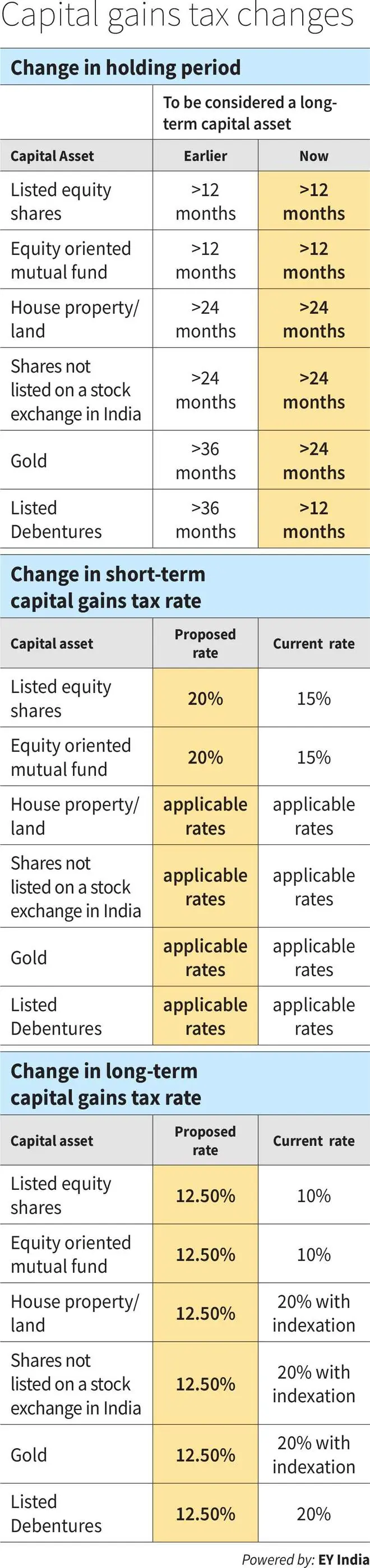

The regime for long and short-term capital gains tax has been rationalised or simplified across asset classes, but the implications for investors are quite complex, entailing much higher outflows.

Profit from listed stocks and equity-oriented mutual funds will qualify for long-term capital gains if held for 12 months or more. There is no change here. But taxation will be 12.5 per cent on gains over ₹1.25 lakh, up from 10 per cent currently (for gains more than ₹1 lakh).

In the case of all other asset classes — property, gold, bonds, debentures — long-term capital gains will kick in after a holding period of 24 months. And LTCG tax will be 12.5 per cent, down from 20 per cent with indexation benefits in some cases.

But the biggest challenge posed is the complete eradication of indexation benefits across asset classes.

Then there is also the clarification on specified mutual fund for the purpose of determining what a debt scheme is.

Does simplification of holding periods and the taxation rates make asset allocation any easier? Not necessarily.

Factoring in higher tax outflows

Investing in equity entails a goal-based focus — retail investors looking to save for specific long-term targets such as children’s education or marriage or any other goal. For example, with an investment of ₹50 lakh over many years, if you want to reach a target of ₹1 crore, the sum that would be required to earn this amount post-tax would vary.

With 12.5 per cent long-term capital gains tax and ₹1.25 lakh exemption, you will need ₹1.76 lakh more than you would with 10 per cent LTCG and ₹1 lakh with exemption. Earning this additional amount will entail making higher investments or generating greater returns (which would mean more risks for the same horizon).

With fixed income, the problem becomes more complex. With fixed deposit interest and coupons on bonds or debentures, the entire amount becomes taxable at your applicable slab rate. But capital gains would have a 12.5 per cent tax on long-term profits of debentures or bonds. Investing in a debt fund would mean a 12.5 per cent tax on profits after a holding period of two years, but there are duration and interest rate risks.

And as you near your goal and you shift some equity proceeds to debt funds or deposits for safety, you will pay higher long-term capital gains tax on the equity part. And withdrawing the debt portion for your goals before two years will mean paying 20 per cent taxes on gains, higher if FDs are part of the equation. For example, if you exit a flexi-cap fund about a year or so before your goal and shift the proceeds to a money market or liquid fund, and finally withdraw everything, you will pay 12.5 per cent LTCG on the equity part and 20 per cent on the bond fund profits.

With real estate, the major advantage of indexation is done away with. Those who bought plots of land or houses as investments two decades or more, hoping that indexation would shield them from higher outflows, would now have to deal with a 12.5 per cent tax on the entire gains. If the gains are truly superlative, then perhaps a 12.5 per cent tax could be at par or beneficial.

However, if a person who wants to sell her apartment that hasn’t appreciated much in, say, the past 15 years and would even possibly incur a capital loss if indexation were applied, would now have to pay tax on an already under-appreciated property. It will worsen an already distressed sale.

From an overall asset allocation perspective, removing inflation and its erosive effects from decision-making may mean sub-optimal choices. For, aren’t investments and asset allocation decisions meant to beat inflation in the first place?

Clarity on gold ETF

The Budget memorandum has some clarification on debt funds, which arose due to removal of indexation in the 2023 Finance Bill.

A mutual fund that invests more than 65 per cent of its total proceeds in debt and money market instruments or a fund which invests 65 per cent or more of its total proceeds in units of a fund referred to earlier is a specified debt mutual fund.

Since a gold ETF or a gold fund does not fall in the above categories, it would go to the 12.5 per cent (LTCG on 24 months holding) and 20 per cent (STCG on less than 24 months holding) slabs.

Gold is a safe haven and is expected to beat inflation over the long term. With taxation (albeit at lower rates without indexation), its role in the portfolio will, again, have to be evaluated.

Overall, taxation and holding periods are simple. But asset allocation and goal-based investing have gotten tougher with higher investment requirements, perhaps higher risk appetites and longer time horizons.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.