Demat accounts allow investors to digitally hold financial securities and trade shares in the Indian share market. Possession of a Demat account is compulsory for those wishing to invest in the stock market and can be used to create a portfolio of one’s equity shares, ETFs, bonds, debt securities, mutual funds, and government securities.

Also read: Chennai Corporation: How to download birth and death certificates online

Paytm Money, a SEBI registered Investment Advisor, allows users to open a Demat account for free in a few easy steps.

Documents needed to set up Demat account via Paytm Money include:

- PAN Card

- Aadhaar card

- Bank account details

To open a demat account through Paytm Money:

- Step 1: Install and open the Paytm Money app

- Step 2: On the Home page, click ‘Set up account’

- Step 3: Enter PAN Number and tap ‘Proceed’. Verify identity by clicking ‘Yes, This is me’ when registered name comes

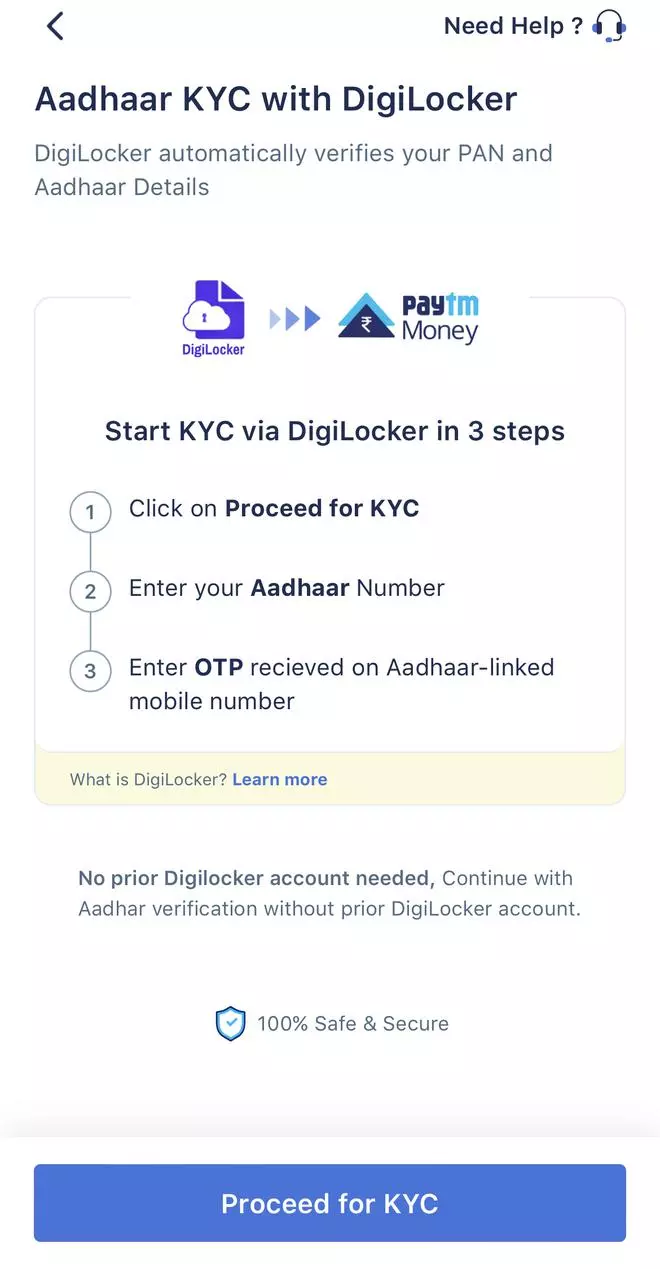

- Step 4: Select ‘Proceed for KYC’. Aadhaar KYC with Digilocker will help verify PAN and Aadhaar number at this step automatically

- Step 5: Enter Aadhaar number, and security code, and hit ‘Next’

- Step 6: Enter OTP sent to registered mobile number and click ‘Continue’

- Step 7: Confirm linking Digilocker as an authenticator

- Step 8: Enter personal details (marital status, profession, etc.) once KYC has been digitally verified

- Step 9: Upload a clear picture (selfie can be taken with camera)

- Step 10: Now, upload digital signature (sign on screen)

- Step 11: Provide some details (annual income, etc.) and verify email address

- Step 12: Finally, enter bank details (IFSC) for adding and withdrawing funds from the Demat account.

- Step 13: Provide any additional details that are requested (investment questions about experience, etc.)

Demat account will be open once the verification process is complete.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.