India’s import of Ural crude oil hit a new high in July as Indian refiners, particularly State-run oil marketing companies (OMCs), stocked up on the grade fearing supply disruptions during August and September as Russia limits exports to shore up prices and meet domestic demand.

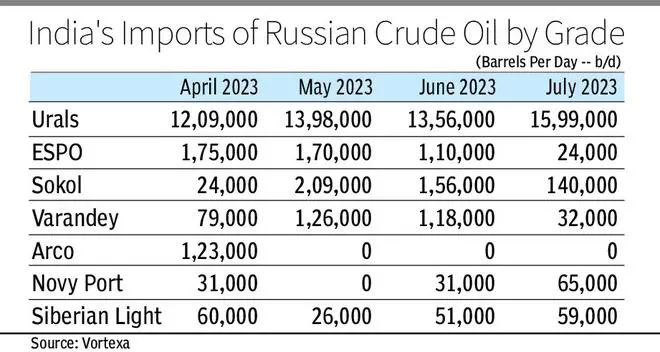

According to energy intelligence firm Vortexa, Indian refiners imported around 1.6 million barrels per day (mb/d) of the medium sour grade last month, higher by 18 per cent compared with June and 14 per cent higher than the record in May 2023.

India’s preference for Russia’s largest export grade, Ural, can be gauged from the fact that its imports are close to the combined shipments by the other three top suppliers — Iraq, Saudi Arabia and the UAE — at 1.67 mb/d.

State-run OMCs accounted for 63 per cent, or 1.21 mb/d, of the total crude oil imported by India from the erstwhile Soviet Union during July at 1.92 mb/d with private refiners accounting for the remaining cargoes.

Indian refiners

Vortexa data shows that Indian refiners majorly cut down on premium light sweet grades such as ESPO, Varandey and Sokol (marginal decline) in July 2023. Besides, the import of other light sweet crude, Novy Port doubled, while that of the lighter grade Siberian Light was higher marginally.

“With Russia ramping up its refinery runs post maintenance to meet domestic demand and cutting crude production, the country’s crude exports have evidently fallen. Russian crude exports in July are down nearly 650,000 b/d versus the peak seen in April/ May,” Vortexa’s Head of APAC Analysis, Serena Huang told businessline.

Crude exports

Crude exports could retreat further if Russia continues to raise its domestic refinery runs in August, she anticipated.

Earlier this year, Russia announced a cut of 500,000 barrels per day (b/d) from February 2023 levels till end-2023. Subsequently, in July it announced another cut of 500,000 b/d for August. Urals, Russia’s flagship export grade, will account for most of the cuts.

Quest for Urals

A State-run OMC official said competition for Ural is expected to continue. Russian supply disruptions, especially for Urals, are expected for the next two months at least. Higher volumes by refiners is to make up for the lag in the coming months.

“Indian refiners will continue to lap up any available Urals. Current discount is around $2-3 per barrel against Brent, which is still a good proposition. Even if the price cap is breached, India and Russia will find avenues to continue trading. What needs to be seen is the global price rally as Brent is again at $85 level,” the official explained.

Vortexa’s Huang pointed out “With reduced Russian crude exports, we could either see lower supplies to India or volumes to India holding up at the expense of China’s share. The outcome will ultimately be determined by price and politics.”

Another private refinery official said with the summer season in Russia, the country’s demand for fuel has risen and refiners are back online post maintenance. Hence lower volumes of Urals are available for trade.

“Discussions with traders and company officials indicate that the October-December period will again see rising availability of Urals. But premium light grades are available,” the official added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.