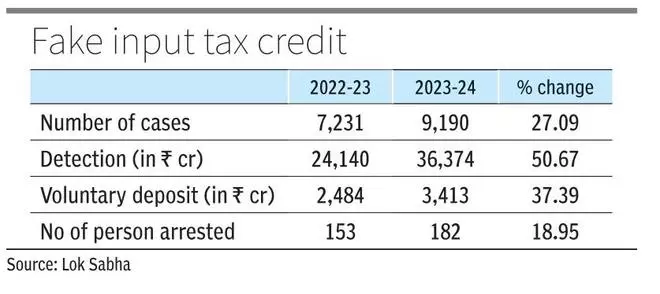

Fake input tax credit (ITC) detection surged 50 per cent in FY24 to over ₹36,000 crore, the Finance Ministry informed the Lok Sabha on Monday However, not even 10 per cent of the said amount has been deposited voluntarily.

According to data presented as part of written response to an un-starred question in the Lok Sabha by Minister of State in the Finance Ministry, Pankaj Chaudhary, over ₹36,000 crore worth of fake ITC detected during FY24 as against over ₹24,000 crore in FY22. Fake ITC refers to a mechanism where there is no real supply of goods or services but invoice issuance and such is used fraudulently to avail ITC.

Challenges

When asked about challenges being faced by the government in tracking the fake ITC fraudsters, Chaudhary said: “The challenges relate to masterminds who operate the fake ITC generation through control and management of a complex web of entities created across jurisdictions. Such challenges are being met through coordination with multiple stakeholders, including law enforcement agencies.”

Unscrupulous elements misuse the identity of other persons to obtain fake/ bogus registration under GST to defraud the Government. Such fake/non-genuine registrations are used to fraudulently pass on input tax credits to unscrupulous recipients by issuing invoices without any underlying supply of goods or services or both.

Fake registrations and issuing bogus invoices for passing off fake ITC have become a serious problem, as fraudulent people engage in dubious and complex transactions, causing revenue loss to the government. According to officials, in the current financial year, the Directorate General of GST Intelligence (DGGI) has emphasised identifying and apprehending the masterminds of fake ITC and disrupting syndicates, operating across the country.

12 steps

Chaudhary listed 12 steps taken by the government to curb the ITC frauds. These include risk based biometric-based Aadhaar authentication of registration applicants who appear to be risky based on data analytics beside physical verification in high-risk cases, even when Aadhaar has been authenticated restriction on availment of ITC to invoices and debit notes furnished by the supplier in their statement of outward supplies

Other measures include filing of FORM GSTR-1 made mandatory before filing of FORM GSTR-3B for a tax period and filing of FORM GSTR-1 made mandatorily sequential. Also, there is provision of making the beneficial owner liable for penal action and prosecution similar to that of actual supplier/recipient, in cases where a supply has been made without the issuance of an invoice, or invoice has been issued without supply, or excess ITC has been availed or distributed.

“Regular use of data analytics to identify or track risky GST registrations to detect tax evasion, all India drive to weed out fake/bogus registrations and sharing of data amongst enforcement agencies for targeted interventions on continuing basis,” Chaudhary mentioned.

In recent times, DGGI has unravelled cases using data analysis aided by advanced technical tools, which led to the arrest of tax evaders. These tax syndicates often use gullible persons and entice them with job/commission/bank loans, etc., to extract their Know Your Customers (KYC) documents, which were then used for the creation of fake / shell firms/companies without their knowledge and consent. In some cases, the KYC method was used with the knowledge of the concerned person by paying them small pecuniary benefits.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.