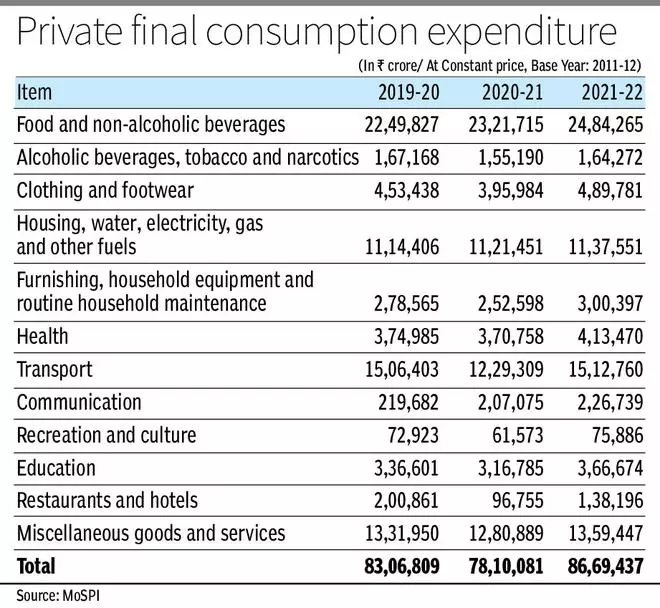

Expenditure on clothing topped the list in terms of growth rate for various items under the Private Final Consumption Expenditure (PFCE) in FY22, followed by alcohol and footwear, according to a report by the Statistics Ministry. However, the increase in food expenditure was in the single digit.

PFCE includes the final consumption expenditure of households and non-profit institutions serving households (NPISH) such as temples and gurdwaras.

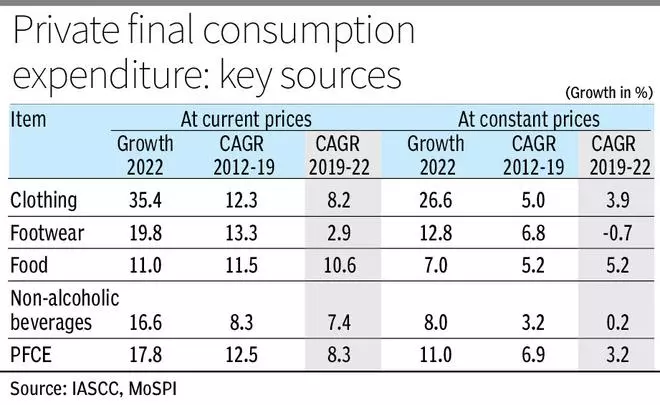

Data showed that at the constant price (with a base year of 2011-12), the expenditure on clothing rose over 26 per cent, followed by a 14.3 increase in alcohol and 12.8 per cent in footwear, while that of food rose by just 7 per cent.

At the current price, the increase for textiles was over 35 per cent, followed by 19.76 per cent for footwear and 19.16 per cent for alcohol in FY22. Expenditure on food recorded a rise of 11 per cent

According to DK Srivastava, Chief Policy Advisor at EY India, because of Covid, health expenditures, reduced incomes, and increased demand for precautionary savings forced families to cut down on their consumption, especially on non-essential items such as alcohol and to some extent textile and footwear.

As incomes started to increase in FY22 and Covid subsided, households attempted to restore their pre-Covid consumption levels.

“Growth in food expenditure was relatively less as compared to the other items because food expenditure growth in the Covid year was positive unlike the other commodities where there was a strong contraction,” he said.

Anil Kumar Sood, Professor and Co-Founder of the Institute for Advanced Studies in Complex Choices (IASCC), said the PFCE has indeed grown significantly in real as well as nominal terms — 17.8 per cent and 11 per cent, respectively.

However, “we must interpret the consumption data for FY22 very carefully, as we had experienced a collapse in consumption during FY21 and FY20, too, was not good”, he said.

Further, high growth during FY22 still does not offset the consumption decline experienced during the pandemic. Growth in discretionary expenditure is still significantly below the trend rate.

For example, even with clothing expenditure growing by 26.6 per cent in real terms, the pandemic period growth is still at 3.9 per cent, compared to the trend rate of 5 per cent. It is worse for footwear at -0.7 per cent, compared to the pre-pandemic CAGR (Compounded Annual Growth Rate) of 6.8 per cent

Srivastava expects a restoration of normal growth of the pre-Covid years in FY23. According to NSO’s second advance estimates, overall private final consumption expenditure is estimated to grow in real terms by 7.3 per cent.

This is only marginally higher than the average annual growth of 6.9 per cent during the pre-Covid period from 2015-16 to 2019-20. “We also expect demand for food to grow around 5 per cent which was its normal growth in the pre-Covid years while expenditure growth in the non-essential items is expected to be higher,” he said.

Sood thinks since India’s real growth in GDP is expected to be only between 6-6.5 per cent during the next five years, which is below the pre-pandemic trend growth of about 7 per cent, “I don’t accept the consumption growth to accelerate anytime soon.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.