UPI has become the most-preferred payment method. Prime Minister Narendra Modi recently mentioned that experts are estimating that very soon the country’s digital wallet transactions will overtake cash transactions. “A large number of transactions via UPI demonstrate that this indigenously designed payment system is very secure,” he added.

If you are facing any issue while processing a UPI transaction or accessing a UPI app, including Paytm, Google Pay, and PhonePe, you can file a complaint with the National Payments Corporation of India (NPCI).

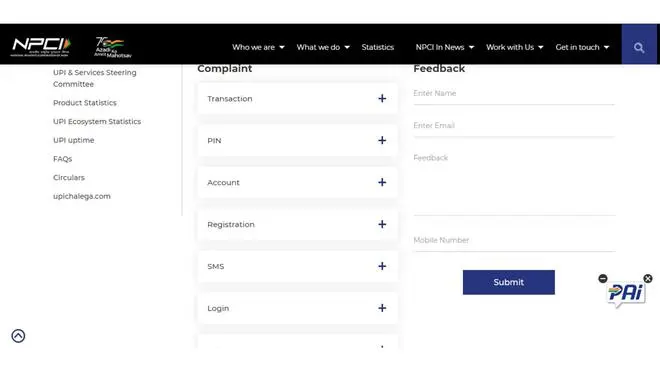

NPCI allows these complaints under its dispute redressal mechanism.

UPI complaints on NPCI

Also read: Know how to retrieve money sent to wrong UPI ID

NPCI could address these UPI issues:

UPI customers have to head to the NPCI’s dispute redressal mechanism portal to file complaints. It can be raised for types of transactions, including fund transfers and merchant transactions, according to the NPCI.

1. Transaction-based issues

Customers who encounter issues while processing a fund transfer with merchants or another individual can approach NPCI. The type of issues include; indirect transfer to another account, transaction failure but money debited, threshold exceeded, transaction pending/ declined, and transaction timed out.

Customers will have to enter their transaction ID, bank details, transaction value, date, email address, and mobile number while filing the complaint.

Also read: Know how to set payment reminders on Paytm

2. PIN-based issues

Customers who are unable to set a UPI PIN, face PIN error, and blocked PIN can approach NPCI with bank details, virtual payment address (VPA), email, and mobile number to file their complaint.

3. Other issues

NPCI allows customers to file complaints if they could not fetch or link accounts, remove or de-register UPIs, and seek redressal. Customers could reach NPCI even while facing registration issues, and login issues. In addition, they can also file complaints if they have not received OTPs to process a UPI transaction.

Also read: How to pay utility bills via Paytm

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.