Buoyed by India's strong consumption patterns, venture capitalists are flocking to fund retail sector startups.

Investor confidence in new-age retail companies and startups has surged, with funding in the retail sector increasing by 32 per cent to $1.63 billion in the first half (H1) of 2024, up from $1.23 billion in H1 2023, according to data intelligence firm Tracxn.

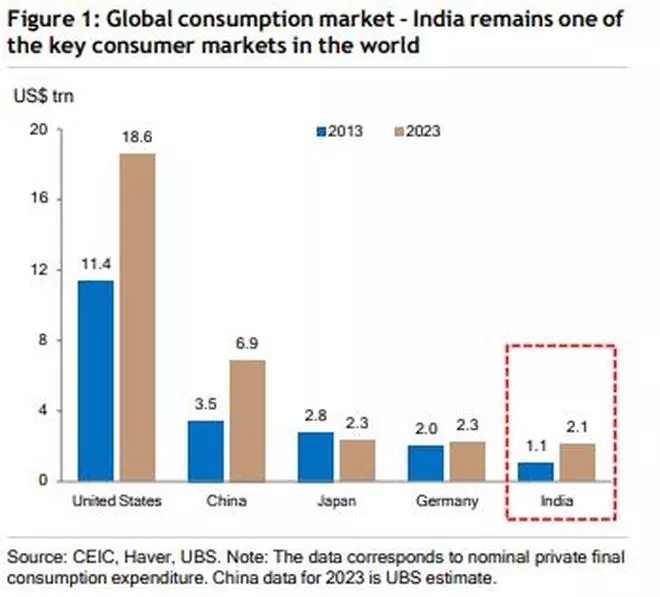

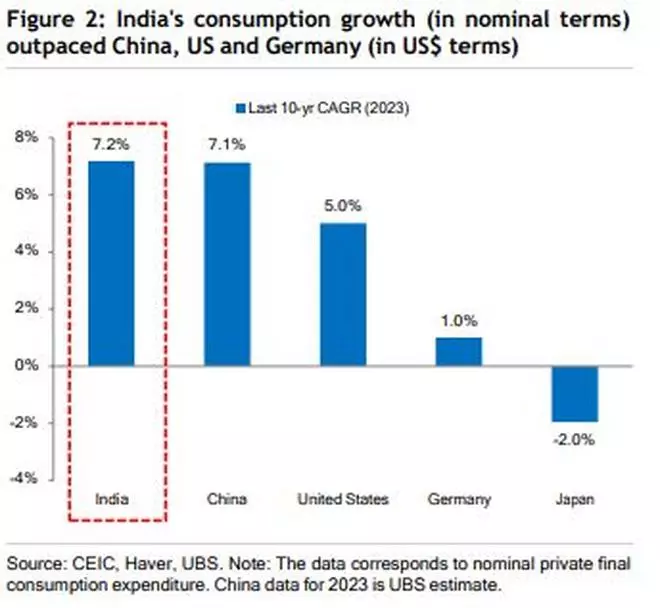

The Indian economy is on track to emerge as the third-largest economy in the world by 2026. Last year, the country's consumption grew at a faster pace than that of advanced economies such as China, the US, and Germany, as observed in a UBS report.

The report further noted that India's household consumption nearly doubled in the past decade to $2.1 trillion last year, with an annual compound growth rate of 7.2 per cent, higher than the aforementioned countries. Additionally, India is expected to surpass Germany (in 2024) and Japan (in 2026) to become the third-largest consumer market in the world.

Commenting on venture capitalists’ interest in new-age retail companies, Harmanpreet Singh, Co-founder and Managing Partner of Parth Ventures, said, “India’s GDP is projected to reach $8 trillion by FY32, with consumption expected to remain around 60 per cent of GDP. Thus, Indian consumption is expected to cross $4.5 trillion in the same period.”

“For context, this is more than double the current consumption and will equal what China’s consumption was in 2015. With this context, there is naturally some catching up to do for venture capital to invest in this space,” he said.

He opines that companies such as Zomato and Nykaa have yielded attractive outcomes in the consumer-tech space. However, investors have witnessed large failures driven by unsustainable unit economics and misallocation of funds.

The industry is perhaps over-correcting by focusing on more conventional businesses like retail and omnichannel brands, where more sustainable business models are being funded. "We expect the focus on profitability and sustainable business models to keep this sector at the forefront of investor interest in 2024 and beyond," he added.

Singh highlighted that during 2020-2022, investors strongly favoured online and consumer-tech businesses due to the COVID-19-driven surge in digital adoption, resulting in high growth and controlled customer acquisition costs.

However, two key realizations have emerged: the number of consumers willing to spend significant money online is limited to around 40-50 million, and even these customers still value the trust and reliability that offline retail and distribution provide.

Shravan Shetty, Managing Director at Primus Partners, said, "The sector's share has increased as interest in the sector has remained buoyant, while exuberance for other sectors has reduced. Venture capital is behaving similarly to the markets, where the long-term story of consumption has picked up compared to other themes like fintech, which has seen reduced interest compared to previous years."

According to the Tracxn report, the first half of 2024 witnessed 8 funding rounds surpassing $100 million such as Flipkart's USD $350 million Series J round led by Google, Apollo 24|7's $297 million PE round, and Meesho's $275 million Series F round, underscoring the VCs strong intent for the retail sector companies.

Dr Ashwini Mahajan, who led the delegation of economists that met Finance Minister Nirmala Sitharaman with suggestions, told ANI, "As far as investors are concerned, they always make comparisons between economies, and India, due to its sustained performance on the GDP front, is among the best places to invest. Due to its expanding economy and consumption, the country is able to attract investments."

The Indian economy has witnessed a significant change in spending patterns by consumers. Spending in rural areas increased by 164 per cent and in urban areas by 146 per cent since 2011-12, at current prices, as demonstrated by recently released data from the Household Consumption Expenditure Survey.

According to the survey, the country saw a significant surge in Monthly Per Capita Consumption Expenditure (MPCE) in 2022-23, with rural spending reaching ₹3,773 and urban spending at ₹6,459, reflecting a 164 per cent and 146 per cent increase, respectively, since 2011-12 at current prices. Adjusted to 2011-12 prices, the growth is 40 per cent in rural areas and 33 per cent in urban areas.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.