Global funds have poured close to $18 billion into the Indian government debt since the September 2023 index inclusion announcement of J P Morgan Chase & Co, data with depositories showed.

JP Morgan had then announced that it would add from June 28, the Indian government bonds to its global emerging markets index for government bonds, opening up a $1.3-trillion Indian sovereign debt market to a broader range of global investors.

The inclusion of Indian government bonds will be staggered over a 10-month period from June 28 to March 31, 2025, it was then announced.

Also, at the end of March 2025, Indian government bonds will hold 10 per cent weightage in the GBI-EM Global Diversified Index after 1 per cent is added every month, JP Morgan had said.

RBI-classified bonds

Only those bonds classified by Reserve Bank of India under the Fully Accessible Route (FAR) were eligible for index inclusion. Within this subset of IGBs, there are currently 27 FAR-designated bonds which met the index inclusion criteria as of June 28, 2024.

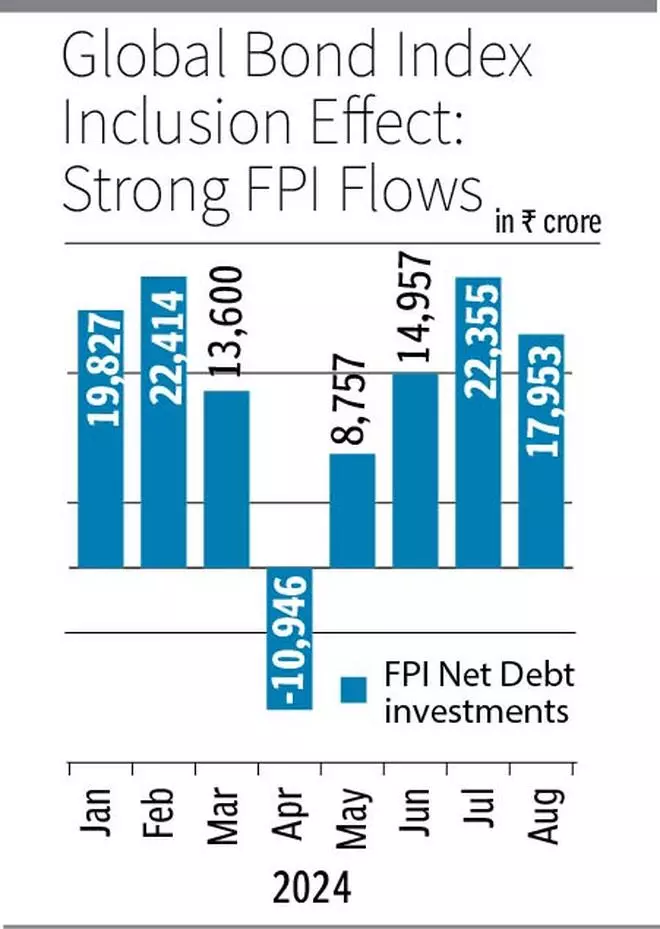

Now, of the $18 billion that FPIs have invested in Indian government debt post index inclusion announcement, as much as $12.9 billion has come between October 2023 and June 2024. The net debt FPI flows since June 28 — day of index inclusion— till end August stood at $5.1 billion.

“Also, now with the expectation of prospective sovereign rating upgrade given the country’s strong fiscal balances, commitment to improved fiscal consolidation and stable political regime leading to growth stability, we should see FPI debt flows continuing to remain positive,” Anitha Rangan, Economist at Equirus, said.

“This is the highest (inflows) after a steady outflow we have been witnessing since 2018. Net/net after more than five years, debt FPI inflows have resumed on a steady positive note,” she added.

Rangan also highlighted that the likely upcoming US Fed rate cuts will trigger further FPI debt flows into India along with the prospect of ratings upgrade.

Meanwhile, debt market experts highlighted that global investors tend to take advantage of the positive movement in yields (of g-secs) before the actual event.

Post the index inclusion announcement, India’s 10-year G-sec yield has gained 25 basis points rallying from 7.25 per cent to 7 per cent by June 2024. It has further moved to 6.85 per cent in September 2024, reflecting a gain of 40 basis points.

Mahendra Jajoo, Chief Investment Officer-Fixed Income, Mirae Asset Investment Managers (India), said that India’s global bond index inclusion story so far has unfolded in line with expectations. The story is very much intact. Because of temporary factors, it has now become a side story, but will bounce back someday, he added.

Overall story has been in a way “high jacked” by new hot issues such as global central banks rate cuts, domestic banks fighting for deposits etc. This (India bond inclusion) has become a side issue for now, he noted.

“The long-term story on bond inclusion is very much intact, but there would be temporary roadblocks when there are structural developments. Policies need to be reviewed and tweaked as experiences are gained”, Jajoo said.

“This (India bond inclusion) has become a side story and not the frontline story anymore. What could have been a very big thing has become subdued because of attendant factors. Had larger index players quickly come to include it and there was no tweaking in FAR rules, then the bond inclusion story would have been even more pronounced.”

Focus on US Fed

On an optimistic note, Jajoo said that once the imminent US Fed rate cut happens this month, FPI flows would continue to improve on the back of strong India story.

Shantanu Bhargava, Managing Director, Head of Listed Investments, Waterfield Advisors, said, “Indian Bond Index inclusion has prompted foreign portfolio investors to look at our markets and invest. Notwithstanding the bond index’s inclusion, we believe FPIs would’ve and will continue to invest in eligible Indian bonds, given our re-rating as an economy. This inclusion has simply accelerated the trend”.

He said the US Fed reduction will likely benefit emerging markets as a whole in terms of flows away from US , as the yield on US Treasury securities will fall. “India is well-positioned among EMs to draw more such flows. At this moment, there are a few options in the emerging market space that are as well-positioned as India,” Bhargava added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.