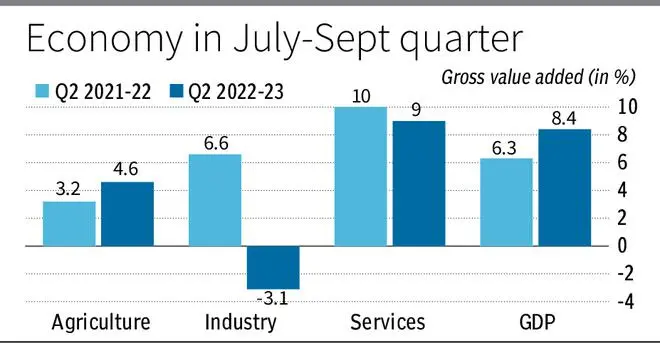

The Indian economy slowed down in the September quarter (Q2 FY23) as the GDP growth rate dropped to 6.3 per cent from 8.4 per cent in the year-ago period. Growth in the June quarter (Q1) was at 13.5 per cent.

Despite the drop in Q2, Chief Economic Advisor V Anantha Nageswaran said he was confident of the economy delivering a 6.8-7 per cent growth this fiscal, driven by domestic demand. “Domestic inflation is expected to ease further on the back of softening global commodity prices and expectations of a good rabi crop. Corporate earnings’ outlook is to improve as price pressures moderate and supply chain improves,” said the CEA. However, he cautioned that the financial conditions in developed economies remain a near-term risk.

Downside risks

Three factors seem to be lowering growth — waning favourable base impact, pressure on domestic and global demand and higher inflation. Although there was an apprehension that the growth rate will further slow down in the remaining two quarters, various agencies still estimated growth rate to at 6.5-7 per cent for the full fiscal.

Swati Arora, Economist with HDFC Bank, said Q2 GDP growth was largely supported by contact-intensive services while the manufacturing sector was a drag. “GDP is expected to grow by 6.8 per cent in FY23 with downside risks emanating from a slowdown in global growth and tightening financial conditions,” she said.

According to Rajani Sinha, Chief Economist, CareEdge, the most critical aspect will be a further pick-up in the domestic demand as the external environment continues to remain challenging. The pick-up in private capex cycle will be contingent on continued improvement in the domestic demand scenario. The fall in global commodity prices should provide comfort to the manufacturing sector in the coming quarters. “We expect GDP to grow at 6.9 per cent for the full fiscal year,” she said.

Fiscal deficit

Fiscal deficit during the April-October 2022 period touched 46 per cent of the Budget estimate (BE) as against 36 per cent in the year-ago period. Experts say though the deficit is expected to exceed BE in value terms, it is unlikely to exceed in percentage terms. The government had targeted to limit the deficit to over ₹16.61-lakh crore or 6.4 per cent of the GDP in this year’s Budget.

Aditi Nayar, Chief Economist with ICRA, said based on the available trends, gross tax revenues in FY23 is expected to exceed BE by a considerable ₹3.1-lakh crore while expenditure is likely to go up by up to ₹3-lakh crore.

“Taking into account the estimated additional expenditure likely in FY23, we estimate the extent of the overshoot in the fiscal deficit at a modest ₹1-lakh crore, given the considerable upside seen in non-excise tax revenues as well as savings expected under other expenditure heads. The fiscal deficit in FY23 is unlikely to exceed the budgeted 6.4 per cent of GDP, on a higher nominal GDP (ICRA expectation: +15 per cent) compared to what was indicated in the Budget (+9.1 per cent),” she said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.