Paytm, in association with HDFC ERGO General Insurance, launched ‘Paytm Payment Protect’ in December 2022, in order to insure transactions done through UPI across all apps and wallets.

The offering allows users to protect themselves against mobile fraudulent transactions up to ₹10,000.

Payment Protect can be availed at only ₹30 per annum, according to Paytm.

Also read: Paytm UPI Lite: Know how to set up

How to get Paytm Payment Protect

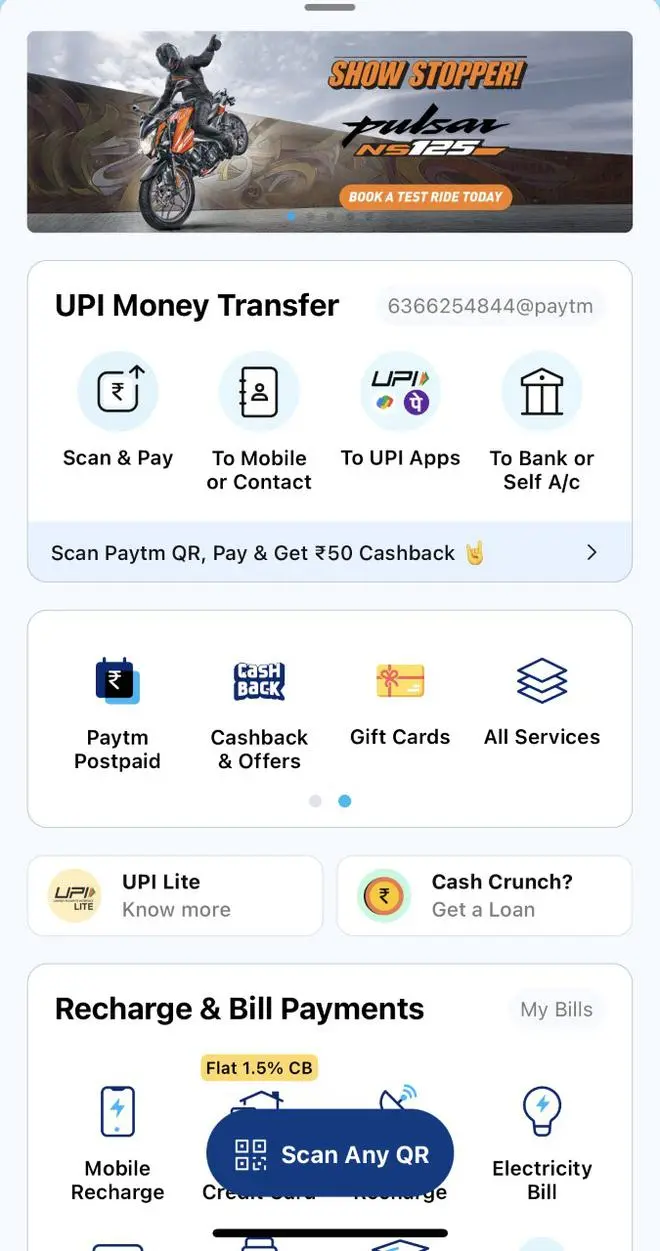

- Step 1: Open the Paytm app.

- Step 2: In the Home page, tap ‘All Services’.

Also read: How to create private UPI ID on Paytm?

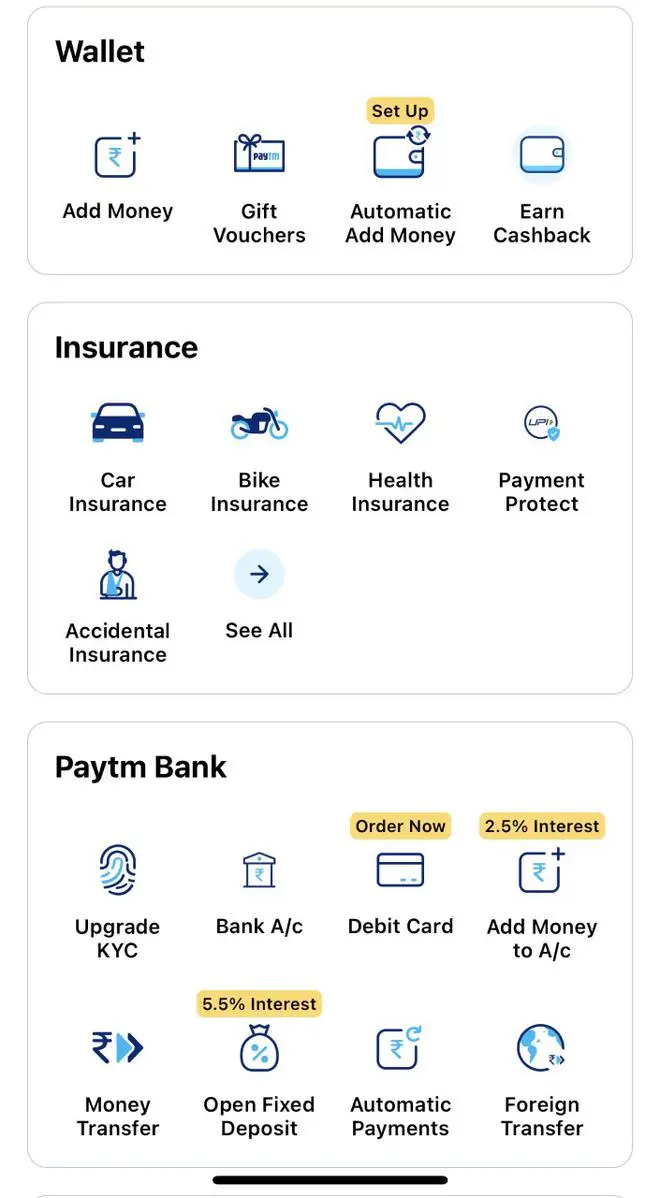

- Step 3: Under ‘Insurance,’ tap ‘Payment Protect’.

- Step 4: Confirm personal details in the next step, and select ‘Proceed to pay ₹30’.

- Step 5: Complete the payment through cards, net banking, or Paytm Wallet.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.