One of the most talked about amendments from the Budget presented on Jul 23, 2024 has been the removal of indexation benefit for long term capital gains (LTCG), especially on sale of property.

The current taxation helps taxpayers claim losses in scenarios where the property value did not appreciate in line with inflation as during real estate downcycles.

Now under the proposed taxation, it will be a simple direct math subtracting the purchase price from the sale price. And where the difference is positive, pay tax at 12.5 per cent on the same, assuming you have held the property for at least 2 years.

Comparison

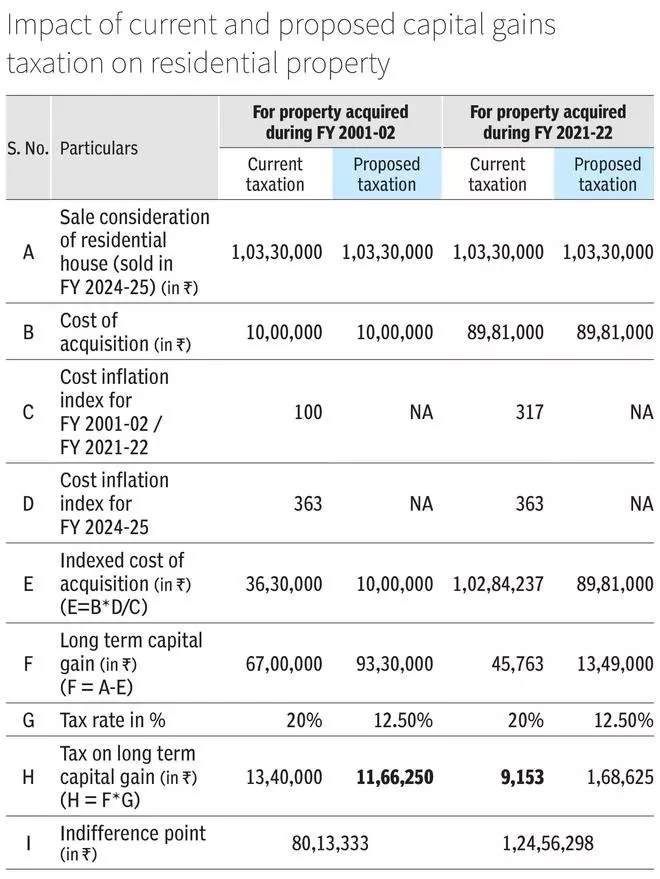

The government’s stand is that the proposed scheme without indexation will help save taxes better in most scenarios, than the current taxation with indexation. In the accompanying table, we cover a few broad scenarios to see if you benefit from the move or not.

The numbers considered in the illustration are based on market value of a 1000 sq. ft. apartment in Pune, using NHB’s Residex.

Where the sale consideration as on date, of a property purchased for ₹10 lakh during FY 2001-02, stands at ₹1.03 crore, the taxpayer would technically benefit under the proposed taxation as the lowered tax rate helps beat the indexation benefit.

But the tax outgo would be indifferent under both the present and proposed taxation at a sale price of around ₹80.1 lakh. However, any increase in the sale price beyond this indifference point, would make the new taxation beneficial.

That said, for a property purchased as recently as in FY 2021-22, the indexation benefit offered by the old tax taxation comfortably beats the benefit of the lowered tax rate.

The indifference point for this would be around ₹1.25 crore and similarly, any sale price above the indifference point makes the new taxation beneficial.

Grey Area

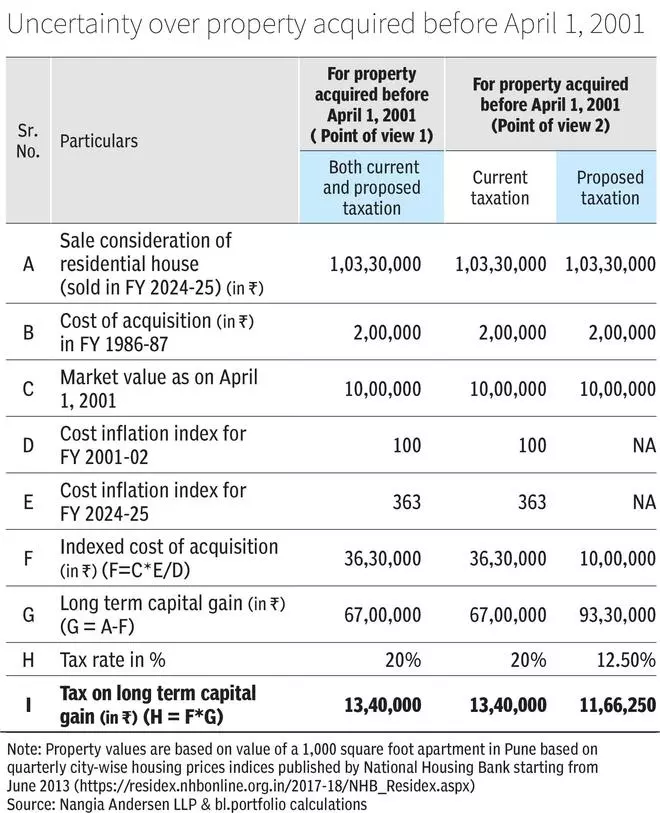

On the face of budget documents, it was plainly said that the indexation benefit is removed as a whole. However, in the post-budget conference, it was stated that in the case of properties acquired before April 1, 2001, the indexation benefit is available only up to April 1, 2001.

Assume that this property was bought in FY 1986-87 for ₹2 lakh. This is brought up to the Fair Market Value (FMV) as on April 1, 2001, as per tax laws, which would be ₹10 lakh, in line with the illustration.

Experts we spoke to are of the view that the indexation benefit is available till the date of sale, and that the proposed taxation is not applicable, thus resulting a tax outgo of ₹13.4 lakh (as per current taxation).

However, there is also another interpretation that no indexation benefit accrues post April 1, 2001 and the initial exercise to bring the purchase price to FMV as on April 1, 2001 is only allowed. This would result in a tax outgo of ₹ 11.7 lakh as explained in the illustration.

Clarity is awaited in this regard.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.