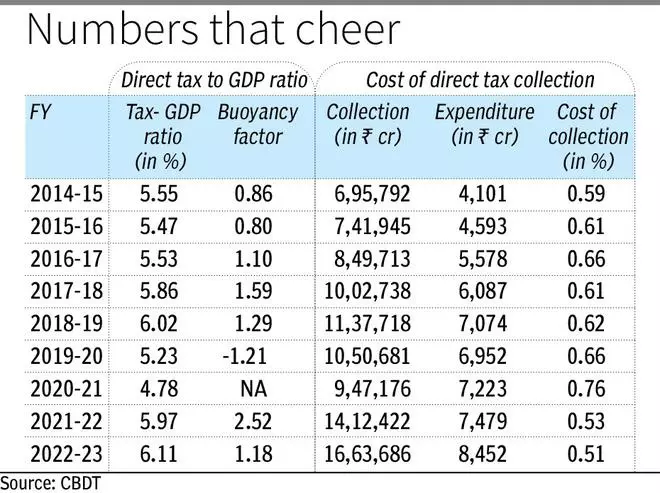

The direct tax-to-GDP (Gross Domestic Product) ratio reached an all time high of 6.11 per cent at the end of FY23, detailed data released on Tuesday by Central Board of Direct Taxes (CBDT) showed. The data also revealed that the cost of collection has come down to lowest level since FY15.

Direct taxes comprise of Personal Income Tax (PIT) and Corporate Income Tax (CIT)

The data shows that previous highest of direct taxes-to-GDP ratio was 6.3 per cent in 2007-08. This is the third time in the last 22 financial years when the ratio has crossed sixper cent level.

According to Asian Development Bank (ADB), the tax-to-GDP ratio indicates the total tax revenue as a percentage of GDP which shows the share of a country’s output that is collected by the government through taxes. It can be regarded as a measure of the degree to which a government controls the economy’s resources.

A research paper by NACIN (National Academy of Customs, Indirect Taxes and Narcotics) observed that countries significantly increase the overall level of taxation (as a share of GDP) as they become richer, in line with Wagner‘s law, which states that the size of the government — proxied by the tax (and expenditure) share to GDP — rises as the associated country‘s income level also rises.

The time series data released by CBDT also showed that between FY14 and FY23, the net direct tax collections surged by over 160 per cent to over ₹16.64-lakh crore in FY23. As the size of nominal GDP grew by around 140 per cent, it also boosted the direct tax-to-GDP ratio.

Further data highlighted that the total number of Income Tax Returns (ITR) filed in FY23 stood at 7.78 crore, showing over 104 per cent growth as compared to total number of ITRs of 3.80 crore filed in FY14. In the current fiscal, the number of returns have already crossed 8 crore.

Meanwhile, the cost of collection has also come down. Data showed that the cost of collection decreased to 0.51 per cent in FY23 as compared to 0.57 per cent of total collection in FY24. Officials credit better tax administration along with use of technology for collecting more at lower cost.

During the current fiscal, latest data showed collection has been encouraging. A statement issued by Central Board of Direct Taxes (CBDT) last week said that direct tax collection, net of refunds, stands at ₹14.70-lakh crore, which is 19.4 per cent higher than the net collections for the corresponding period of last year. This collection is 80.6 per cent of the total Budget Estimates of direct taxes for FY24. With this kind of rise, collection for full fiscal is likely to exceed budget estimate.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.