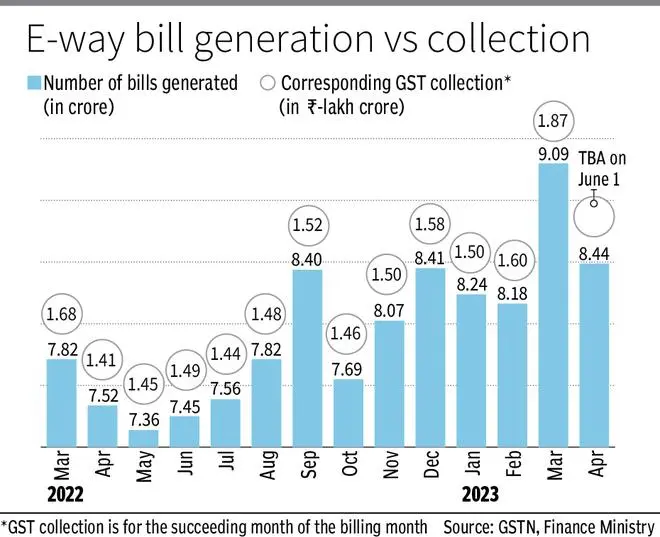

E-way bill (EBW) generation has dropped in April from all time high number in the month of March. Experts say this is signal to drop in collection during the month of May.

Data from GSTN shows, EVB generation clocked 8.44 crore in April as against 9.09 crore in March. However, it is much higher than last April number of 7.52 crore. This means, generation slowed down by 7.15 per cent, but 12.23 per cent higher than last April. This year, April recorded an all-time high GST collection of ₹1.87-lakh crore, overtaking last April’s high of ₹1.68-lakh crore. Tax collection in April is reflective of goods consumed and services availed in March.

E-way bill is required to be generated for the movement of goods, if its value is ₹50,000 or more. It is proof that tax has been paid on the goods that are being taken from one State to another, or even from one city to another within a State. In case of a mix of goods and services, then EWB is required to be generated by entering codes for both.

March normally sees very high generation of EWB, but it dropped in next month this time. This happened because companies tried to end the fiscal on high by exhausting inventory and started the next fiscal on a clean slate. This led to increased movement of goods and thus higher generation of EWB. And in April, the first month of fiscal, movement of goods normalised again.

For example, during 2022, EWB generation was 6.91 crore in February. It rose to 7.82 crore in March, which came down to 7.52 crore in April. Similarly, in 2023, EWB generation was 8.18 crore in February which surged to over 9 crore in March and then dropped to 8.44 crore in April.

Drop in tax collection

Harpreet Singh, Partner with KPMG India says EWB is linked to movement of goods, consequent to supply liable to GST. Accordingly, lesser e-way bills in April are indicative of less manufacturing and trading activities, and hence reduced GST collections. “Unless GST collections on services and imports (first leg) offset the reduction in domestic movement of goods, lesser e-way bill generation is likely to result in a drop in tax collections,” added Singh.

Now, expectation is that EWB generation might fall further in coming months. According to Prateek Bansal, Tax Partner with White and Brief, Advocates & Solicitors the CBIC has recently announced launching a special all-India drive (from May 16-July 15, 2023) against fake GST registrations to nab the issue of circular trading. Consequently, the fake EWB would probably reduce, atleast during this period.

“While the lesser generation of e-way bills suggest that GST collection for May 2023 may see a downward trend, such reduction may prove to be beneficial in the long-run as the unscrupulous activities would be weeded out,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.