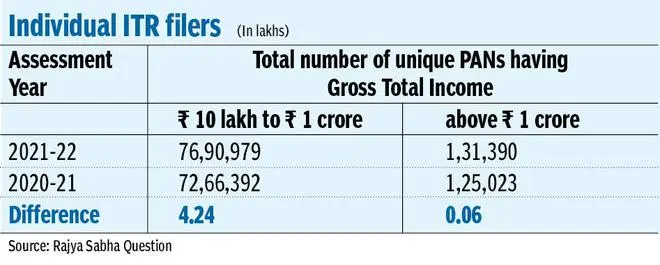

The club of crorepatis in India swelled in FY 2021-22, with 1.31 lakh people showing total income above ₹1 crore compared to 1.25 people a year earlier.

Data from Finance Ministry also showed a significant increase in the number of filers who declared income between ₹10 lakh and ₹1 crore.

Higher income

In a written response in Rajya Sabha, Minister of State in the Finance Ministry, Pankaj Chaudhary presented a summary of tax filers with Gross Total Income of ₹10 lakh to ₹1 crore and above ₹1 crore in Assessment Years 2021-22 and 2020-21. The number of individuals whose total income was between ₹10 lakh to ₹1 crore climbed to 77 lakh from nearly 73 lakh.

ITR in AY 2022-23

The Income Tax Department has reported that 5.8 crore people filed returns at the end of July 31, on the due date for assessees whose accounts need not to be audited.

Meanwhile, Revenue Secretary Tarun Bajaj said that ITR filers for AY 23 (2022-23) would be ‘nudged’ for an explanation or even need to file a revised return, in case there was a mismatch in Annual Information Returns. A large number of filers have complained about no updation in Annual Information statement (AIS) which could result in a mismatch.

But Bajaj also assured that such filers need not fear scrutiny as “only those cases will be picked up which are flagged by Risk management System.”

However, he assured that filing returns would get further simplified next year.

Officials in Income Tax Department have already said that just because of a mismatch, a case will not be picked up for scrutiny and such apprehensions are unwarranted. Further, they added that there is also provision to file updated returns. Enough tools are available to rectify the mismatch. “Nothing adverse will be initiated without any detailed explanation from the assessee,” one of the officials said.

The AIS was introduced last November. As soon as it becomes fully operational, it will replace Form 26AS. It has information not just about tax paid and income received but also includes information relating to interest, dividend, securities transactions, mutual fund transactions, foreign remittance information or even payment made for credit card.

Chartered Accountant Vinod Jain explained that assessees may be asked to explain about mismatch under section 131(1A) of the Income Tax Act.

Normally if the mismatch is of smaller figures, the department accepts the explanation and the matter is resolved.

However, in case of bigger sums involved in the mismatch, the Department has the power to issue notice under section 142 and simultaneously ask for assessment to take place under section 143. There the process of assessment needs to be completed by the end of AY. i.e., by March 31 for AY 23, Jain said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.