A GST invoice is generated by a supplier or seller of goods and services to the buyer. The document contains purchase information and details of the supplier and buyer.

According to a circular issued by the Ministry of Finance for the identification of fake GST invoices, a fake GST bill is generated without an actual supply of goods or services or GST payment.

Individuals can identify a fake GST invoice in two ways: by checking the GSTIN format and by checking the authenticity of GSTIN on the GST website.

Also read: Lost Aadhaar? Here’s what you can do

Here’s how to check authenticity of GST invoice

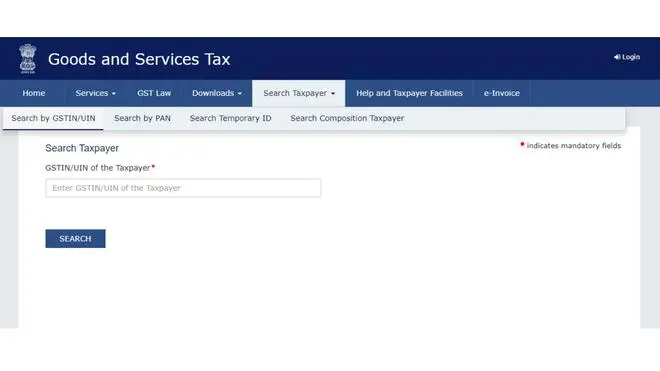

Step 1: Head to the Goods and Services Tax website.

Step 2: Click on the ‘search taxpayer’ option.

Step 3: Click to ‘search by GSTIN/UIN’ from the drop-down menu.

Enter the GSTIN

Step 4: Enter the GSTIN number mentioned in the GST invoice.

If the GSTIN number is authentic and valid, the details of the supplier will be displayed on the GST portal.

Also read: How to raise EPF complaints?

Understanding GSTIN format

Individuals can also check the GSTIN format to identify a fake GST invoice.

The first two digits of the 15-digit GSTIN number assigned to a supplier indicate the state code. The next ten digits are the PAN number. The 13th digit is the entity number of the pan card holder in the state and the 14th digit is the letter ‘Z’.

The last digit is the checksum digit. Any mismatch in the combination helps in identifying discrepancies in the GST invoice.

Also read: How to apply for an Aadhaar PVC card?

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.