to that, he said the acreage will go up further by August 15. “I am expecting that the increase will be higher than the last year looking at the current price and favourable monsoon so far,” he said.

“India’s kharif oilseed crop has been good till now, except in some areas of Maharashtra and Madhya Pradesh where there was flooding. These areas may face some damage but we have to see how the monsoon behaves in the central India growing areas over the next couple of weeks since heavy rains have been forecast. Floods could affect the crop,” said Abdul Hameed, Director- Sales, Manzoor Trading in Lahore, Pakistan.

“We have observed an increase in the sowing of oilseeds this year despite a drop in the total area under cultivation. Unexpected rainfall can affect the overall production of seasonal oilseeds such as groundnut, sunflower, soybean and castor. Owing to heavy rainfall in Andhra Pradesh and Karnataka, the groundnut crop could be affected by a fungal infection,” said Sateesh Nukala, CEO and Co-founder, BigHaat.

“However, the same rains can wash away the pests and negate any loss due to infection,” he said.

“Sowing of oilseeds in India will be more, but the market will be bearish in view of the imports under TRQ,” Hameed said.

Farmer sources said soyabean and cotton emerged as promising bet with significantly high prices recorded last year.

Soyabean

Among the oilseeds, the acreage under soyabean sowing has seen a maximum growth till July 29.

The area under soyabean was at 117.51 lh till August 3 against 115.10 lh in the corresponding period a year ago. With this, kharif sowing of soyabean has a growth of 2.8 lh till July-end.

Mehta said the acreage under soyabean is likely to go up further as farmers are getting good price for the commodity.

DN Pathak, Executive Director of Soyabean Processors Association of India (SOPA), said: “As of now the prospects for soyabean is very good. There are no complaints and the area will be similar or slightly higher than last year, but it is too early to quantify the crop size.”

According to SOPA, the soyabean acreages will be around 120 lh.

States reporting higher acreages, according to SOPA, include Maharasthra 47.12 lh (44.49 lh in same period last year), Rajasthan 11.32 lh (10.3 lh) and Karnataka 4.13 lh (3.78 lh). In Madhya Pradesh, the largest producing state, acreages are seen lower at 50.21 lh (55.68 lh).

Monsoon and soyabean

However, soyabean cultivation has suffered a major setback in Maharashtra, though kharif sowing has gained momentum in the state.

Marathwada and Vidarbha regions are the major soya growers. But heavy monsoon showers in the region has affected cultivation and in many places, and farmers have to go for second and third sowing.

Nukala said heavy rains in some of the growing regions in Maharashtra and Karnataka have led to stunting or reduced growth of soyabean, but fewer pest attacks have been seen for the same reason.

Farmers and experts say that the overall output of soyabean in Maharashtra will be affected. Twenty-one of the 34 districts in the State received excess rainfall this monsoon. A majority of these districts are in the Marathwada and Vidarbha regions.

Pathak said though there are reports of excess rains affecting the soyabean crop in some areas of Maharasthra, it is unlikely to have any impact.

Stating that the monsoon has been good during this year till now, Mehta said there was not much impact due to floods, etc. “By and large we are not getting heavy damage to the crops,” he said.

Sunflower

Under sunflower, the overall acreages have increased to 1.70 lh as of August 5 compared with 1.32 lh in the same period last year. Karnataka has led to this increase in area under sunflower. In Karnataka, the area has increased to 1.40 lh from 0.95 lh in the same period a year ago. Lack of quality seed availability has led to the limited increase in area expansion under sunflower.

With entities such as NDDB, Karnataka Oilseed Federation, University of Agricultural Sciences, Bangalore, and the Indian Institute of Oilseeds Research, Hyderabad, coming together to scale up sunflower seed production, the availability of quality seeds is likely to the increase for the upcoming rabi season.

BigHaat’s Nukala said with the unexpected rains during the flowering stage, the yield will likely be affected.

Groundnut

The area under groundnut was at 41.09 lh till August 5 against 44.39 lh a year ago, a decline of 3.3 lh.

Quoting the sowing figures, Mehta said the definitely soyabean is getting the boost, but groundnut is lagging. However, the weekly numbers of kharif sowing by mid-August will have to be looked at to get a clear picture.

Gujarat’s three-year average oilseeds acreage is 28 lh against which this year the cultivation stood at 20.7 lh (22.97 lh last year), primarily hit by a switch towards cotton.

Of the three kharif oilseed crops -- groundnut, sesame and soyabean -- sowing for groundnut and sesame took a beating while that for soyabean remained stable. But reports from Tamil Nadu say farmers in the southern State have gone in for groundnut this year instead of ragi or maize.

“Farmers in Tamil Nadu find it cumbersome to grow coarse cereals such as maize and ragi. There are problems of labour shortage, too. So, many have switched over to groundnut, which is considerably easy to cultivate,” said Vettavalam K Manikandan, President, Tamil Nadu Farmers Association.

In Gujarat, groundnut has been sown on 16.72 lh (18.93 lh), 12 per cent down over the same period a year ago, and sesame seed area was down by about 40 per cent to 47,063 hectares. But soyabean acreage stood at 2.11 lh (2.19 lh).

Sameer Shah, a Rajkot-based expert in edible oils, said the trade and farmer groups had anticipated a large dip in groundnut sowing owing to attractive alternate of cotton and soyabean. The sowing is still under progress and a clearer picture will be seen once the monsoon ends.

Sesame

The sesame seed crop is seen vulnerable to extended rainfalls activity, which dented the quality of the seed. This would hamper the export market, therefore, farmers preferred winter sowing for sesame seed than the kharif. “The groundnut and sesame seed growers have switched over to cotton in anticipation of a repeat of higher prices as observed last year,” he said.

Castor

SEA’s Mehta said he did not take castor sowing into account while referring to the sowing of oilseeds as the normal sowing of castor takes place around July 15. “We will get a correct picture when we get the numbers by August-end,” he said.

The area under castor was at 3.08 lh till August 5 against 1.48 lh during the corresponding period of 2021, a growth of 1.6 lh.

Looking at the current situation, he said, the overall sowing numbers could be higher by 5 per cent compared to the last year. There was a record oilseed crops production during kharif 2021, he added.

Govt thrust

The Government is giving more thrust on increasing the area under oilseeds cultivation and improving the yield of the crops in the country considering the demand and supply gap for edible oils in the country.

The National Conference on Agriculture (kharif campaign 2022) in April this year had focussed on this issue.

AK Singh, Agriculture Commissioner of the Department of Agriculture and Farmers’ Welfare, under the Union Ministry of Agriculture and Farmers’ Welfare, who had made a presentation at the conference, said increasing productivity and acreage under oilseeds are the two-pronged approach, along with the strategies/action plans, similar to that of pulses, for marching towards the self-sufficiency in edible oils.

Stating that the gap between demand and supply for edible oils has widened in India over the years, Singh said in the presentation that per capita consumption of edible oils has increased from 15.8 kg a year in 2012-13 to 18.8 kg a year in 2019-20. There has been 2.48 per cent annual growth in the per capita consumption.

His presentation had set 26.89 million tonnes (mt) of oilseeds production target for the kharif sesaon and 14.45 mt for rabi.

Seeds availability

According to the conference presentation, the availability of the seeds for sowing was surplus for groundnut, sunflower, sesame and castor; and there was a deficit in the case of soyabean seeds.

The conference had estimated the requirement of soyabean seeds for kharif season at 3.72 lakh tonnes (lt). However, it had put the availability of soyabean seeds at 3.52 lt.

Referring to the information provided by the states in zonal seeds review meeting (ZSRM) Kharif-2022, the meeting was informed that the deficiency will be met from farm-saved seeds, NSC (National Seeds Corporation) and private seed companies.

The conference estimated the requirement of groundnut seeds at 2.13 lt and availability at 2.18 lt, sunflower seed requirement at 1258.8 tonnes and availability at 1607.1 tonnes, sesame seed requirement at 1890.9 tonnes and availability at 2059.8 tonnes, and castor requirement at 4916.5 tonnes and availability at 5262.2 tonnes.

(With inputs from Vishwanath Kulkarni ,Bengaluru; Rutam Vora, Ahmedabad; Radheshyam Jadhav, Pune; and Subramani Ra Mancombu, Chennai)

(This is the fifth in the series of report on Kharif outlook. On August 8: Cotton outlook)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.