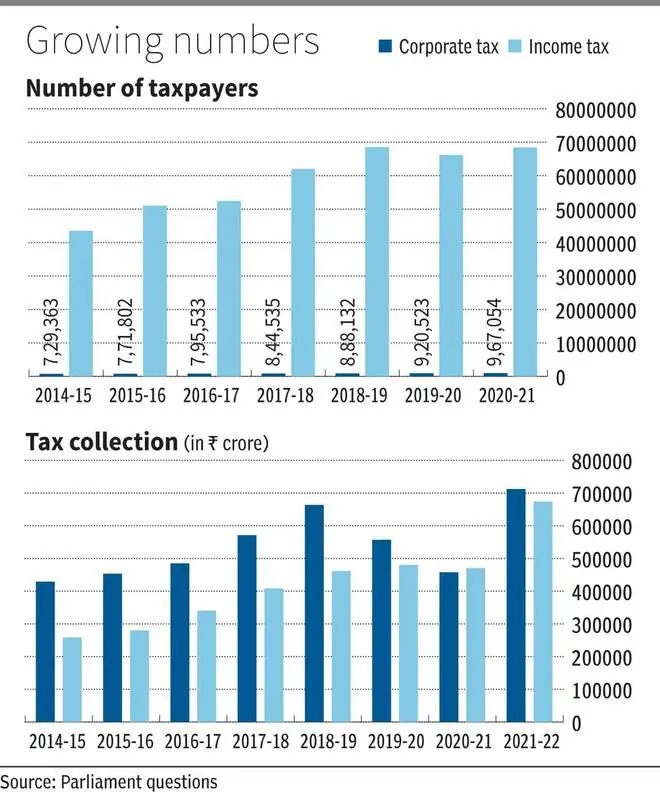

The number of personal income tax payers surged by around 1 crore in the fiscal year immediately after demonetisation, data tabled in the Lok Sabha on Monday showed. The number of corporate tax payers and personal income tax payers also rose over 32.5 per cent and around 60 per cent, respectively, during the first seven years of the Modi Government.

A written response by the Minister of State in the Finance Ministry Pankaj Chaudhary, in the Lok Sabha did not give a specific reason for the rise in number of income tax payers. Officials, however, said it could be attributed to a number of factors, including pace of formalisation of the economy, better use of technology, tracking high spenders and deposit of demonetised notes in banks. Further simplification of return filings and ease in compliance also helped add to the number of taxpayers.

Data shows that in the Fiscal Year 2016-17 (Assessment Year 2017-18), the number of personal income tax payers was over 5.10 crore. In the same year, on November 8, Prime Minister Narendra Modi announced the demonetisation of Rs 500 and Rs 1,000 notes. On the same date, new notes of Rs 500 and Rs 2,000 were issued. People were given the option to exchange old notes with new ones on or before December 30, 2016. People who were outside India during November 9-December 30, 2016 were given the opportunity to deposit old notes by March 31, 2017.

Later, the government had to face criticism when in August 2017 RBI reported that over 99 per cent of the old notes had returned to the system. However, tax officials say this helped in tracking depositors which, also helped in adding more tax payers.

Meanwhile, data given by the Finance Ministry in the Lok Sabha showed that personal income tax collection surged to over Rs 6.73 lakh crore in FY 22 from Rs 2.58 lakh crore, a growth of over 160 per cent. During this period, corporate tax rose to over Rs 7.12 lakh crore from over Rs 4.28 lakh crore, a growth of over 66 per cent.

Chaudhary clarified there was no proposal to withdraw the collection of revenue under surcharges and cess. However, the Finance Bill, 2023, has proposed to reduce the surcharge applicable where the total income exceeds Rs 5 crore to 25 per cent, from 37 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.