With contraction in capital expenditure and lower gross tax collection, fiscal deficit touched 46.5 per cent of Budget Estimate (BE) during the first seven months (April-October) of this fiscal, data from Controller General of Accounts released on Friday showed.

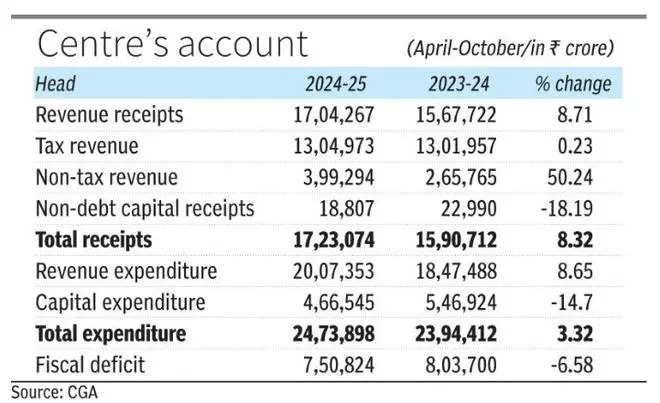

Fiscal deficit refers to difference between the expenditure and the income. In absolute terms, fiscal deficit was over ₹7.5 lakh crore as against over ₹8 lakh crore in the corresponding period of the last fiscal. In terms of share of BE, it was 45 per cent during the first seven months of the last fiscal.

In the Budget, the government had projected that the fiscal deficit would be brought down to 4.9 per cent of gross domestic product (GDP) in financial year 2024-25. The deficit was 5.6 per cent of the GDP in 2023-24. In absolute terms, the government aims to contain the fiscal deficit at over ₹16.13 lakh crore.

The Centre’s revenue-expenditure data for the first seven months of 2024-25 showed that the net tax revenue was about ₹13 lakh crore or 50.5 per cent of Budget Estimate for the current fiscal. The net tax revenue collection was 55.9 per cent at September-end of the last fiscal.

The total expenditure in the seven months through October stood at ₹24.7 lakh crore or 51.3 per cent of Budget Estimate. Expenditure was 53.2 per cent of Budget Estimate in the year-ago period. Of the total expenditure, ₹20 lakh crore was in the revenue account and ₹4.66 lakh crore in the capital account.

According to Aditi Nayar, Chief Economist with ICRA, after 10.3 per cent growth in Q2 FY2025, capex recorded an unexpected 8 per cent contraction in October. “To meet the FY2025 RBE, the government needs to incur a capex of ₹. 1.3 lakh crore per month during November-March FY25, which entails a daunting expansion of 61 per cent. We are apprehensive that the capex target of ₹11.1 lakh crore for FY25 will now be missed by a margin of at least ₹1 lakh crore,” she said.

CORPORATE TAX MOP-UP

While corporate tax collections have been tepid, rising by just 1.2 per cent in April-October, income tax collections have expanded by a robust 20.2 per cent during this period, although these trends may have been partly distorted by the timing of refunds.

“ICRA believes that income tax collections may surpass the FY25 RBE of ₹11.5 lakh crore, unless large refunds are released in the latter part of the fiscal, while corporation tax inflows may print in line or slightly lower than the target,” Nair said, adding that the anticipated miss in the capex target is expected to offset any shortfall on account of disinvestment and taxes and thus deficit will mildly trail the estimates.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.