Indian IT firms are increasing the utilisation levels quarter by quarter and are seeing the metric as a margin lever. Human resource experts note that reduction in headcount, lack of demand visibility and the changing nature of deals are the reasons behind the surge in rates.

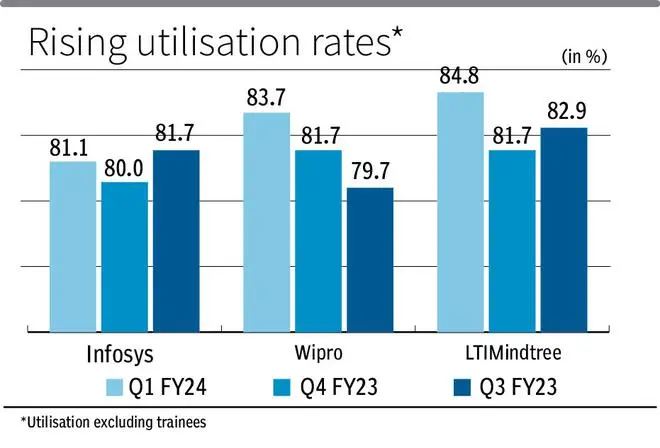

Utilisation rates for IT companies refer to the percentage of staff members engaged in ongoing active projects. A few quarters ago, this metric had dropped significantly. For Infosys, the utilisation rate has gone up to 81.1 per cent from 80 per cent last quarter. Wipro’s utilisation rate went from 81.7 per cent in Q4FY23 to 84.8 per cent in Q1FY24.

ALSO READ | Slow hiring for Indian IT sector continues for Q1FY24

IT majors in their Q1 commentary noted that utilisation will be an important margin lever and there is more headroom for improvement, indicating that the rates could rise higher in the quarters to come. This is also in tandem with the slowdown in hiring that the sector is seeing, as the demand environment continues to be gloomy.

“Utilisation clearly is going to continue to be a KPI that we will keep driving. We are also looking at different utilisation components, not only the aggregate number in terms of location. There is still some room to drive our utilisation up from where we are,” said Amit Choudhary, COO, of Wipro, in Q1 earnings call.

Similarly, Samir Seksaria, CFO, TCS said, “We will continue to use levers like utilisation. Utilisation still has scope for further improvement and it continues to have.” The company however does not specify the utilisation rates.

Aditya Mishra, CEO, of CIEL HR Services, said, “The major driver is the lack of demand visibility as they haven’t been aggressive in their hiring as well. At the same time, companies have also reduced the subcontractor hours, as there is volatility in the demand side. The surge in rate is also to drive cost optimisation, as utilisation and subcontractor costs are the most important ways to do so.”

He also noted that utilisation has gone by at least 5-10 bps, and subcontractor costs have been slashed by 20-40 per cent in the industry.

Further, Kamal Karanth, Co-founder, Xpheno, explains, “The rise in utilisation rates in the last quarter is a critical calibration for some bellwethers. Dipping utilisation rates seen in the latter quarters of FY2023 were not sustainable amidst mounting margin pressures. Negative headcount growth reported by the bellwethers in Q1 is a tactical rebalancing to optimize capacity and increase utilisation. Reducing the headcount denominator through hiring pauses and slower onboards has helped push utilisation rates up by a significant 2-3 per cent.”

Pushing utilisation rates up was also critical on the backdrop of compensation costs moving up by 2.4 to 5 per cent in Q1. Mounting costs and lowering utilisation in a slowdown market is not a sustainable mix for large enterprises. The correction hence was necessary to optimise costs and capacity to tackle margin pressures, he further added.

In addition, the changing nature of deals is also one of the reasons. Mishra said that the current deals and projects are mostly for business-critical applications and not innovation and future-technology-oriented. The projects that required niche skilled employees have become lesser. Companies are now able to retrain the employees on the bench and utilise them instead of hurrying to hire for the new projects that come in.

However, utilisation rates are still well below the highs of FY2022 and late FY2021. Bellwethers do have headroom to tweak and push utilisation rates up by a few more percentage points if situations demand it, Karanth said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.