In recent times, credit card transactions have become one of the most efficient way of spending. According to reports by Statista, nearly 121 million point-of-sale transactions have been made via credit cards in India. The Credit Information Bureau (India) Ltd is one of the largest credit information agency authorised by the Reserve Bank of India (RBI).

The CIBIL score is a three-digit summary of your credit history, and is derived using credit history found in the CIBIL Report or Credit Information Report (CIR). A CIR is an individual’s credit payment history about loan types and credit institutions over a period of time.

Step-wise guide to check CIBIL report

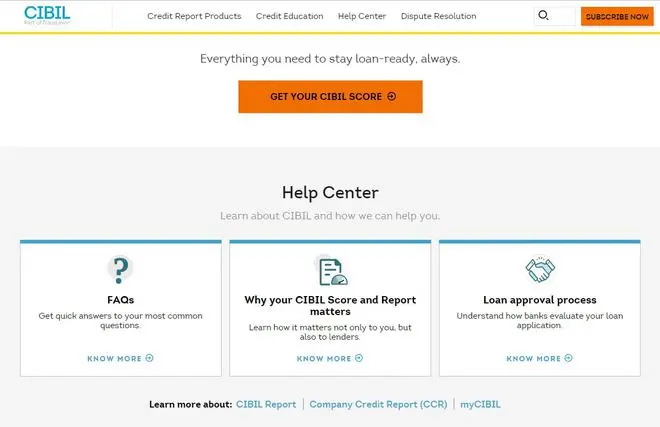

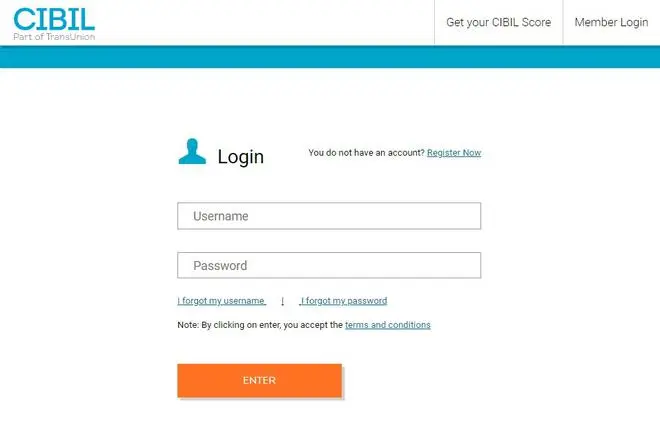

- Go to the official CIBIL website, and Select 'Get your CIBIL Score’.

CIBIL website | Photo Credit: -

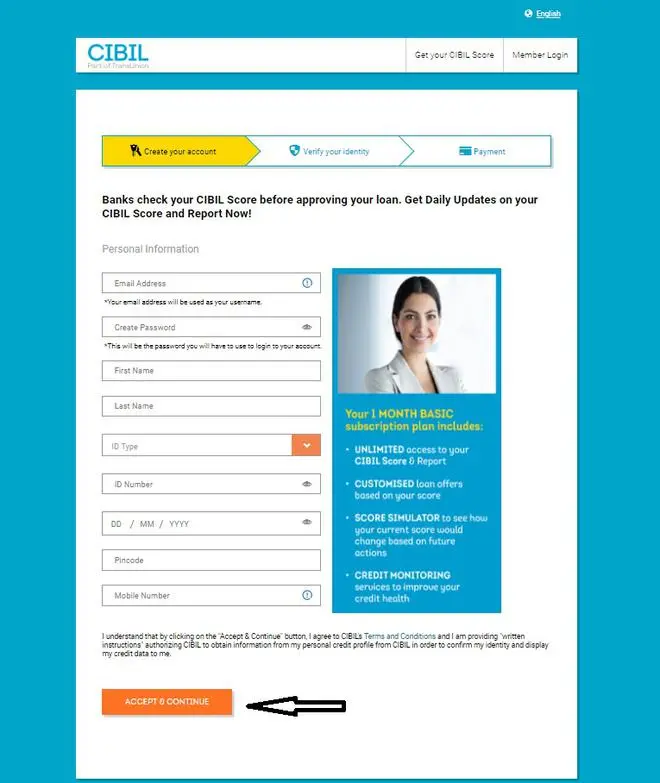

- Type in the required details like name, email ID, and password. Attach an ID proof (passport number, PAN card, Aadhaar or Voter ID), and enter your PIN code, date of birth, and also your phone number. Then tap on ‘Accept and Continue’.

Create account on CIBIL website | Photo Credit: -

- On the next step, you will be sent a One Time Password (OTP).

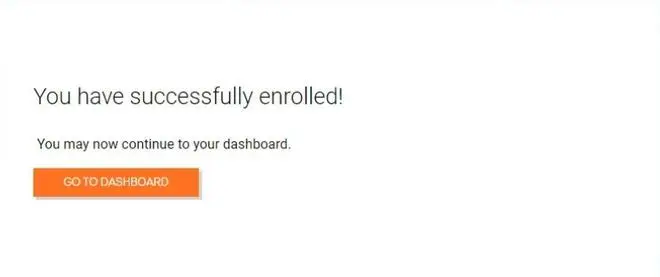

- For the next step, select ‘Go to dashboard’.

Check your credit score by selecting ‘Go to dashboard’. | Photo Credit: -

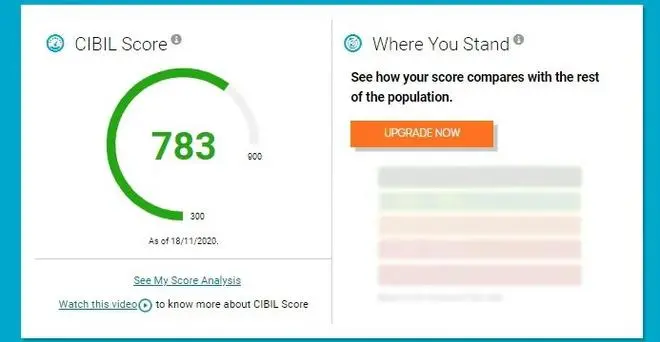

- Next, you will be redirected to myscore.cibil.com, where you can see your credit score up on your screen.

Credit score | Photo Credit: -

- Click on ‘Member Login’ every time you wish to view your CIBIL score.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.