18As the country’s peak power demand nears last year’s all-time high of 200 gigawatts (GW), the coal stocks position at power plants has become worrisome, While domestic coal-based (DCB) plants have supplies for just over 8 days, imported coal-based (ICB) units have stocks for nine-and-a-half days.

For instance, on April 8, the peak power demand met during the day hit 199.58 GW, the highest this fiscal year. On the same day, power outages across India due to coal shortage totalled 7,085 MW.

Dipping fuel stocks

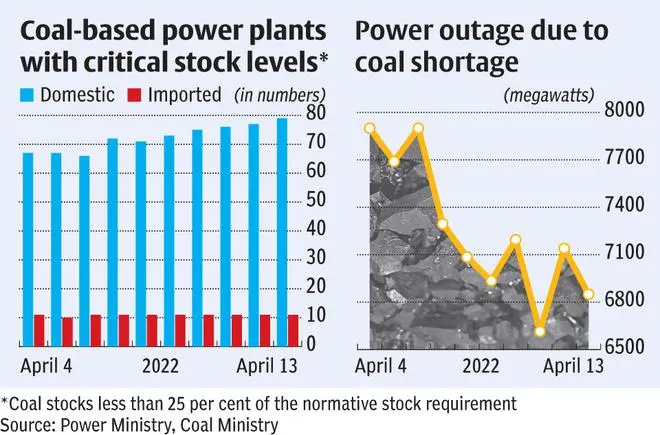

Though the maximum peak power demand met during the day came down from the April 8 high, the average demand met between April 4 and 13 (10 days) stood at a significant 195.43 GW. On April 4, the number of DCB and ICB power plants with critical coal stocks (below 25 per cent of the normative requirement) stood at 67 and 11, respectively. This rose to 81 DCB and 11 ICB plants on April 17.

Related Stories

India risks widespread blackouts this summer

Since the middle of March, the grid has routinely reported maximum loads above 195,000 MW, including a peak of 199,584 MW on April 8The coal supply to power and non-power sector is handled by the Ministries of Coal, Power and Railways. While Railways blames the coal mining PSUs and power plants for delay in loading and unloading of rakes supplying the key commodity, Coal Ministry blames Railways for not supplying the requisite number of rakes. The issue of rakes comes up almost every year, particularly during the peak demand season from April to October.

To deal with coordination issues, the government has formed an Inter-Ministerial Sub Group with senior officials from Ministries of Power, Coal, Railways, CEA, CIL and SCCL. The group meets regularly to take various operational decisions to enhance supply of coal to thermal power plants as well as for meeting any contingent situations relating to Power Sector including to alleviate critical coal stock position in power plants.

Fitch, in a report on April 7, said a commensurate increase in electricity generation to meet the increased demand is unlikely, limited by the availability of coal, which accounts for two-thirds of the power generated. Coal inventory, affected by the early onset of summer, is already low at around nine days, compared with normal requirements of around 24 days.

For perspective, stocks at DCB power plants fell from 23.5 mt on April 4 to 21.36 mt on April 17. For the ICB plants the supply fell marginally from 1.42 mt to 1.41 mt in the same period.

On April 4, the DCB power plants had supplies for 9.10 days, which came down to 8.22 days on April 17. For ICB plants, the stocks declined from 9.45 days to 9.39 during the same period.

Rising power demand

According to a a recent ICICI Securities report, the daily peak power demand in Q4 FY22 averaged 187GW against 179 GW in the same period of FY21. Between April 1 and 12, the average daily peak demand exceeded 194 GW.

Another indication of the surge in power demand is the price scenario in spot markets. At the Indian Energy Exchange (IEX), the average MCP stood at around ₹4.4 per kilowatt hour (kWh) in FY22, which is the highest in the last 10 years.

A senior government official said that demand will rise further based on experience. Some States are buying more due to coal shortage. Imported coal and gas prices are at a record high. Besides, over 50 per cent of the imported-coal-based capacity is not operational due to high prices and high logistics cost.

“Gas plants are operating at extremely low PLF (plant load factor or capacity) as spot gas prices are over $40 per mbtu. The weather has also changed suddenly from winter to summer coupled with the mercury soaring. There was virtually no spring this time,” he added.

For the first quarter of FY23, India Ratings and Research (Ind-Ra) said the power demand will rise with increasing demand from residential consumers, given the unprecedented change in weather conditions resulting in higher-than-expected temperatures.

“However, a likely coal shortage both from domestic and international sources (due to high international prices of imported coal) may lead to artificial demand suppression resulting in power outages and, thus, lower-than-actual demand growth on a Y-o-Y basis,” it said in a recent report.

Analysts said the situation is especially worrisome in Maharashtra, Madhya Pradesh and Andhra Pradesh that are already experiencing coal supply issues.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.