The average daily turnover in the equity segment of stock exchanges has declined over the past four months, as retail investors turning cautious on high valuations and are shifting to other avenues of investment such as mutual funds, gold and bank deposits.

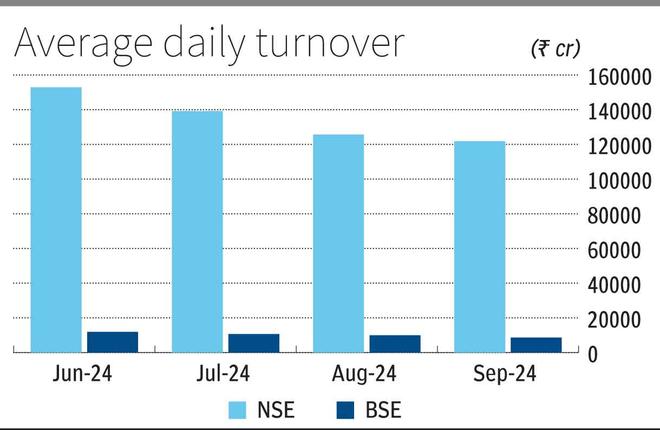

The average daily turnover (ADT) on NSE dropped by 23 per cent in September, to ₹1.22 lakh crore from ₹1.59 lakh crore in June. Reflecting the rally in the value of shares, the market capitalisation surged by 8 per cent to ₹470.65 lakh crore from ₹435.74 lakh crore in the same period.

Similarly, the ADT on BSE fell by 28 per cent last month at ₹8,603 crore, compared to ₹11,947 crore in June. During the same period, the number of trades on the exchange decreased by 13 per cent, from 10.80 crore to 9.40 crore.

Market concerns

Amit Golia, Group CEO of MarketsMojo, said that one of the reasons for the downturn in trading could be the concern over high valuations, as India’s markets are currently among the costliest globally, surpassing even developed economies such as the US, Japan, and the UK.

This apart, he added that the unexpected 50 bps rate cut by the US Fed has raised concerns globally, signalling a potential slowdown in the US economy and escalating tensions in West Asia have contributed to a cautious stance among Indian equity investors.

The benchmark Sensex has rallied 7 per cent to 84,300 points in September compared to 79,033 points in June. Similarly, during the same period, the Nifty has rallied 7 per cent to 25,810 points, against 24,011 points.

Demat growth

The decline in trading turnover was despite a surge in investors rushing to open new demat accounts. In August, over 40 lakh new demat accounts were opened, bringing the total number of accounts to over 17.1 crore across the National Securities Depository and Central Depository Services.

In the first eight months of the current year, around 3.2 crore demat accounts have been opened. Though the rush to open demat accounts can be traced to investing in IPOs, investors’ interest in the secondary market seems to be muted. As of August 31, More than 50 companies have raised ₹53,419 crore through IPOs this year.

Anand James, Chief Market Strategist at Geojit Financial Services, said “Over ₹20,000 crore a month has been flowing into the mutual funds through SIPs in the last four months. This clearly indicates that equity investment has replaced the conventional bank deposits or recurring deposits.“

“A plethora of IPOs that have continuing to hit the market this year, attempting to tap into the bull market has been another avenue that has probably attracted the interest of investors, he added.

Pravesh Gour, Senior Technical Analyst at Swastika Investmart, said the second-quarter earnings season will kick off with key companies such as TCS, Tata Elxsi, DMart and IREDA among others, which will drive stock-specific movements.

He added that domestically, liquidity remains strong, with signs of sectoral rotation from overvalued segments to areas with more attractive valuations.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.