Collection from Goods & Services Tax (GST) in May stood at ₹1.73-lakh crore, the Finance Ministry reported on Saturday. It was lower than ₹2.10-lakh crore in April but higher than ₹1.57-lakh crore in May, last year.

Collection in May is related to consumption of goods and services availed of in April. Experts believe that with the May print, average collection of ₹1.7-lakh crore is the “new normal” against ₹1.6-lakh crore of FY24.

According to a Finance Ministry statement, the gross GST collections in FY 25 till May stood at ₹3.83-lakh crore. This represents an impressive 11.3 per cent year-on-year growth, driven by a strong increase in domestic transactions (up 14.2 per cent) and marginal increase in imports (up 1.4 per cent). After accounting for refunds, the net GST revenue in the FY 25 till May stands at ₹3.36-lakh crore, reflecting a growth of 11.6 per cent compared to the same period last year, the statement added.

‘Robust economy’

Commenting on the collection, MS Mani, Partner with Deloitte, said the latest number is in line with the recent GDP estimates which indicate a robust economy which does not appear to have been impacted much either by the election season or the heatwave across the country. “The resilience shown by the GST collections, without significant seasonal or event-based variations across recent months, indicates the maturity of the GST system,” he said.

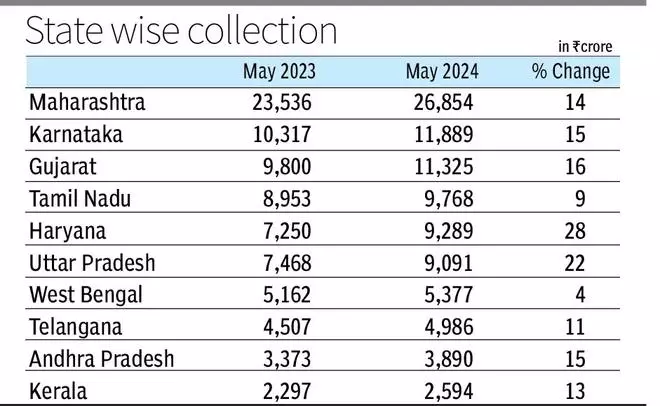

Saurabh Agarwal, Partner with EY, said a rise in GST collections from Jammu & Kashmir, Manipur, Puducherry, and Arunachal Pradesh suggest growing consumption in these developing regions, indicating broader economic progress. “Increased GST in northern states like Delhi, Uttar Pradesh, etc, might be due to election spending and a surge in purchases of fans, coolers, and ACs caused by high temperatures compared to last year. However, a decline from last month’s collections could be due to year-end tax payments in May and potentially stagnant auto sales,” he said.

Vivek Jalan, Partner of Tax Connect Advisory Services, said the first two months of this fiscal have been election months and still an increase of 14 per cent in domestic collections is the effect of the time barring period of issuing notices for FY 2019-20 and the consequential collections due to partial admittance of issues by taxpayers. “Another reason for high collections is the recovery action taken by some GST departments for recovery of 100 per cent of demand amounts barring set up of GST Tribunal,” he said.

Talking about next months, Mani said: “There will now be renewed confidence in moving ahead with the next stage of reforms in the coming months, without significant concerns on the revenue impact that such reforms could elicit.”

- Also read:GST lowered taxes on many essential items compared to pre-GST rates: FM Nirmala Sitharaman

Adding to that, Agrawal said the combination of summer heatwave and lower auto sales might lead to flat or lower GST collections in June 2024 compared to April’s peak. “As the GST Tribunals are expected to be set up this year, the collections may take a hit in the 4th quarter of this fiscal and thereafter,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.