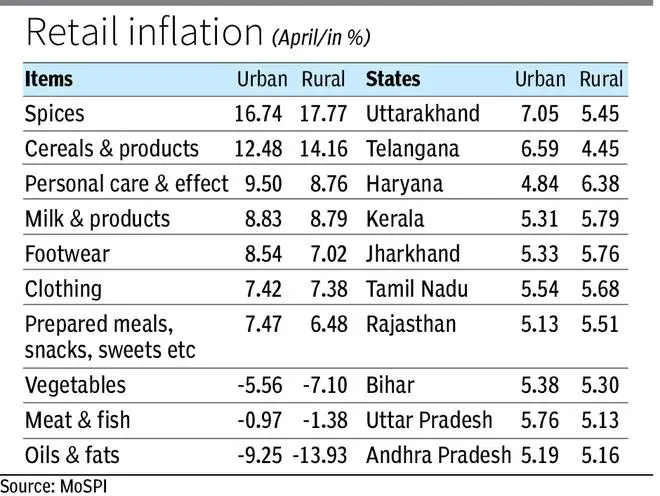

Base effect and deceleration in the prices of edible oil and vegetables pushed retail inflation based on Consumer Price Index to an 18-month low of 4.7 per cent in April as against 5.7 per cent of March and 7.79 per cent of April last year. At the same time, electricity and manufacturing brought industrial growth based on Index of Industrial Production down to 1.1 per cent in March as against 5.8 per cent in February.

As retail inflation is close to median rate of targeted inflation rate range (2-6 per cent), Monetary Policy Committee is expected to continue with a pause when it meets early next month for a review.

Also read: Industrial production rises 1.1% in March, 5.1% in FY23

Data released by National Statistical Office (NSO) on Friday showed food inflation based on Consumer Food Price Index (CPFI) slipped to 3.84 per cent in April as against 4.79 per cent in March. At the same time, rural inflation was lower (4.68 per cent) than urban areas (4.85 per cent).

‘Inflation cooling very satisfying’

Reserve Bank of India Governor Shaktikanta Das on Friday said the cooling off in headline inflation to 4.7 per cent during April is “very satisfying”.

The governor said the release of the official data on Friday gives confidence that the “monetary policy is on the right track”.

Aditi Nayar, Chief Economist with ICRA, said easing in retail inflation was a result of high base as well as cooler-than-normal temperatures, which delayed the seasonal rise in prices of perishable items.

“ICRA foresees the CPI inflation to remain range-bound at 4.7-5.0 per cent in May-June 2023. With a dip in the CPI inflation below 5 per cent and a surprisingly subdued IIP growth, we foresee a high likelihood of a pause from the MPC in its next meeting,” she said.

Sunil Kumar Sinha, Principal Economist and Paras Jasrai, Senior Analyst at India ratings & Research (Ind-Ra), highlighted that subsiding of inflationary pressures is now more broad-based. It can be gauged from the fact that CPI (excluding fruit and vegetables) dipped below 6 per cent after a gap of 23 months. The moderation in core inflation to 5.2 per cent is also on the expected lines. However, going forward, it is expected to stay sticky around 5.1-5.3 per cent.

“For the ongoing fiscal, we expect the retail inflation to remain range bound in 4.5-5.0 per cent range and therefore expect the central bank to sustain the status quo in policy rates,” said they in a note.

Industrial Growth

Meanwhile, the contraction of electricity output (1.6 per cent) and the flat yearly growth of 0.5 per cent in the manufacturing segment dragged the IIP growth to a five-month low in March. The mining sector grew at a modest 6.8 per cent y-o-y in March. Even at the use-based level, the picture is not encouraging either. Barring primary (3.3 per cent), capital (8.1 per cent) and construction goods (5.4 per cent), all the other sectors have recorded muted growth.

According to Rajani Sinha, Chief Economist with CARE, the poor performance of consumer goods segment is concerning as consumer durables and non-durables have contracted in March. Going forward, it is very critical for the domestic consumption demand to show improvement, given that external demand is likely to remain weak. “Pick-up in investment demand will also be contingent on continued revival in domestic consumption demand,” she said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.