Taxpayers are eligible to receive refunds if the tax paid by them exceeds the liability. The Income Tax Department processes the returns and assesses the tax liability based on the returns filed by a taxpayer. Individuals can check their income tax refund status online.

- Also read: Know how to find your EPF UAN

Step 1: Head to the income tax e-filing portal.

Step 2: Log in using your credentials.

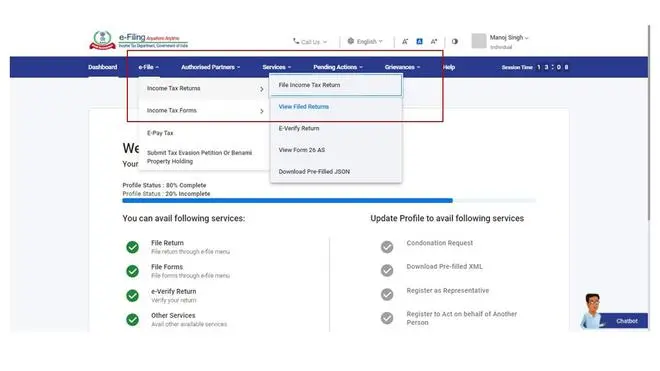

Step 3: Navigate to e-File > Income Tax Returns > View Filed Returns.

A new webpage will display information on your ITR (income tax return) fillings, including the date of filing, the processing status, and the date of refund.

Also read: Having two PANs? Know how to surrender duplicate PAN

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.