Gold smuggling appears to be on rise as seizure by Custom officials surged 40 per cent during fiscal year 2023-24, says the annual report on smuggling prepared by Directorate of Revenue Intelligence.

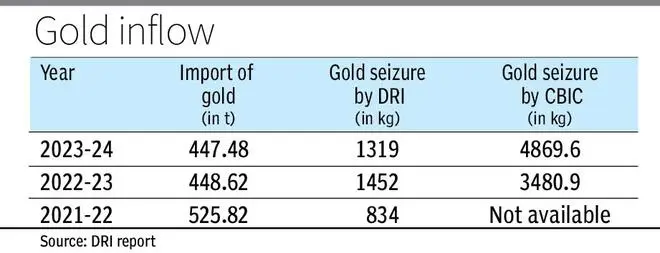

Released on Wednesday as part of 67th foundation day of DRI, the report showed over 4800 kg gold was seized by Custom field formation during FY24 as against around 3500 kg in FY23. During the same period, gold seizure by DRI came down to over 1300 kg against over 1400 kg.

The report said gold smuggling through air routes remains a prominent method used by smugglers. Middle East and South East Asian countries have traditionally been the major points of origin. Recently, African airports such as Nairobi and Addis Ababa, along with Central Asian airports like Tashkent, have also emerged as key locations for smuggling operations.

In addition to smuggling by passengers, cargo and courier routes have become another significant method for smuggling gold into India. Smugglers use these channels to transport gold by concealing it within items such as machinery parts, household goods, etc. Advanced techniques, such as embedding gold as parts of machinery, make it harder to detect during routine checks.

Significant challenge

The report highlighted that smuggling gold in paste form continues to be a significant challenge. Smugglers melt pure gold, adulterate it with impurities, transform it into a solution, dry it, and then convert it into a paste. This paste form is easier to smuggle, often disguised as harmless substance or hidden within legitimate goods. There has been a noticeable increase in the number of carriers employed by smuggling syndicates to transport smaller quantities of gold, in order to reduce potential losses in case of interception by law enforcement agencies paste.

Meanwhile, addressing DRI officials, Revenue Secretary Malhotra urged the DRI officers to focus energy on “big fish” and masterminds and bust syndicates in smuggling operations. However, he added that the officers have to be “very careful” while taking action against traders or businesses involved in potential commercial fraud cases.

“We are here not only for revenue, we are here for the whole economy of the country. So, if in the process of garnering some small revenue, we are hurting the whole industry or the economy of the county, it is certainly not the intent. Revenue comes in only when there is some income, so we have to be very cautious so that we do not in the process, as they say, kill the golden goose,” Malhotra said.

During 2023-24, DRI has detected duty evasion through misclassification and misdeclaration of goods, worth ₹10,000 crore.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.