Bolstered by strong growth in manufacturing, the Indian economy expanded at a rapid 7.8 per cent in January-March (Q4 of FY24), surpassing expectations and pushing up the growth rate for fiscal year 2023-24 (FY24) to 8.2 per cent, Statistics Ministry reported on Friday.

The growth at 8.2 per cent in FY24 was substantive as against 7 per cent of Fiscal Year 2022-23. The growth momentum is expected to continue on account of better monsoon and continuous strong performance of various segments of the economy.

Taking to X, Prime Minister Narendra Modi said: “The Q4 GDP growth data for 2023-24 shows robust momentum in our economy which is poised to further accelerate. Thanks to the hardworking people of our country, 8.2 per cent growth for the year 2023-24 exemplifies that India continues to be the fastest growing majory economy globally. As I’ve said, this is just a trailer of things to come.”

Upbeat

Finance Minister Nirmala Sitharaman said: “It is worthwhile to note that the manufacturing sector witnessed a significant growth of 9.9 per cent in 2023-24, highlighting the success of the Modi government’s efforts for the sector.” Further, many high-frequency indicators show that the Indian economy continues to remain resilient and buoyant despite global challenges. “India’s growth momentum will continue in the third term of PM Narendra Modi-led government,” she said.

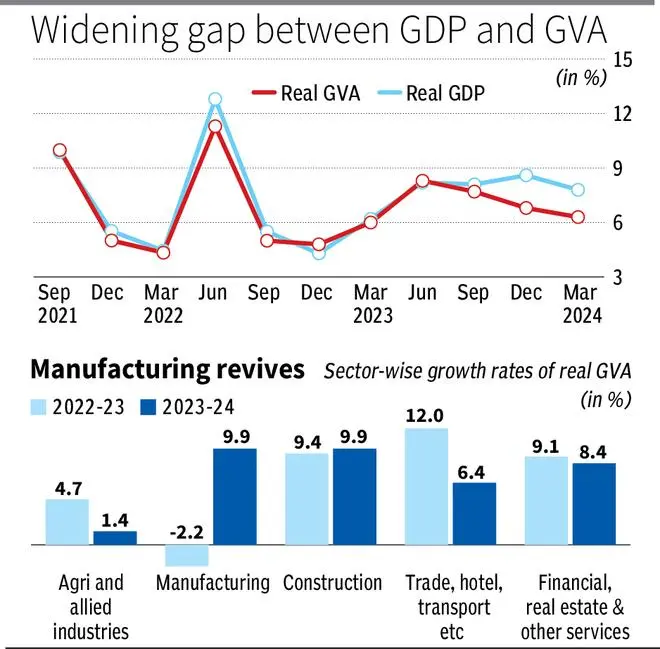

While the industry, led by manufacturing, did well with its growth rate in FY24 jumping to 9.7 per cent as against 2.1 per cent of FY23, services growth rate dipped to 7.6 per cent from 10 per cent. Agriculture growth rate came down to 2.1 per cent from 4.4 per cent on account of uneven monsoon.

Decoding the number, D K Shrivastava, Chief Policy Advisor with EY India, said while private final consumption expenditure (PFCE) growth is still languishing at 4 per cent, the main demand side push is coming from gross fixed capital formation which has grown at 9 per cent. The external sector drag has also lessened. “In Q4, the contribution of net exports turned positive after remaining negative for three successive quarters,” he said.

Meanwhile, the divergence between GVA (Gross Value Added showing supply side) and GDP (Gross Domestic Products showing demand side) continues. “A sharp divergence to the tune of 150 bps between GVA and GDP is due to higher net indirect taxes as subsidy outgo was lower while tax collections rose in the last quarter,” Swati Arora, Economist with HDFC Bank explained while expecting this to continue in the current quarter as well.

Shreya Sodhani, Regional Economist, Barclays, said: “Despite today’s stronger-than-expected print and consequent high base, we maintain our FY24-25 GDP growth forecast at 7 per cent.”

Growth momentum

Further, she expectsthe steady domestic growth momentum to continue supported by the following factors – continued increases in government capex (albeit at a slower pace), the much-anticipated rising private investment, some recovery in rural consumption, even if cylical, and recovery in exports with the uptick in global trade.

“That said, monetary policy expectations suggest rates will remain elevated for longer, creating some headwinds for growth, as reflected in our forecast moderation in growth between FY 23-24 and FY 24-25. In addition, softening GVA for three straight quarters (Q1-Q3 FY24), suggest growth could ease from FY24,” she said.

Shrivastava said FY25 real GDP growth is likely to be in the range of 7 to 7.5 per cent, expecting continued high capital expenditure growth in the forthcoming full year FY25 Budget. “With fiscal deficit at 5.6 per cent of GDP, buoyancy of gross taxes at 1.4 in FY24, and a substantive rise in RBI dividends, the GoI is in a position to lay down a solid foundation for medium term growth averaging 7 per cent,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.