The government’s most transformative reform, the Insolvency and Bankruptcy Code (IBC), which was intended to enforce a time-bound insolvency process, is grappling with inordinate delays.

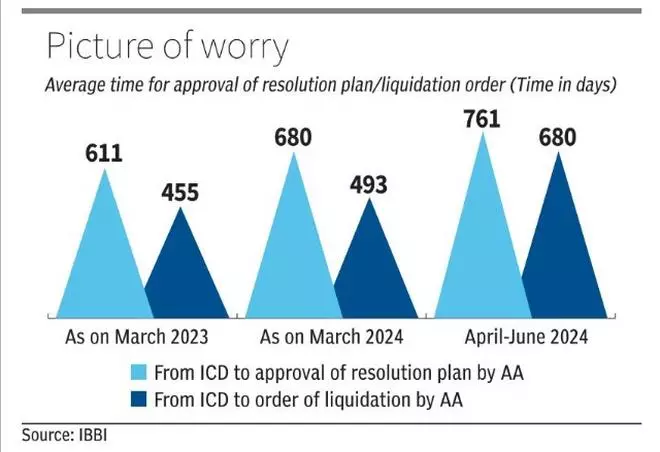

Latest IBBI data showed that the average time for the approval of resolution plans is extending to over two years (761 days), far exceeding the statutory limit of 330 days.

This time period of average 761 days (April-June 2024) is only in respect of time taken between the insolvency commencement date (ICD) and the date of approval of resolution plan by the Adjudicating Authority (AA), which basically is the National Company Law Tribunal (NCLT). This does not cover the time taken from the date of filing application till the date of order commencing CIRP.

The delays are getting prolonged with each passing month as the average time taken for resolution plan approval as on March 2023 stood at 611 days, while it went up to 680 days as on March 2024, IBBI data showed.

Liquidation Orders

The same situation of absence of timelines holds true for liquidation cases too with the average time period for order of liquidation by AA from the ICD coming in at 680 days, IBBI data showed.

The absence of timelines is now threatening to place a question mark on the success of this IBC framework as it completes its eight-year journey, said insolvency law experts.

Understanding the root causes of these delays is crucial to addressing the inefficiencies that undermine the effectiveness of the IBC. These include judicial bottlenecks, complexity of cases, litigation tactics by promoters, creditors and other stakeholders, resolution plan rejections and regulatory and administrative hurdles, they said.

Some of the solutions could be strengthening the NCLT, discouraging frivolous litigations, encouraged pre-packaged insolvency mechanism for all companies.

Experts’ Take

Hari Hara Mishra, CEO, Association of ARCs in India, said: “The timelines for approval of resolution plan and order for liquidation is on rise. There is a need to have an empirical study to find out actual time taken at various stages of IBC process versus prescribed timelines based on some representative cases.”

Wherever substantial time overrun is noticed, reasons for delay and measures to overcome those factors need to be initiated. “Time is money, and more so in distressed assets, where value erosion is fast,” he said.

Misha, Partner, Shardul Amarchand Mangaldas & Co, said, “Ever since the Covid pandemic, an apathetic mindset has crept into the system. The urgency and sanctity of timelines under IBC are no longer sacrosanct.

The reason for delays is not only huge pendency but also lack of active disposal of matters alike. What is more worrisome is that delay in IBC litigation has become a norm rather than an exception”.

Deepika Kumari, Partner, King Stubb & Kasiva, Advocates and Attorneys, said this delay is primarily due to the overburdened NCLT, with its limited capacity and staffing shortages, along with the complexity of cases that require extensive negotiations and judicial scrutiny.

Frequent litigation, challenges in asset valuation, procedural inefficiencies, and promoter resistance further contribute to these prolonged timelines, highlighting the urgent need for systemic reforms to streamline the insolvency process and ensure timely resolutions, she said.

Anjali Jain, Partner at Areness law, said that IBC, being a multi-stakeholder law, one or few would certainly be disadvantaged in any given situation and with an easy litigating culture in India, litigants feel free to flood our Courts or tribunals having limited bandwidth. Also, even though Appellate forums are stringent on admission of appeals but due to diverse or lack of legal jurisprudence, stay or status quo on proceedings is granted which culminate further delays. Process Delays occur due to operational challenges, resistance by ex-management, regulatory departments interventions etc. which require procedural, behavioral and other structural change, Jain added.

Abdullah Qureshi, Associate Partner, IndiaLaw LLP, said inherent causes of delay such as inadequate bench strength, case back log etc still persists. In addition, resolution professionals are also hesitant for taking up new matters because they are concerned that they are becoming scapegoat among various stakeholders, Qureshi added. “IBBI has to take more measures to address the concerns of RPs”, Qureshi said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.