As India’s peak power demand broke all past records during the humidity-impacted August, the domestic coal-based (DCB) power plants are facing shortage of coal, which in the first 21 days of the month has already surpassed 4.43 million tonnes.

India’s electricity consumption during peak hours surpassed Power Ministry’s estimate of 229 GW on August 16, August 17 and August 18, with peak demand met during the day hitting 233 GW, 234.1 GW and 231.6 GW, respectively.

Sources said as India faces higher requirement for electricity due to high heat index and humidity, power demand appreciated significantly, particularly in North, Central and South India.

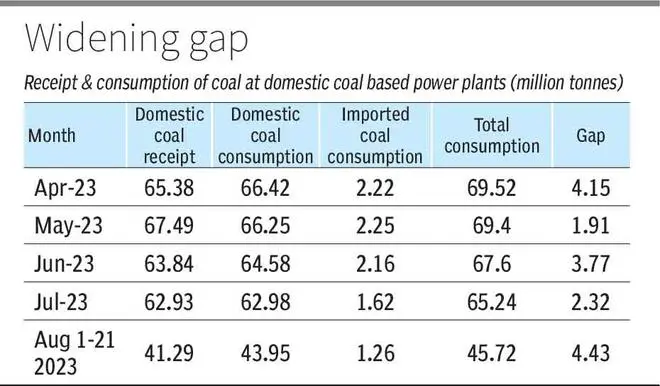

At the same time, there is a gap between receipt and consumption of domestic coal, which has been increasing, said one of the sources.

For instance, DCB plants consumed 45.72 mt of the dry fuel between August 1 and August 21 against a receipt of 41.29 MT taking the shortage to 4.43 mt, which is the highest in FY24 and “possibly” in the current calendar year.

Similarly, the gap between receipt and consumption of coal during April, May, June and July 2023 stood at 4.15 mt, 1.91 mt, 3.77 mt and 2.32 mt.

“This shortage forced power plants to import coal. Had plants not imported coal during December 2022, the shortage could have been higher. There seems to be a lag in the planning of transporting coal as electricity demand started rising in July and August against the summer months,” a senior government official explained.

Coal imports rise

Power sector imported 14.21 mt of coal during Q1 FY24. Besides, CareEdge data show that imports rose 25.6 per cent Y-o-Y to 192 mt in April-December FY23 with non-coking coal, mainly used in power generation, accounting for 66 per cent of the total.

According to the National Power Portal, the pan-India coal stocks at DCB plants stood at 29.7 mt, which is sufficient for just 11.4 days as on August 21. On the same day, the number of DCB plants with critical stocks stood at 28.

A comfortable position for reserves is around 14-15 days, an official said, adding that during rains transporting coal becomes an issue. The planning for transporting the crucial resource should have been done at least by April-May 2023.

- Also read: Coal India production up 13.4% in July

Coal reserves data for DCB plants show that the 147 non-pithead plants with a capacity of 148.37 GW, against a daily requirement of 2.08 mt, the domestic stocks stood at 20.89 mt and imports were at 1.24 mt, as on August 21. The percentage of actual stocks vis-a-vis normative stock was 51 per cent.

This impacts power generation, another senior government official said. Between August 12 and August 21, the pan-India peak demand met during the day averaged at almost 225 GW, while the peak shortage averaged at around 3.80 GW.

Heat & humid weather

The official explained that heat and humid weather led to higher demand for cooling, which rose from an average of around 5-6 hours per day to more than 10 hours. It reflects in the record high consumption.

The power shortage during solar hours has been lower compared to non-solar hours. For instance, on August 17 the max demand met for solar hours stood at 212.72 GW, and 234.1 GW in non-solar. However, the shortage in solar hours was just 87 MW against 6,719 MW in non-solar hours.

Similarly, on August 21, the peak demand met during solar hours was 226.24 GW and 208.36 GW in non-solar. The shortage in non-solar hours stood at 716 MW, while that in non-solar hours zoomed to 9,640 MW.

The record high consumption and deficit also reflected in the high prices for procuring electricity at power exchanges. For instance, at the Indian Energy Exchange (IEX), the average market clearing price on August 20 was ₹6.9 per unit, which rose to around ₹8 per unit a day later, and then went further north to ₹9.4 a unit on August 22.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.