With Reserve Bank of India estimating over ₹1.50-lakh crore of ₹2,000 notes deposited, depositors with higher value of transactions need to take extra precaution.

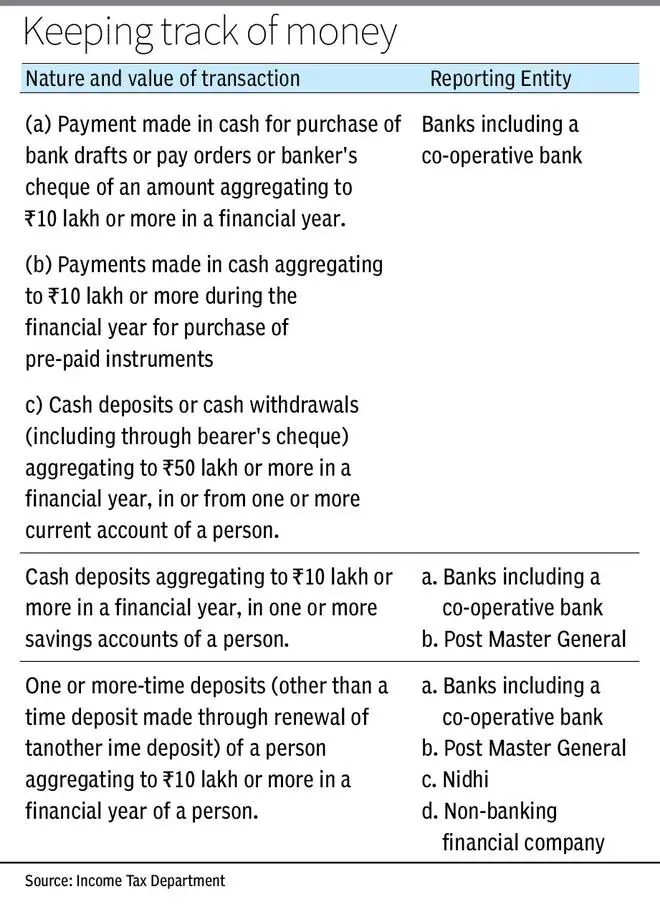

According to Rule 114E of Income Tax Rules 1962, all categories of banks, post offices, NIDHI and NBFcs are required to report Specified Financial Transaction (SFT), done by their customers to the Income Tax Department. This is being done to keep track of transactions, curb black money and check illicit activity. Two such transactions are cash deposit above ₹10 lakh in saving accounts (one or more) and ₹50 lakh (one or more) in current accounts.

Reporting entities such as banks are required to give details about such transaction by May 31 of the next financial year. This means information about deposit of ₹10 lakh or ₹50 lakh or payment of ₹10 lakh for bank drafts or pre-paid instruments by way of ₹2,000 notes during May 23 and September 30, 2023 will be given to the Income Tax Department by May 31, 2024.

Also read: Govt introduces black money Bill

Widening tax net

According to, Vivek Jalan, Partner with Tax Connect Advisory, the objective of SFT was to curb black money and widen the tax base. Amit Maheshwari, Tax Partner, AKM Global, a tax and consulting firm, said: “Reporting of transaction is also reflected in the depositor’s form 26AS and Annual Information Statement which effectively means that this information is very well shared with the tax department.”

Over the past few years, the Income-Tax department has adopted technology well to monitor and detect any unusual or suspicious transactions/filters in the returns which get processed.

Hence, “any unreasonable and unusual movement in the bank account of the depositor may invite a tax notice and it is advisable to have an adequate documentation on the source of the income and the source of such deposits since unexplained or undisclosed income will be subject to taxation and applicable interest and penalties,” Maheswari said.

Double whammy

Jalan cautioned that already the cases for cash deposited in accounts during demonetisation are being investigated by various income tax agencies. Hence it is expected that the current 2K notes deposited would certainly come under income tax scrutiny above the Rule 114E level. Issue is that even in genuine cases assesses may be at pains to explain the source of the cash deposits to Income Tax Officers. When taxmen start investigating a case for suppressed income, the GST Authorities would also pounce on the evasion angle.

“Important to note again is that even in case an assessee declares an income to the extent of the amount of cash deposited in the form of ₹2,000 notes, one has to justify the source. Incase the source is not justified then penalty to the extent of 200 per cent may be levied,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.