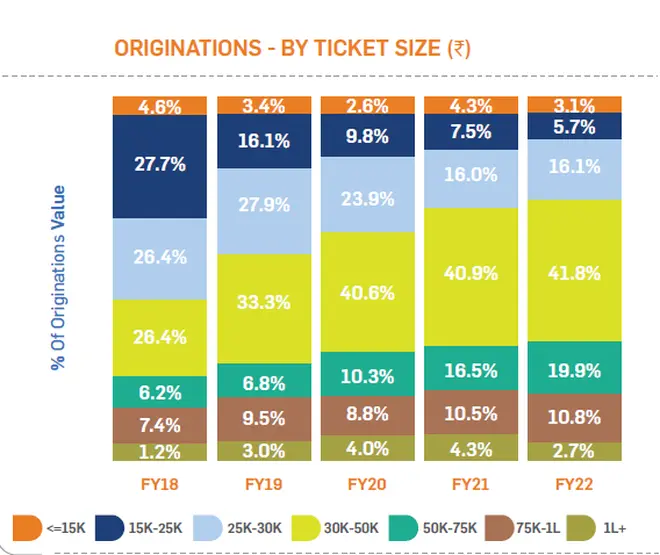

The average ticket of microfinance loan originations has risen by 36.6 per cent from FY18 to ₹38,100 in FY22. Simultaneously, the share of loan originations over ₹30,000 has increased to 75.2 per cent from 41.2 per cent over the same period.

On an annual basis, the average ticket size for microfinance originations is up 7.6 per cent from ₹35,400 in FY21, when the share of loans over ₹30,000 stood at 72.2 per cent, as per a report CRIF Highmark titled ‘How India Lends’.

The ₹30,000-50,000 bucket accounted for the highest share of microfinance loan originations in FY22 at 41.8 per cent, with the ₹50,000-75,000 bucket coming at a far second with 19.9 per cent share.

“FY22 witnessed an increase in average ticket size as well as average balance per account. This growth trajectory in the microfinance credit landscape signals credit appetite amongst the borrowing community and enhances opportunities for lenders,” said Sanjeet Dawar, MD of CRIF High Mark.

Outstanding microfinance loans stood at ₹2.9 lakh crore as of Mar 2022, a growth of 10.2 per cent on-year. Overall, microfinance loan originations in FY22 grew 22 per cent on-year in terms of value and 13 per cent in terms of volume.

Banks continued to dominate the market with a share of 37.7 per cent in terms of value followed by NBFCs which had a share of 33.3 per cent. In terms of volumes too, banks led with 36.3 per cent share, the report said.

The proportion of borrowers having exposure to four or more lenders reduced from 4.4 per cent in March 2020 to 4.0 per cent in March 2022. Tamil Nadu, Karnataka, and Bihar had the highest exposure to multiple lenders, while West Bengal had the least exposure.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.