Employees typically pay 12 per cent of their salary towards Employee Provident Fund (EPF) with a matching contribution from the employer. On retiring, they receive a tax-free lumpsum, i.e. the entire contribution of the employee and employer with interest from the Employee Provident Fund (EPFO) . The interest rate earned is fixed, which is set by the organisation every year. The EPFO allots a Universal Account Number (UAN), a single ID for its subscribers.

You can check your EPF balance through its portal, Umang app, SMS, or missed call to a toll-free number.

Four ways to obtain EPF balance

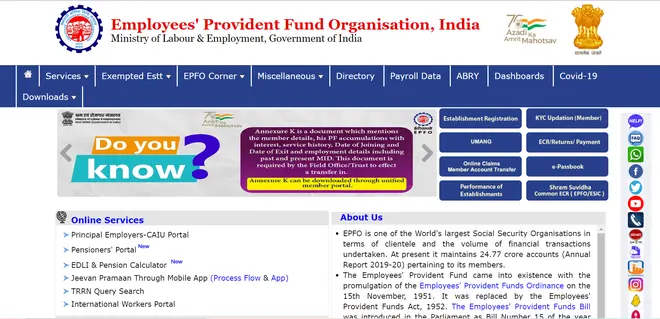

EPFO online portal

Head to EPFO portal, jump to the section for employees and select on “Member Passbook.” You will be asked for UAN and password to access the PF passbook. You will get a detailed information about opening and closing balances, monthly employee and employer contributions, and the yearly interest generated.

EPFO website for PF balance. | Photo Credit: -

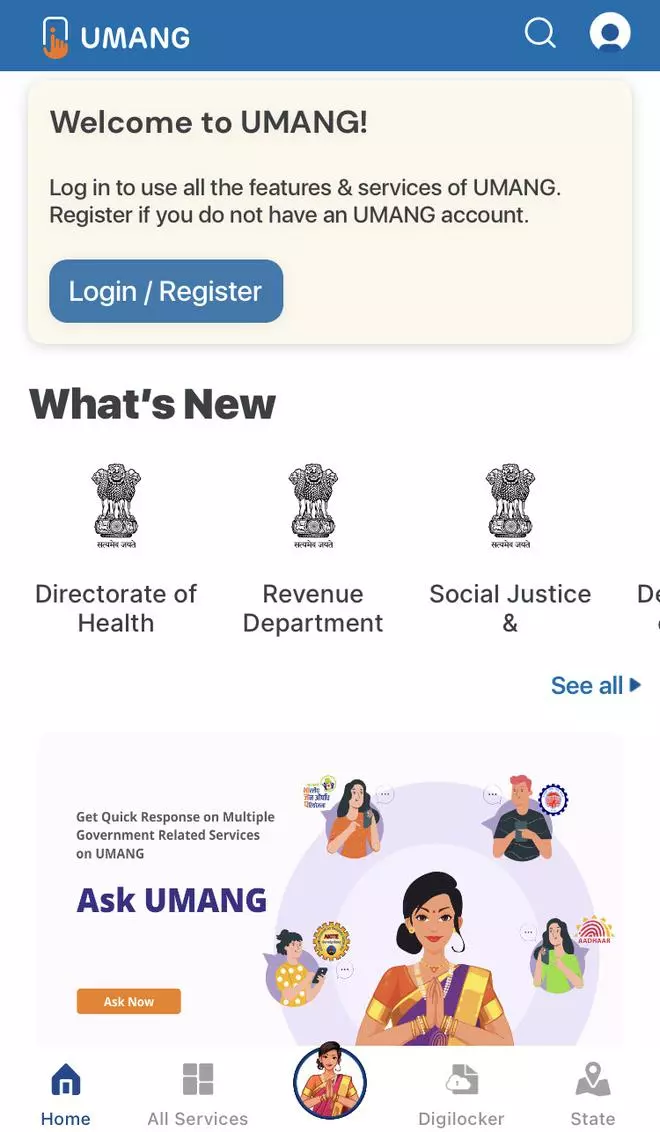

Umang App

Employees can download the Umang app on their iOS and Android smartphones. The app provides details on EPF with just a single tap. At one place, the Umang App by the Ministry of Electronics and Information Technology provides various government services. Employees can use the app to submit their claims, view their EPF passbook, and track their claims. An user just needs to enter their phone number and finish the one-time registration.

UMANG app

SMS

The EPF balance can also be received via SMS. To receive the service, one needs to send an SMS to 7738299899 for obtaning the details. With the UAN linked to their bank account, Aadhaar and PAN, one should send the following text on the SMS: EPFOHO UAN ENG.

Missed call to toll-free number

An employee with UAN can access EPF information by making a missed call from the registered mobile number to 011-22901406. Again, it should be noted that the Aadhaar details, PAN, and bank account is seeded with the UAN.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.