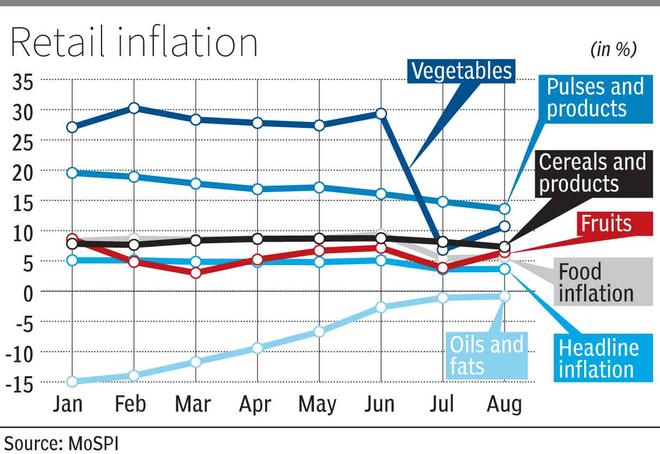

Rise in vegetable and fruit prices pushed the retail inflation rate slightly higher at 3.7 per cent in August, government data released on Thursday showed. The rate was 3.6 per cent in July.

Despite the rise, the retail inflation, based on Consumer Price Index (CPI), is second lowest in the last 59 months. Also, this is the second successive month of sub-4 per cent retail inflation rate. But the expectation is that the rate may go up further in September. Keeping this in mind, the October review meeting of the Monetary Policy Committee (MPC) is unlikely to make any change in policy interest rate.

Key drivers

Vegetable inflation recorded a jump to over 10 per cent in August as against 6.8 per cent in July. Similarly, fruit inflation rose to over 6 per cent as against around 3.5 per cent during the period under consideration. Prices of pulses and cereals were still high, impacting headline inflation.

Though the core inflation (headline inflation minus fuel and food inflation) remained steady at 3.4 per cent, economists believe it would go up. Swati Arora, Economist with HDFC Bank, said core inflation (excluding food and fuel from headline inflation) has bottomed out and is expected to rise going forward, perhaps moving above 4 per cent over the coming months reflecting higher gold prices, improvement in pricing power and recovery in demand. “A low base is also likely to weigh on core inflation reading. For the full year, we continue to expect CPI to average at 4.6 per cent,” she said.

Going further, a rise in overall rate is expected.

Aditi Nayar, Chief Economist with ICRA, estimated the headline CPI inflation to rise to 4.8 per cent in September led by a sharp uptick in the food and beverages inflation print amid the fading of the elevated base (food and beverages inflation: 6.3 per cent in September 2023 vs. 9.2 per cent in August 2023).

Policy stance

“Notwithstanding the anticipated hardening in September, the average CPI inflation will undershoot the MPC’s Q2 FY25 estimate of 4.6 per cent. With the Q1 FY2025 GDP growth print (6.7 per cent), having undershot the MPC’s forecast for the quarter (7.1 per cent), a change in stance in the October 2024 policy meeting can’t be entirely ruled out,” she said.

Upasna Bhardwaj, Chief Economist, at Kotak Mahindra Bank, said: “The slight uptick in we continue to expect full year estimate at 4.5 per cent and hence RBI to remain focussed on inflation over the next few months. Meanwhile, given benign global conditions and persistent easy liquidity conditions, we see high probability of a change in the policy stance to neutral in the upcoming policy.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.