PAN cards are issued by the Income Tax department for individuals to link TDS/TCS credits, tax payments, returns of wealth, specified transactions, and others. An e-PAN card can be downloaded either through the NSDL portal or through the UTIITSL portal.

Also read: Know how to check if Aadhaar is linked to PAN

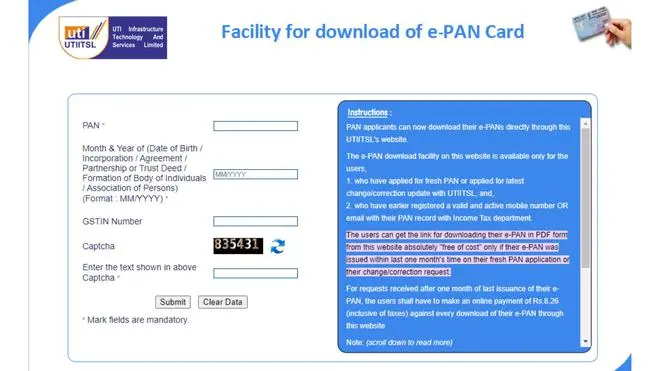

Steps to download PAN card on UTIITSL portal

Step 1: Head to the e-PAN portal of UTIITSL.

Step 2: Enter the PAN number, date, GSTIN number, and captcha, and proceed to submit.

e-PAN portal of UTIITSL.

Step 3: Enter the OTP sent to the registered mobile number, email, or both.

Step 4: If the PAN issuance period is more than 30 days, the user will be directed to a new page to make an online payment of ₹8.26.

Step 5: Now, you can download the ePAN.

Also read: Steps to download e-PAN card from the NSDL portal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.