As expected, the Reserve Bank of India’s Monetary Policy Committee (MPC) stood pat on the policy repo rate amid the risk of elevated food inflation spilling over to retail inflation and continued momentum in economic activity.

- Also read:RBI Monetary Policy 2024 reactions

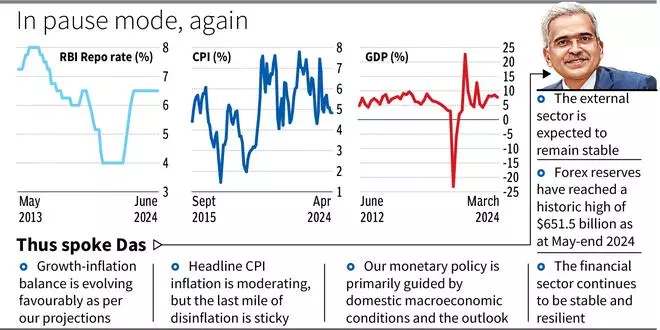

The MPC has been on pause mode for about 16 months now. The last time there was a rate action was on February 8, 2023, when the repo rate (the interest rate at which banks draw funds from RBI to overcome short-term liquidity mismatches) was upped from 6.25 per cent to 6.50 per cent.

“Growth-inflation balance is evolving favorably as per our projections. Headline CPI inflation is moderating, but the last mile of disinflation is sticky; our target is 4 per cent on a durable basis and we will work towards that,” Governor Shaktikanta Das said at the post-Monetary Policy press conference.

Bright GDP growth outlook

The Governor emphasised that the GDP growth outlook is bright, and the momentum of economic activity is well sustained. The central bank has revised FY25 real GDP growth projection upwards to 7.2 per cent from the earlier 7 per cent projection in a sign that economic activity is likely to pick up further momentum.

However, CPI (retail) inflation projection for FY25 has been left unchanged at 4.5 per cent.

Elephant (inflation) walking slowly

“The elephant (inflation), as usual, is walking very slowly...We are watchful, and we would like the elephant to enter the forest and be there (in the sense that we would like inflation to align with the target and be there on a durable basis).

“The last mile of our journey towards 4 per cent (inflation target) is very sticky and that is the case world over....Once inflation reaches 4 per cent on a durable basis, we can then think of further monetary policy action,” Das said.

The Governor observed that while the MPC took note of the disinflation achieved so far without hurting growth, it remains vigilant to any upside risks to inflation, particularly from food inflation, which could possibly derail the path of disinflation.

Hence, monetary policy must continue to remain disinflationary and be resolute in its commitment to aligning inflation to the 4 per cent target on a durable basis. Sustained price stability would set strong foundations for a period of high growth, Das said.

On right track

On inflation, the Governor said RBI is on the right track, but there is still work to be done.

He said that globally, there are concerns that the last mile of disinflation might be protracted and arduous amidst continuing geopolitical conflicts, supply disruptions and commodity price volatility.

“In India, with growth holding firm, monetary policy has greater elbow room to pursue price stability to ensure that inflation aligns to the target on a durable basis.

“In its current setting, monetary policy remains squarely focused on price stability to effectively anchor inflation expectations and provide the required foundation for sustained growth over a period of time,” Das said.

Not guided by ‘follow the Fed’ principle

Referring to a view that in matters of monetary policy, the RBI is guided by the principle of ‘follow the Fed’. the Governor said: “I would like to unambiguously state that while we do keep a watch on whether clouds are building up or clearing out in the distant horizon, we play the game according to the local weather and pitch conditions.

“In other words, while we do consider the impact of monetary policy in advanced economies on Indian markets, our actions are primarily determined by domestic growth-inflation conditions and the outlook. “

Abheek Barua, Chief Economist and Executive Vice-President, HDFC Bank, said the RBI remains in a wait and watch mode to assess domestic developments like the monsoon performance, food inflation and the new fiscal strategy before moving on rates.

“We continue to see the possibility of a rate cut in Q4 (October-December) 2024.

“Despite the Governor’s emphasis that monetary policy decisions are driven primarily by domestic considerations, we think that any rate cut action could end up being aligned with the timing of the Fed’s rate cut cycle to limit financial market volatility,” Barua said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.